Economic – Financial Expert, founder of Think Future Consultancy, Mr. Nguyen Duc Hung Linh.

Sir, if at the beginning of the year, many economic experts predicted that the exchange rate would only increase by about 3 – 5% in 2024, but in just the first 4 months of the year, the exchange rate has increased by almost the same rate as predicted for the whole year. Is there still pressure on the exchange rate, sir?

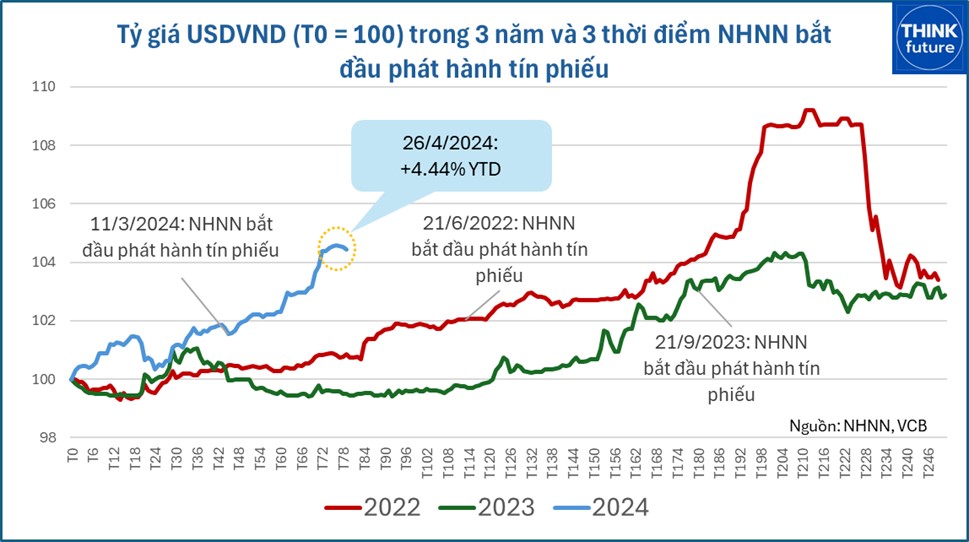

In contrast to the 2 years 2022 and 2023, the exchange rate has been “hot” right from the beginning of the year. Since the beginning of the year, the exchange rate has increased by 4.44%. If we calculate from when the State Bank of Vietnam (SBV) started issuing credit notes to absorb liquidity to support the exchange rate (March 11), the exchange rate has increased by 2.65%.

Like any other commodity, supply and demand are the determining factors for the exchange rate, and what we need to find out is which factors are affecting this supply and demand.

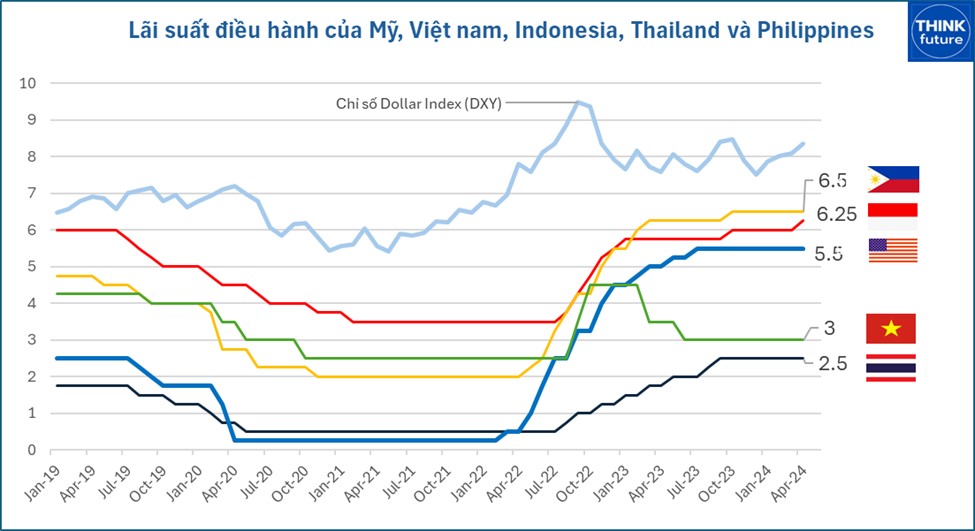

Before 2022, the exchange rate was often very stable, even the VND appreciated. In 2022, the exchange rate began to depreciate rapidly. In 2022, there was unrest in Europe, which led to a sharp increase in commodity prices. This caused the US Federal Reserve (FED) as well as most central banks in the world to raise interest rates to counter inflation. US interest rates have been raised continuously from 0.5% to 5.5%, causing the USD to appreciate against most currencies in the world. The dollar index (DXY), if calculated from the beginning of 2022 to the present, has increased by 10.3%.

US interest rates have been raised continuously from 0.5% to 5.5%, causing the USD to appreciate against most currencies in the world.

In addition to the factor of the USD appreciating globally, each country also has its own factors that further affect the exchange rate. In the case of Vietnam, the policy interest rate has been reduced to stimulate the economy, which is quite different from the rest of the region and the world.

Vietnam is cutting interest rates to support growth, which is putting pressure on the VND.

If we calculate from the beginning of 2023 to the present, the DXY index has only increased by 2.3% while the VND has depreciated by 7.4%.

