The first two trading sessions in early May after a long holiday break recorded relatively positive developments. The VN-Index maintained its green color at the closing time of both days, increasing by a total of 10.51 points to 1,221.03 points. Notably, the end of the week session on May 3 witnessed portfolio restructuring activities of ETF funds with a focus on the VNDiamond basket as MWG shares officially left the basket, replaced by BMP. Despite some fluctuations, the benchmark index still maintained a good uptrend.

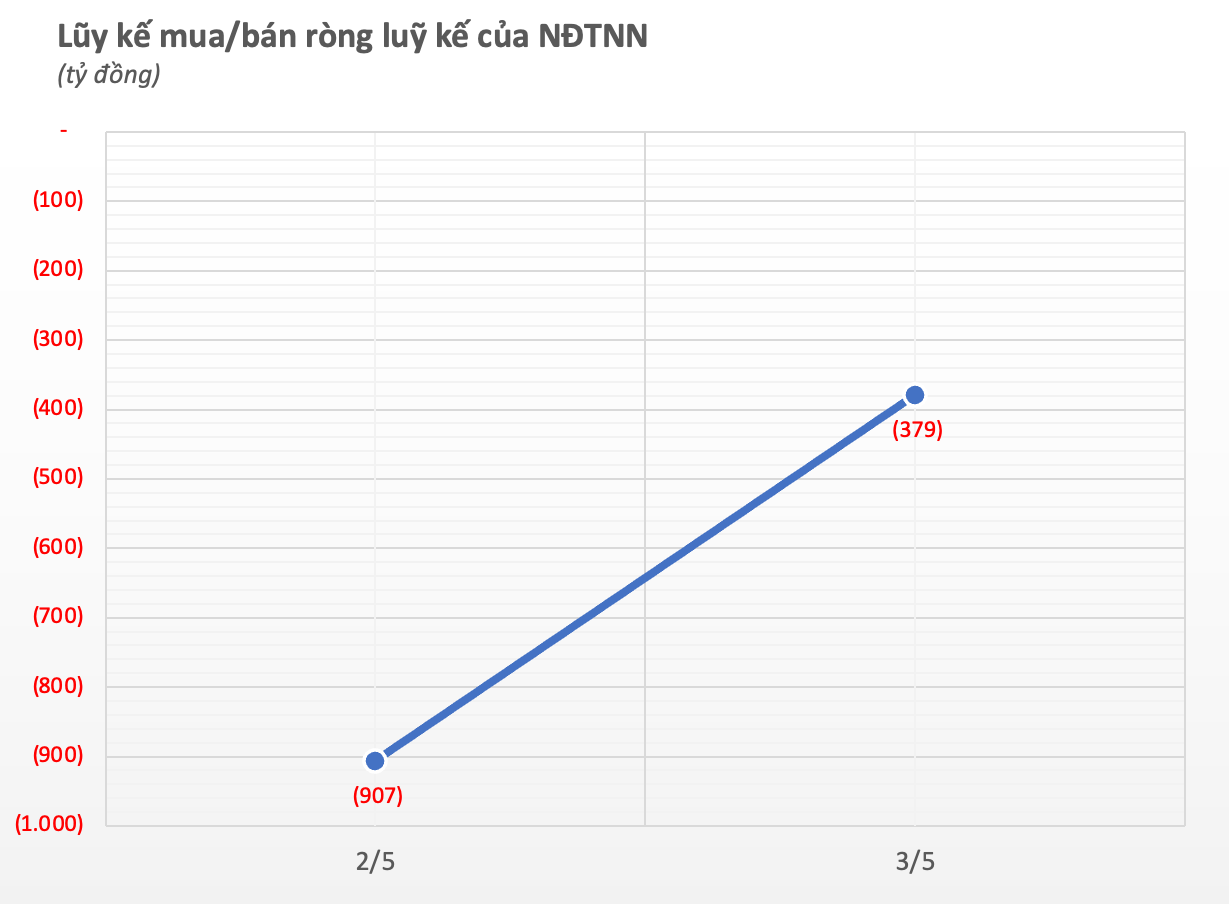

In that context, foreign investors continued to have a net selling week with a value of 378 billion VND after two sessions. Specifically, foreign investors sold nearly 1 trillion VND net in the first session of the month, then returned to net buying on May 3. In terms of each channel, foreign investors traded actively, buying a net 294 billion VND through matching orders, however, the group of foreign investors sold a net 672 billion VND through negotiation.

Looking at each exchange during the week, foreign investors sold a net 313 billion VND on HoSE, bought a net 11 billion VND on HNX, and sold a net 76 billion VND on UPCoM.

