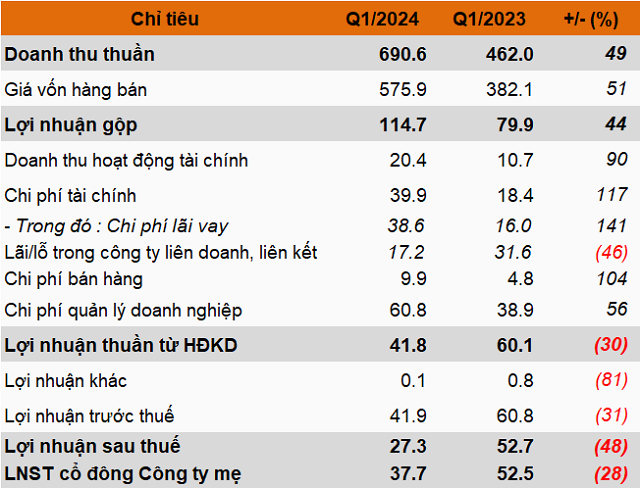

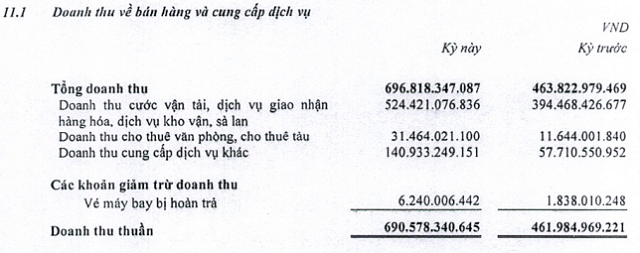

In Q1/2024, all of TMS core business segments recorded revenue growth year-over-year. Specifically, revenue from freight, cargo handling services, warehousing services, and barges was over VND524 billion, a 33% increase; revenue from office and ship rentals was over VND31 billion, a 171% increase; revenue from other services was almost VND141 billion, a 144% increase.

With the deduction of revenue from refunded flight tickets, the net revenue of TMS reached nearly VND691 billion, a 49% increase year-over-year, and fulfilled 24% of the annual plan of over VND2,895 billion. After deducting the cost of goods sold, TMS‘s gross profit was nearly VND115 billion, an increase of 44%.

Source: TMS’s 2024 Q1 financial statements

|

Another highlight is the financial revenue, which increased by 90% to VND20 billion, due to the emergence of profits from the transfer of investments and trading securities, increase in dividend payments, profit distribution, and exchange rate differences.

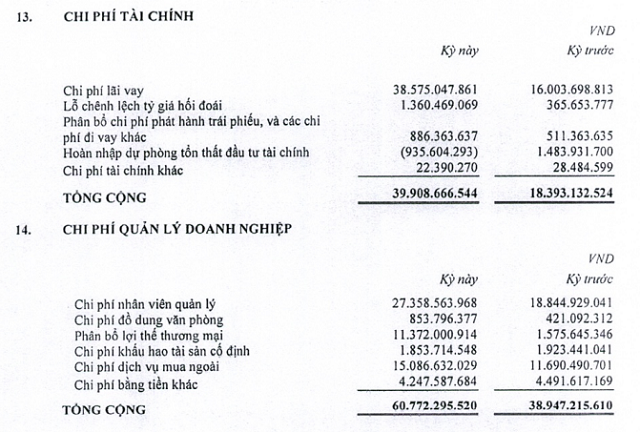

However, TMS was not able to maintain the net income of the previous period, due to the pressure from significantly increased financial expenses and management costs as well as a sharp decrease in profits from associated companies and joint ventures.

Specifically, TMS‘s financial expenses in Q1 amounted to nearly VND40 billion, a 90% increase due to higher interest expenses. Additionally, TMS‘s management costs rose by 56% and reached VND61 billion as a result of increased spending on management personnel, outsourced services, and commercial advantage allocation.

Source: TMS’s 2024 Q1 financial statements

|

In terms of income from joint ventures and associates, TMS only received over VND17 billion in the first quarter, compared to nearly VND32 billion in the same period last year.

In fact, this below-expectation business result has indeed been reflected in the business results of 2023 and not just in joint ventures and associates but also in other related companies of TMS.

Specifically, at the 2024 Annual General Meeting of Shareholders, the Chairman of TMS‘s Board of Directors, Mr. Bùi Tuấn Ngọc, mentioned a number of related companies that were not performing effectively. These included Nippon Express (Vietnam) Co. Ltd. which failed to fulfill the plan, reaching only 30% and significantly lower than the results of 2022; Mipec Port JSC which was making losses due to the failure to fill the weekly cargo volume and certain shipping lines had yet to select the port; Transport and Trade Services JSC (Transco) was incurring losses due to the forced liquidation of two aging bulk carriers at the end of 2023; other companies such as Foreign Trade Transportation and Logistics JSC (VNT), Central Vietnam Transportation and Logistics JSC (Vinatrans Da Nang), Transimex Distribution Center Co. Ltd. (DC), and Thang Long Logistics Service JSC (Thang Long Logistics) recorded difficult results, while despite making a profit, Thang Long Logistics did not meet its targets.

In the end, TMS‘s pre-tax profit was nearly VND42 billion, a 31% decrease year-over-year and only 10% of the target plan of close to VND419 billion. Net income was nearly VND38 billion, a reduction of 28%.

|

TMS’s Q1 2024 Business Results

Unit: Billion VND

Source: VietstockFinance

|

As of the end of Q1/2024, TMS‘s total assets were over VND7,838 billion, a 4% increase compared to the beginning of the year, the majority of which was the value of fixed assets of over VND2,832 billion (36%) and the value of long-term financial investments in joint ventures and associates of over VND1,735 billion (22%).

According to the explanatory notes to the financial statements, TMS has 1 joint venture, Nippon, and 5 associated companies, namely Import-Export and Investment Cho Lon (CLX), Foreign Trade and Transportation (VNT), Hai An Container Transportation (HACT), Thuy Dac San (SPV), and Vinloc Industrial Park.

Of the above-mentioned companies, Nippon is the largest investment, valued at nearly VND783 billion. At the 2024 Annual General Meeting of Shareholders, TMS‘s Chairman shared that this transportation service company contributes a significant annual dividend to TMS. In the future, TMS plans to continue negotiations to divest this investment.

Source: TMS’s Q1 2024 financial statements

|

Additionally, TMS allocated over VND210 billion to short-term investments in listed stocks and deposited nearly VND299 billion in short-term bank deposits. At the end of Q1, TMS‘s cash and cash equivalents had grown by 19% to nearly VND531 billion, accounting for 7% of total assets.

In terms of capital sources, TMS has outstanding loans of over VND2,320 billion (30%), an increase of nearly 6% compared to the beginning of the year. The company borrowed short-term and long-term loans from banks to supplement working capital needs and issued domestic corporate bonds to raise capital for investment and business operations.