DGW: Positive with a Target Price of VND70,400/Share

MB Securities (MBS) recommends buying DGW shares of Digiworld Corporation (Digiworld) with a target price of VND70,400/share, based on the forecast that Digiworld’s net profit will increase by 39% and 30% year-on-year in 2024-2025, respectively.

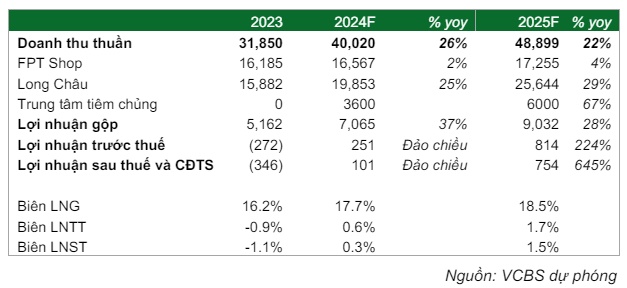

MBS believes that the ICT-CE segment (mobile phones and electronics) has bottomed out in Q2/2023 and will recover in the second half of 2024, and improve significantly in 2025 as consumption recovers. Therefore, Digiworld’s ICT-CE revenue is expected to recover and grow by 10-15% year-on-year in 2024-2025.

In the office equipment sector, DGW has a growth driver in the labor protection equipment market in the medium term. MBS forecasts that office equipment revenue will grow by 28-30% year-on-year in 2024-2025.

In summary, Digiworld’s revenue in 2024-2025 could grow by 16-21% year-on-year.

In addition, DGW can optimize sales support costs, reducing the ratio of sales expenses to total revenue from 6.1% in 2023 to 5.6% in 2024-2025, which could support net profit.

Recently, the share price of DGW has been discounted in line with the market correction, with forward P/E for 2024-2025 at 19x and 14x, respectively, below the average of 21x during the previous recovery and growth period (May 2020-November 2021). Therefore, MBS believes that this is an opportune time to accumulate DGW shares.

Read more here

Buy FRT Shares with a Target Price of VND180,000/Share

Vietcombank Securities (VCBS) recommends buying FRT shares of FPT Retail Corporation (FPT) with a target price of VND180,000/share, based on a positive assessment of FRT‘s profit recovery prospects in 2024-2025.

MBS cites data from Q1/2024, in which FRT recorded net revenue of approximately VND9.1 trillion, up 17% year-on-year. Pre-tax profit was VND80 billion, more than 40 times the same period last year, and achieved 64% of the annual profit target. This positive data was largely driven by Long Chau, which had a pre-tax profit of approximately VND118 billion in Q1, and FPT Shop, which showed a positive improvement in profit margin.

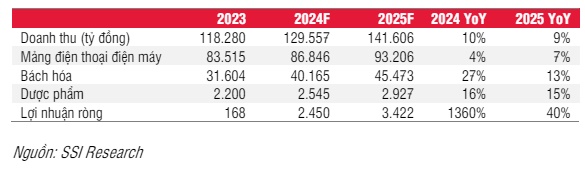

For the full year 2024, VCBS projects that FPT Shop chain revenue will reach VND16,567 billion, up 2.5% compared to 2023, with the main growth driver being the home appliance sector, which is expected to generate revenue of approximately VND1,500 billion. However, the chain will still record a net loss this year as the gross profit margin, although improved, remains low. The FPT Shop chain will need more time to return to profitability in 2025.

With the long-term potential of the pharmaceutical industry, VCBS maintains a positive view of the potential expansion of 400 Long Chau stores in 2024, along with the new support from vaccination centers, which will be a growth driver for FRT.

The initial positive results of the vaccine chain, with an average revenue of VND2.5 billion/month, provide a basis for FRT to accelerate the opening of new vaccination centers (100 centers in 2024) and move towards break-even.

|

Projected FRT Business Results for 2024-2025

|

Overall, VCBS projects FRT‘s net revenue in 2024 to reach VND40,020 billion, a 25.7% increase from 2023. Pre-tax profit is estimated to reach VND251 billion, an improvement from the net loss of VND272 billion last year and double the business plan based on the positive business results of Q1/2024.

Read more here

MWG: Positive with a Target Price of VND56,200/Share

SSI Securities (SSI) maintains its positive recommendation on MWG shares of Mobile World Investment Corporation with a target price of VND56,200/share.

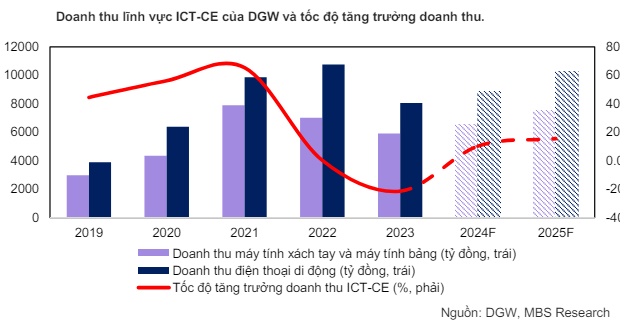

For 2024-2025, SSI projects that the phone and electronics segment (Dien May Xanh, The Gioi Di Dong, Topzone) will experience single-digit revenue growth, with a significant expansion in profit margin due to safer inventory levels and cost-cutting measures.

The retail chain (Bach Hoa Xanh) is expected to grow revenue by double digits and start making profits this year. In 2024-2025, Bach Hoa Xanh’s net revenue is estimated to reach VND40 trillion and VND45 trillion, up 26% and 13% year-on-year, respectively. Net income will reach VND67 billion and VND304 billion, respectively, compared to a loss of VND1.2 trillion in 2023.

Overall, SSI believes that the improvement in Bach Hoa Xanh’s profitability is the main growth driver for MWG from 2026 onwards, while the growth in profit for the phone and electronics chain is expected to return to normal levels after strong growth in 2024-2025.

For the An Khang pharmacy chain, SSI believes that due to An Khang’s lack of focus on the prescription drug segment for chronic diseases like its competitor Long Chau, it will be difficult for it to gain market share from hospital pharmacies. Instead, An Khang still has the opportunity to gain market share from smaller pharmacies, but in the short term, An Khang may still need to refine its product portfolio. SSI expects the pharmacy chain to remain unprofitable in 2024-2025.

|

Projected MWG Business Results for 2024-2025

|

Overall, for 2024-2025, SSI projects MWG‘s revenue to reach VND129,557 billion and VND141,606 billion, up 10% and 9% year-on-year, respectively. Net income will reach VND2,450 billion (up 1,360%) and VND3,422 billion (up 40%), respectively.

Read more here

—