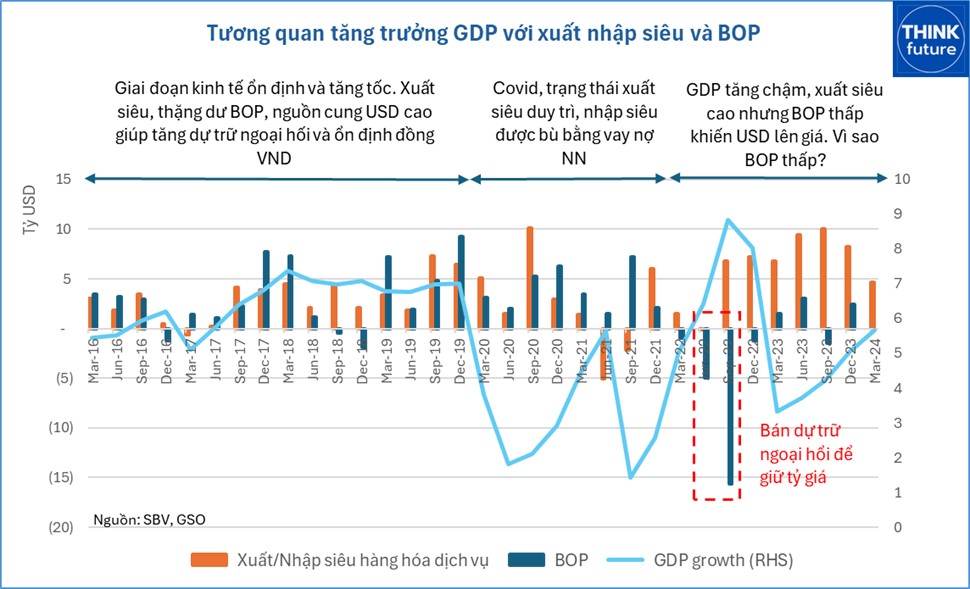

Looking back at 2023, although the interest rate differential had begun to emerge, the exchange rate was not too tense. That is because Vietnam has increased its trade surplus, helping to increase the supply of foreign currency. In 2024, when economic activities “warm up”, leading to high import demand, a tense exchange rate is probably inevitable.

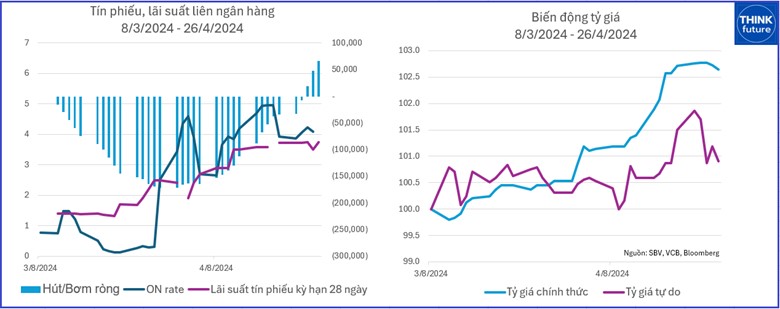

The credit note is the tool used first in all 3 years 2022, 2023, and 2024. The withdrawal of liquidity and the increase of VND interest rates on the interbank market to reduce the gap between USD and VND interest rates on the interbank market is the fastest and simplest measure.

This year, the issuance of credit notes, credit note interest rates have also increased rapidly, from an initial level of 1.4% to the current 3.75%.

Exports are declining and even trade deficits are tending to return.

However, in terms of issuance volume, it is not as much as in 2023. The highest net withdrawal value was 171 trillion VND, much lower than in 2023, which was 254 trillion VND. The reason could be that interbank interest rates have reacted more sensitively. In fact, interbank interest rates have increased sharply from below 1% to around 4% after 7 weeks of issuing credit notes, while in 2023 it only increased to 2.7% and then decreased again.

I think these are the initial steps to test the market. Foreign exchange supply and demand are affected by many factors, in addition to exports and imports, there are also hoarding, speculation or foreign investor capital flows that credit notes find difficult to handle.

There are some opinions that the exchange rate will cool down in the coming time. What is your opinion on this issue and what effective solutions should the SBV implement to control the exchange rate and interest rates to support the economic recovery?

Stabilizing the exchange rate does not mean fixing it, but being flexible, especially in the context of unpredictable external factors, especially inflation in the US, which makes the Fed have no clear stance on whether or not to reduce interest rates. Some countries like Indonesia have just raised their policy rates… All these factors, I believe, are being closely monitored by the regulators.

Domestically, the market context also exerts certain pressures on the exchange rate. The goods trade surplus in April 2024 is estimated to have fallen to a very low level, only 0.68 billion USD. Combined with the service trade deficit, it is highly likely that Vietnam will return to a trade deficit in April 2024. Export/import has a large proportion in the foreign exchange supply and demand balance, and will be a long-term pressure on the exchange rate.

In my personal experience, the exchange rate can be completely controlled, but everything comes at a price. We need to depend on the circumstances and conditions of each period to decide on the measures to control the exchange rate.

One point I would like to mention is the psychology and habits of Vietnamese people. Gold, real estate or foreign exchange can all be speculative or hoarded assets due to concerns that the VND will depreciate. This mentality poses many risks to macroeconomic stability. We need to have consistent and long-term solutions to change this habit, helping to shift the flow of money into economic development.

There are many other exchange rate control tools that I think the SBV will use after the recent market probing moves. Looking back at the two years of 2022 and 2023, there are 3 steps to control the exchange rate.

Step 1: Withdraw liquidity, using credit notes and other operations to raise interbank interest rates