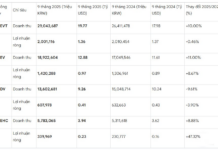

Vietnam Oil and Gas Group (Petrolimex, code: PLX) has just announced its consolidated financial statements for the first quarter of 2024, recording a revenue of VND 75,106 billion, an increase of 11% over the same period. Gross profit reached VND 4,669 billion, an increase of 31% over the same period.

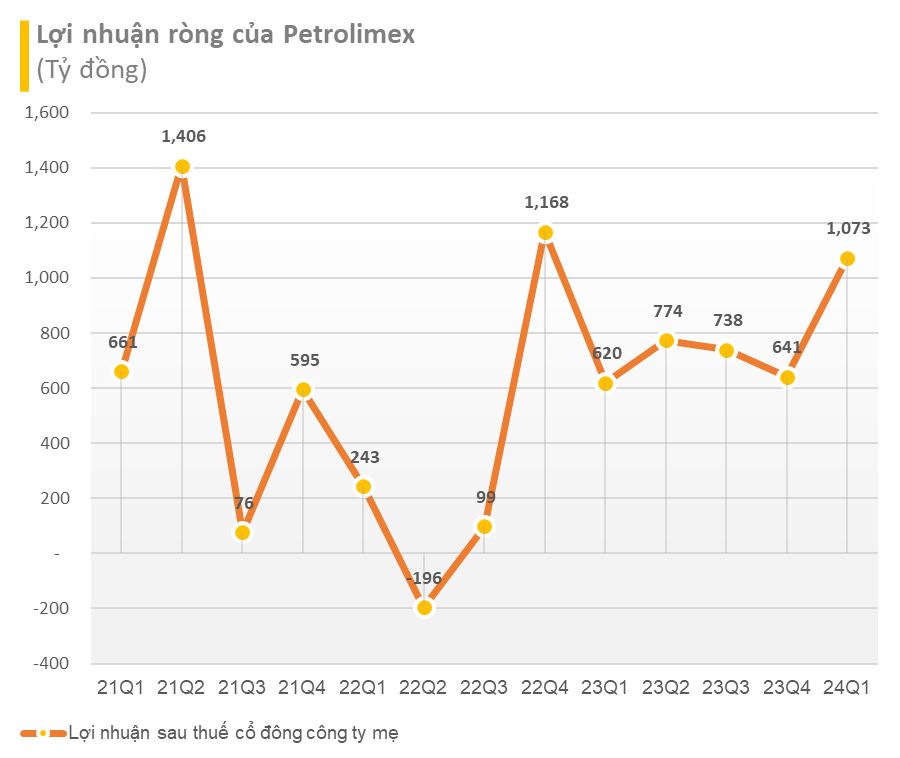

After deducting expenses, Petrolimex recorded pre-tax profit of VND 1,441 billion, an increase of nearly 72% over the same period, and after-tax profit of VND 1,133 billion, an increase of 70% over the same period.

Petrolimex said that the main reason for the increase in after-tax profit in the first quarter of 2024 compared to the same period in 2023 was due to the efficiency of the oil and gas business, while business activities in other fields of the Group were basically stable and grew compared to the same period.

According to Petrolimex, the supply of energy and world oil prices were stable, not fluctuating as strongly as in previous years; the supply of gasoline from domestic refineries was quite stable, and traders imported gasoline and oil according to plan and ensured efficiency.

Financial income also increased compared to the same period last year due to: receiving declared dividends that were not available in the same period; effective use of exchange rate insurance contracts has limited the risk of exchange rate difference losses; and effective business operations have increased net cash flow and increased interest income when using net cash flow compared to the same period.

As of March 31, 2024, Petrolimex’s total assets reached VND 80,732 billion, an increase of 1% compared to the beginning of the year. Cash, cash equivalents and bank deposits were approximately VND 25,086 billion, a decrease of VND 3,530 billion compared to the beginning of the year.

On the other side of the balance sheet, total liabilities were at VND 50,419 billion, a decrease of VND 54 billion compared to the beginning of the year, and total borrowings were at VND 16,624 billion. Equity reached VND 30,313 billion.

SSI Research’s report expects that in 2024, Petrolimex will have the opportunity to gain additional market share, thanks to tighter control over the operations of gasoline distributors.

Firstly, Hai Ha Petro and Xuyen Viet Oil, which are large gasoline distributors with total revenue of approximately VND 40,000 billion in 2022, have had their licenses revoked and have stopped clearing gasoline and oil because they do not meet the requirements to be a gasoline trader and have committed violations related to tax debts or misappropriation of gasoline price stabilization funds.

Secondly, Petrolimex may also benefit from the government’s requirement that retail dealers issue electronic invoices for each transaction in order to increase transparency in Vietnam’s gasoline industry.

Currently, it is estimated that only about 36% of the 17,000 retail units in the country issued electronic invoices at the beginning of February. Gas stations that do not issue electronic invoices may face the risk of having their operating licenses revoked.

Meanwhile, Petrolimex was a pioneer in issuing electronic invoices and has deployed this system at 2,700 of the company’s retail outlets since mid-2023. Therefore, the new regulation could help Petrolimex gain market share in the coming period.