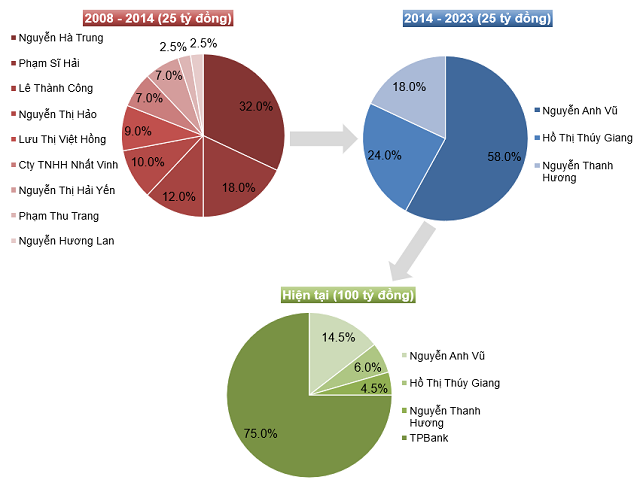

According to the information released by VFC, TPBank is the sole investor participating in the entire offered shares. After the transaction, VFC increased its capital to 100 billion VND, and TPBank also increased its ownership in VFC to 7.5 million shares, equivalent to a 75% stake, from not owning any shares before.

TPBank naturally becomes the largest shareholder in VFC, while the rest belongs to existing shareholders, including Mr. Nguyen Anh Vu (14.5%), Ms. Ho Thi Thuy Giang (6%), and Ms. Nguyen Thanh Huong (4.5%).

Returning to November 22, 2023, the State Bank of Vietnam (SBV) approved TPBank’s capital contribution and share purchase in VFC with a maximum amount of 125 billion VND. Within 12 months from the date the SBV issued the approval letter, TPBank must complete the capital contribution and share purchase in VFC.

This transaction was approved at TPBank’s 2023 Annual General Meeting held in April. The bank believes that capital contribution and share purchase to acquire a subsidiary operating in the asset management field is a necessary objective for TPBank and ensures the legal basis.

Turning back to VFC, the ownership structure of the company has once again experienced significant changes. Before TPBank’s appearance, the 3 individuals Nguyen Anh Vu, Ho Thi Thuy Giang, and Nguyen Thanh Huong collectively owned the entire charter capital of 25 billion VND since 2014, with respective stakes of 58%, 24%, and 18%. From the establishment until 2014, the charter capital of VFC was contributed by 9 shareholders (including 8 individuals and 1 organization), with Mr. Pham Si Hai owning 18% of the capital.

Shareholder Structure of VFC Since Establishment

Source: VietstockFinance

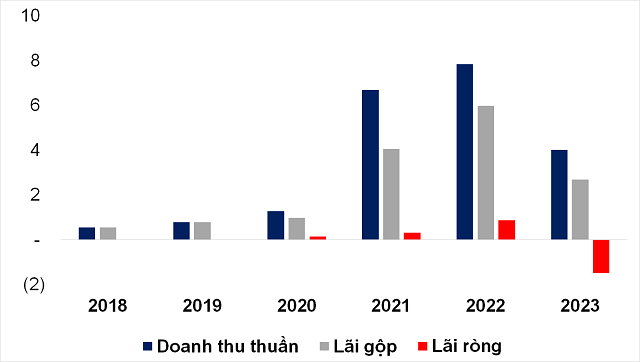

The capital increase and changes in VFC’s shareholder structure occur in the context of the company experiencing a sharp decline in 2023, despite impressive growth in the fourth quarter.

According to VFC’s financial statements for the fourth quarter of 2023, the net revenue in the last quarter was nearly 3.3 billion VND, double the same period last year, thanks to the strong growth in securities consulting activities. After deducting the cost of goods sold and other remaining expenses, VFC achieved a net profit of over 1.2 billion VND, a 12-fold increase compared to the same period.

However, this was not enough to help VFC end 2023 with positive results, as the company incurred a loss of nearly 2.7 billion VND in the first 9 months of the year. In the third quarter alone, VFC’s revenue decreased by 89% to nearly 184 million VND, due to the absence of revenue from securities investment consulting activities, while revenue from portfolio management activities also declined significantly, and the strong increase in financial revenue from securities investments could not save the challenging business period.

Ultimately, VFC ended up with a net loss of nearly 1.5 billion VND in 2023, while it had been profitable in previous years. This negative result also caused the majority of the accumulated profit of 1.8 billion VND earned in previous years to evaporate, leaving only around 384 million VND.

VFC’s Business Results from 2018 to 2023

Unit: Billion VND

Will Viet Cat Fund Management Change Its Fate?