Europe is becoming increasingly reliant on Russian fertilizer, much like it was for gas, according to one of the continent’s largest fertilizer producers.

Svein Tore Holsether, the CEO of Yara International, one of the world’s leading producers, said nitrogen fertilizer, crucial for crop growth, is made using natural gas and that Russia is exporting more to Europe, replacing some that has been sanctioned by Brussels. “Fertilizer is the new gas,” Holsether said. “It’s almost ironic because the objective was to reduce the European dependency on Russia, and now we are building up a new dependency on Russia for another critical input.”

The EU imported more than double the volume of urea from Russia in the 12 months to June 2023 than it did a year earlier, according to Eurostat. Shipments from Russia in the current season (to June this year) are down but still historically high, accounting for about a third of total imports into the bloc.

Fertilizer prices have soared since the war in Ukraine began in February 2022, as sanctions on Russia restricted supplies of natural gas, a key ingredient in nitrogen fertilizers such as ammonia and urea.

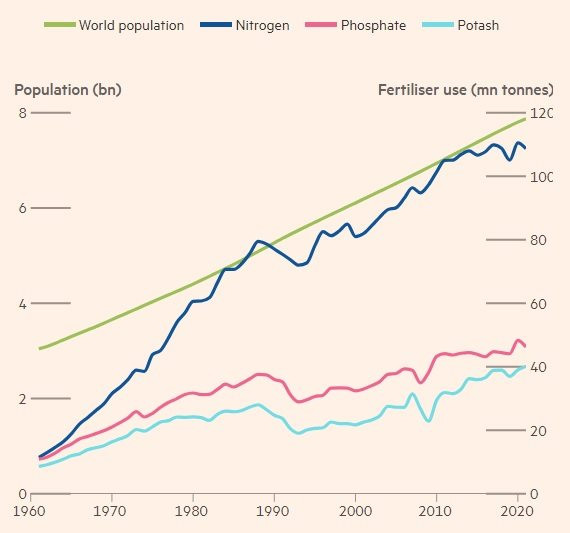

Fertilizer use has increased through the years.

This has hit the finances of Europe’s farmers hard while other parts of the world, such as Africa, have been forced to cut back on fertilizer use altogether, reducing yields and worsening the global food crisis.

Holsether said that fertilizer prices have since come down as gas prices have fallen but the European fertilizer industry still faces difficulties because of the increased market share of Russian imports. Russian fertilizer producers benefit from cheaper energy costs.

Russia is one of the world’s largest producers and exporters of nitrogen fertilizers. This is also true of potash and phosphates, which are mined and cannot be easily substituted for nitrogen-based fertilizers.

While western sanctions exempted food and fertilizer exports from Russia, Moscow has complained that trade in these areas is still being hampered by concerns among buyers and their banks and insurers. Despite this, Russia’s fertilizer export revenues jumped by 70 per cent in 2022, helped by higher prices.

Holsether said that Russia could use its increasing dominance of the fertilizer market for political leverage — in the same way that Moscow has done with energy supplies. “When you have a product that is essential for food production, that is a very powerful tool,” he said.

Source: FT.