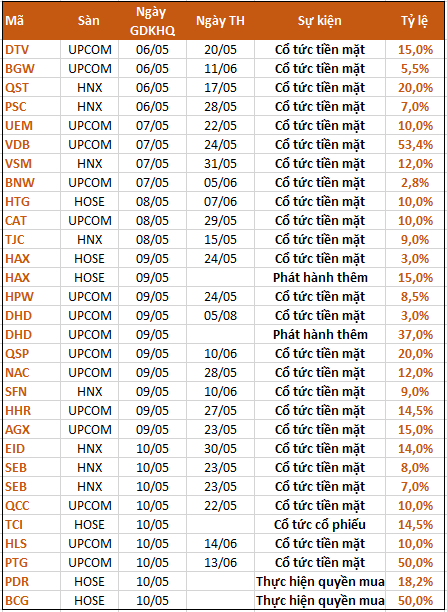

According to statistics, 28 enterprises announced dividend rights in the week of May 6-10, of which 23 enterprises paid dividends in cash, 1 enterprise paid dividends in stock, 2 enterprises issued additional shares, and 2 enterprises paid combined dividends.

This week, many enterprises paid high cash dividends, with the highest payout ratio being 53.4% and the lowest being 2.8%.

On May 7, Dong Bac Coal Transport and Processing JSC (code VDB) will close the shareholder list for the payment of 2023 cash dividends. The payout ratio is 53.36%, which means that shareholders owning 1 share will receive 5,336 VND. The payment date is May 24, 2024.

With 8.6 million shares in circulation, the company plans to spend nearly 46 billion VND to pay dividends this time. Thus, VDB will allocate nearly 90% of its after-tax profit in 2023 (51 billion VND) to pay dividends to shareholders in this tranche.

Looking back at historical data, since it began trading in 2018, this coal company has maintained a steady level of cash dividends, with an annual rate of over 20%. However, the cash dividend in 2023 is still a record high.

Hang Xanh Automobile Service JSC (code HAX) announced that May 10 is the last registration date to receive the 2023 cash dividend and bonus shares.

HAX will pay the 2023 cash dividend at a rate of 3% (shareholders owning 1 share will receive 300 VND). With over 93 million shares in circulation, the Company is estimated to spend over 28 billion VND on this profit distribution. The implementation date is expected to be May 24, 2024.

Also with the shareholding list closed on May 10, HAX will issue bonus shares at a rate of 15% (shareholders owning 100 shares will receive an additional 15 new shares).

On May 13, Phan Thiet Export Garment JSC (code PTG) will close the list of shareholders to receive the first interim dividend of 2024 in cash at a rate of 50% (01 share will receive 5,000 VND). With more than 4.9 million shares in circulation, PTG is estimated to spend nearly 25 billion VND on this dividend payment. The payment date is expected to be June 13, 2024.

In the market, PTG’s share price has been at a mere 500 VND/share for a long time, which is only 1/10 of the dividend shareholders are about to receive. Notably, this is also the historical peak of this stock due to the dividend payment over many years, causing the stock price to adjust to a very low level.

Phat Dat Real Estate Development JSC (PDR) has just announced that on May 13, it will close the list of shareholders to exercise the right to purchase additional shares. Accordingly, Phat Dat plans to issue approximately 134.33 million shares to existing shareholders in the ratio of 5.5:1, meaning that shareholders owning 1 share will be entitled to 1 right, for every 5.5 rights purchased will be purchased 1 new share, the issue price is 10,000 VND/share.

Bamboo Capital Group JSC (BCG) has just announced that on May 13, it will close the list of shareholders to exercise the right to purchase additional shares. Specifically, Bamboo Capital plans to issue more than 266.73 million shares to existing shareholders in the ratio of 2:1, corresponding to 1 share for 1 right, for every 2 rights purchased 1 new share, with the issue price of 10,000 VND/share.