Bitcoin Price Slumps Over 9% to $57,200, Extending April 2024 Losses

Bitcoin has plummeted over 9% to $57,200, extending its decline from April 2024. According to CNBC, it’s the worst rout since November 2022 when FTX collapsed. The sell-off partly stems from waning enthusiasm for the U.S. Securities and Exchange Commission’s delay in approving a spot Bitcoin ETF. Despite the setback, the world’s largest cryptocurrency still remains over 30% higher in 2024.

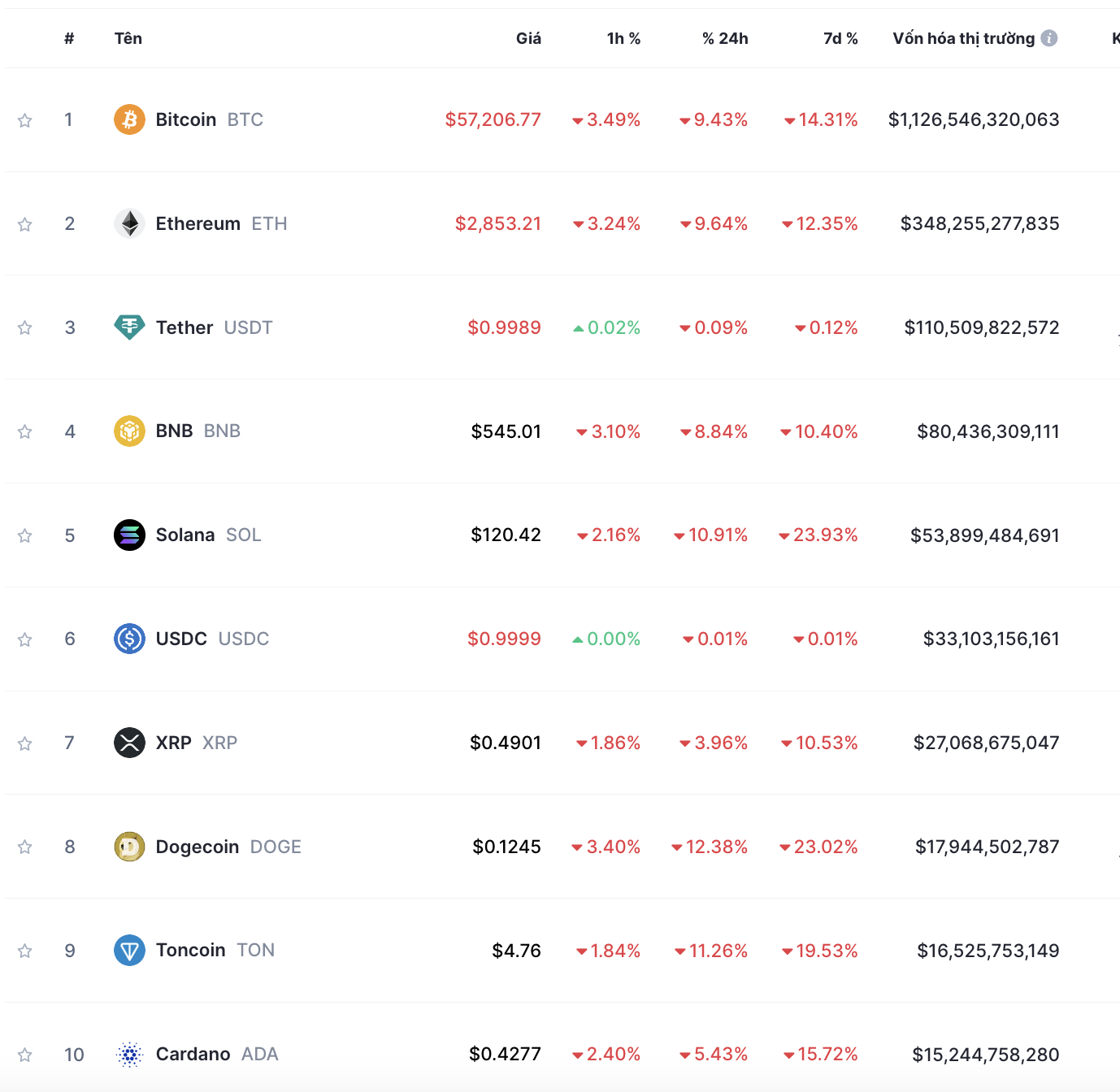

Top 10 Cryptocurrencies

Source: CoinMarketCap

|

The spot ETF frenzy had pushed Bitcoin to a record high of nearly $74,000 in March. However, diminished expectations of rate cuts by the Federal Reserve have curtailed the inflows into investment products.

As of April 29, about $182 million has flowed out of 11 U.S.-listed spot ETFs. That compares with billions of dollars of inflows in previous months, including $6 billion in February alone.

Bitcoin’s halving event, which occurs every four years and reduces the issuance of new Bitcoin, has also had a muted impact since it started on April 19.

“The Bitcoin price drivers like ETFs and halving are behind us, and it could potentially enter a prolonged sideways period similar to what was seen March-October 2023, when Bitcoin traded in the $25,000-$30,000 range,” said Antoni Trenchev, co-founder of crypto lender Nexo.

Historically, May has been a difficult month for Bitcoin in recent years, but investors should try to avoid getting caught up in the negative sentiment for the next few weeks, Trenchev added. If the largest cryptocurrency ends May 2024 in the red, it would mark the fourth consecutive year of such an occurrence.

(Reporting by Vũ Hạo; Editing by Vidya Ranganathan and Jacqueline Wong)