The benchmark index closed at 1,221 points, not its highest point of the session, but trading remained relatively active. Liquidity increased very slowly for 2/3 of the trading time, and it was only towards the end of the afternoon session that cash flow picked up.

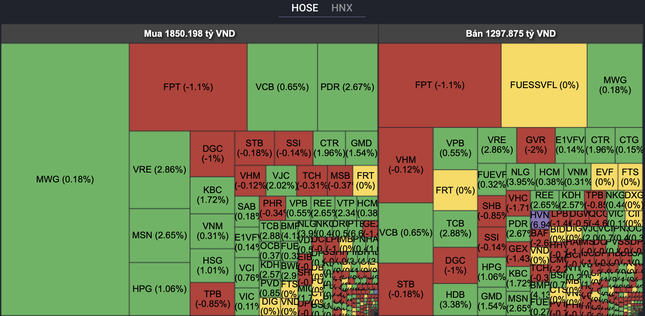

The trading value on HoSE exceeded VND 17,000 billion, with a significant contribution from MWG of Mobile World. Nearly 30 million MWG shares were exchanged, a record high volume since the stock was listed on the exchange. The trading value reached nearly VND 1,700 billion, the highest on the entire exchange. However, the market price increased only slightly by 0.2%.

Not only domestic money, but also foreign investors actively traded this stock, buying a net of nearly 10 million units, worth over VND 545 billion. MWG became the stock that foreign investors accumulated heavily today.

MWG became the focus of foreign net buying.

This retail stock has been in the spotlight in recent sessions after announcing its Q1 business results, with a net profit of VND 902 billion, 43 times higher than the same period in 2023 and the highest level in 6 quarters since Q3/2022.

Despite the explosive trading volume, MWG did not provide any significant boost to the benchmark index, not even making it into the market-leading group, due to the stock price only rising by 0.2%. The stocks leading the uptrend were TCB, VCB, HVN, MSN, HDB, ACB, etc.

The return of blue-chips, especially bank stocks, helped the market trade with enthusiasm. HVN of Vietnam Airlines hit the ceiling, trading volume increased sharply to 6.7 million units after receiving record-high Q1 business results. The airline reported a profit of VND 4,441 billion.

Explaining the sudden profit, Vietnam Airlines said that this is the peak business season in the aviation industry, and the corporation continues to actively implement drastic solutions in business operations such as optimizing and improving the operating efficiency of the fleet and human resources; minimizing costs, negotiating service prices, interest rates, etc.

Vietnam Airlines said that it has completed the restructuring plan for the corporation for the period 2021-2025, reported to shareholders, and approved by competent authorities. In the plan, in 2024-2025, the corporation will implement synchronous solutions to address the state of negative consolidated equity, such as synchronous implementation of solutions to enhance adaptability and profitable business operations, restructuring assets and financial investment portfolios to increase revenue and cash flow.