Caution Before the Long Holiday

Over the past month, the VN-Index saw a sharp decline from 1,270 points to 1,180 points, fueled by macroeconomic risks such as rising exchange rates and political instability. The average trading value reached 21,000 billion VND/session.

Most stock groups and industries faced downward adjustments in line with the overall market trend. The real estate, financial services, and construction sectors witnessed the steepest declines (9–10%) within just one month. However, the market still saw three industry groups maintain green, including tourism, information technology, and retail. Specifically, the tourism sector surged by 11.3%, led by HVN (Vietnam Airlines).

The information technology sector rose by 7.88%, driven by FPT, following the news of its strategic partnership with tech giant NVIDIA to advance research in artificial intelligence. The retail sector increased by 6.77%, primarily due to the performance of stocks FRT and MWG, each with its own positive story, robust Q1 business results, and strong growth potential.

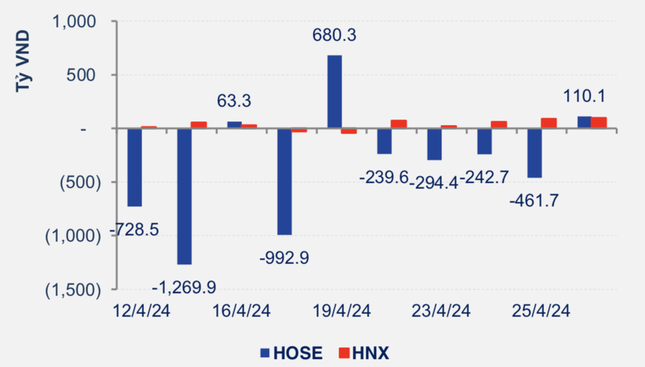

Foreign investors continued to net sell on the HoSE before the holiday.

Analysts from Viet Nhat Securities (VFS) noted that the recent trend in the VN-Index ended the short-term uptrend that began in November 2023. However, on a positive note, the medium- to long-term uptrend since late 2022 remains intact. Liquidity patterns also reinforce the scenario that the VN-Index is yet to complete its corrective phase and is merely experiencing a technical recovery.

Liquidity concentrated on sessions when the VN-Index declined, while sessions with gains witnessed lower liquidity, indicating persistent selling pressure and cautiousness regarding the upward trend, particularly ahead of the long holiday.

”Testing” Bottoms, Portfolio Restructuring

Amidst the ongoing corrective trend, VFS experts recommend that investors maintain low stock exposure, monitoring price action around the 1,200 – 1,230 point range to assess the market’s ability to form a bottom.

Following the holiday, the market may unfold according to two scenarios.

Scenario 1: The VN-Index continues to face downward pressure, dipping to the 1,100 – 1,130 point range. Investors should maintain low stock exposure and expect the VN-Index to re-establish equilibrium.

Scenario 2: The VN-Index recovers with support from capital inflows, rising above the 10-day and 20-day SMA moving averages. This could signal the end of the corrective phase, allowing investors to increase their stock exposure, focusing on stocks that have outperformed the market in recent times.

The KRX system remains delayed.

KRX System Delays

Upon resuming trading after the five-day holiday, the market was once again disappointed by the failure of the KRX system to go live as expected. The Securities and Exchange Commission stated that it lacked sufficient grounds to approve HoSE’s request to launch the KRX system on May 2nd. Consequently, HoSE has instructed securities companies to halt the transition to KRX.

SHS Securities analysts anticipate market fluctuations as it continues its recovery, aiming for the 1,225 point level. Investors with high exposure may take advantage of the upcoming recovery to restructure their portfolios and reduce exposure to safer levels. Medium- to long-term investors can continue their strategy of gradual investment during market declines, targeting leading stocks in their respective sectors with positive growth prospects for the year.

In the short term, after regaining the previous support level of 1,200 points, the VN-Index has followed a positive scenario by completing a small “w” pattern and continuing its recovery during the final session of the week. Next week, the market is expected to extend its short-term recovery, with immediate resistance around 1,225 points and potential resistance at 1,250 points, corresponding to the upper limit of the medium-term range.

In the medium term, losing the 1,250 point level caused the VN-Index to lose its momentum for forming an uptrend, and the index is expected to fluctuate within the 1,150 – 1,250 point range to accumulate strength again. This accumulation phase will likely be prolonged after the recent decline.

During the past week, economic and inflation data from the U.S. provided mixed signals, making it difficult to predict the FED’s interest rate policy in the near future. It is unlikely that interest rates will fall as soon as expected. This could continue to pressure exchange rates in Vietnam, which have been under strain recently. Given this scenario, SHS believes that market consolidation is appropriate, with no risk of entering a new downtrend in the medium term.