Vietnam Airlines Reports Strong Q1 2024 Results

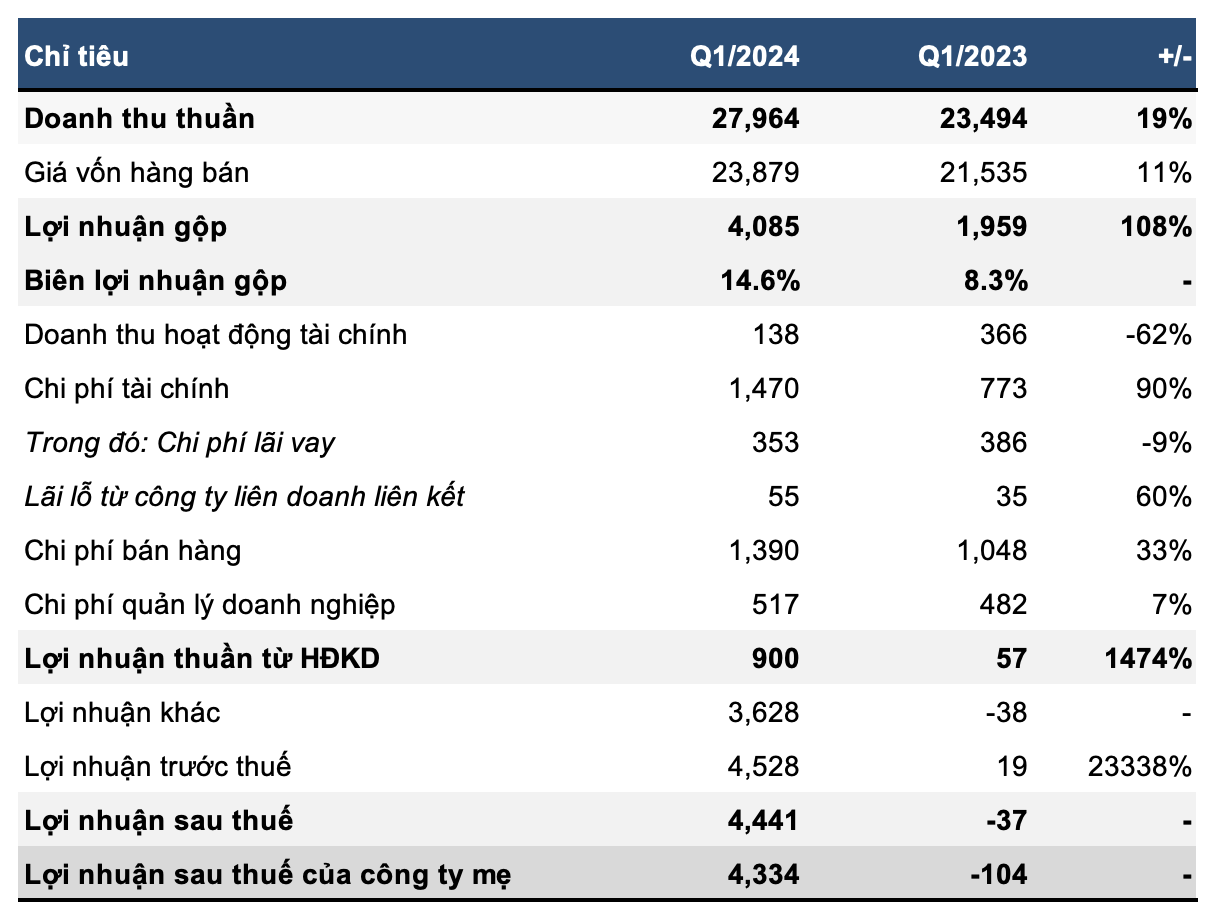

During the first three months of the year, Vietnam Airlines recorded net revenue of nearly VND 28,000 billion and gross profit of nearly VND 4,100 billion, an increase of 19% and 108% year-on-year, respectively. This is also the highest gross profit quarter ever for the national carrier. In addition, the gross profit margin nearly doubled that of the same period last year, reaching 14.6%.

Vietnam Airlines’ Q1 2024 Business Results

Unit: Billion VND

Source: VietstockFinance

|

Vietnam Airlines has witnessed a significant surge in its business activities amid the aviation market’s shortage of aircraft, while the high demand for travel during the peak Tet holiday pushed domestic airfares higher.

Moreover, the resumption of international flight routes also contributed to Vietnam Airlines’ positive business performance. In Q1 2024, international flights accounted for 65% of total air transport revenue.

Along with the recovery of the aviation market, Vietnam Airlines recorded other income of up to VND 3,630 billion. Vietnam Airlines explained that the profit arose from debt forgiveness under the aircraft repayment agreement of its subsidiary Pacific Airlines and collected fines.

Previously, Pacific Airlines announced that it had temporarily suspended operations from March 18, 2024 due to lack of aircraft. The airline successfully cleared USD 220 million of debt, equivalent to over VND 5,000 billion, with its lessor. In return, the airline returned all the aircraft it was operating in Vietnam.

With these positive factors, Vietnam Airlines ended Q1 2024 with a record net profit of over VND 4,300 billion, ending a series of 16 consecutive quarters of losses.

| Vietnam Airlines’ Quarterly Business Results |

After the Q1 2024 results, Vietnam Airlines’ equity is still negative by over VND 12,000 billion, while its accumulated loss has decreased to over VND 36,700 billion.

Even before the announcement of the strong profit report, investors may have noticed positive signs. The share price of HVN has been on a steady rise since the end of 2023 and has now increased by nearly 60% to VND 17,300 per share.

| HVN Share Price Movement |