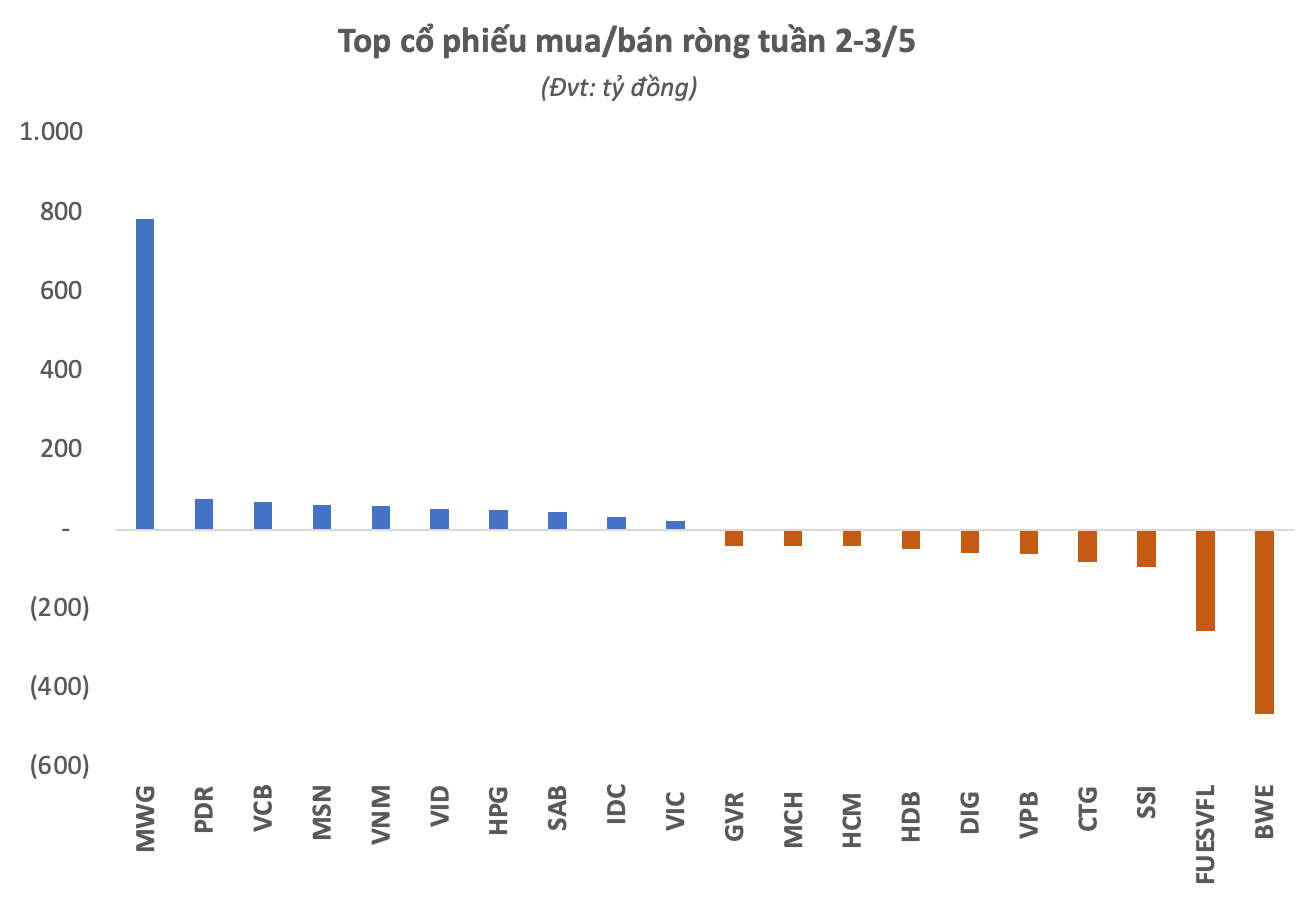

In terms of stock codes, the focus of net selling this week was recorded in the BWE water industry stock with 464 billion VND, mostly in negotiated transactions. FUESSVFL fund certificate also saw net selling with a value of 256 billion VND. SSI securities stock was also sold with a net value of nearly 95 billion VND, while CTG was sold with a net value of 82 billion VND. The two codes VPB and DIG were also sold off with 61 billion VND and 58 billion VND, respectively.

The net selling list also included HDB with a net selling value of 49 billion VND. The list of net sales by foreign investors last week also included HCM, MCH, GVR…