|

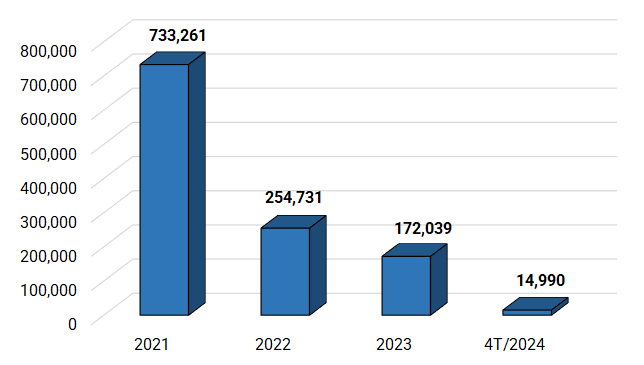

Corporate bond issuance in April 2024: A four-year overview (in trillion VND)

Source: Author’s compilation

|

The amount of capital raised in April this year was 20 times higher than the same period last year, when the market only issued a single lot of bonds worth 671 billion VND from North Star Holdings JSC, indicating positive signs of recovery for this important capital channel after a period of stagnation, although it has not yet returned to the “cheap money” era of 2022 and 2021 (with issuances of nearly 30 trillion VND and 53 trillion VND, respectively).

In April, banks MBB, TCB, and MSB issued a total of 7.8 trillion VND worth of bonds, accounting for 55% of the total. The “Vin” group, comprising VHM and VIC, raised 6 trillion VND. Notably, VHM has issued bonds for the second consecutive month.

This time around, the interest rates offered by banks were extremely low, starting at just 3.7% per annum, while real estate businesses had to bear a minimum cost of 12% per annum for capital mobilization, despite similar maturities. However, compared to previous years, the current interest rates offered by banks are on par.

In the first four months of 2024, banks offered nearly 15 trillion VND worth of bonds, accounting for half of the market’s total value. This figure is less than a tenth of last year’s issuances and equivalent to only about 2% of the amount raised in 2021.

|

Bond issuance value of banks over the years (in trillion VND)

Source: Author’s compilation

|

TCB and MSB make their first appearance this year

Making its first appearance in 2024, Technocommercial Joint Stock Bank (HOSE: TCB) issued a 3 trillion VND bond lot, TCBL2427001, with a coupon rate of 3.7% per annum and a three-year maturity.

According to the Hanoi Stock Exchange (HNX), TCB has nearly 32 trillion VND worth of bonds from 15 lots in circulation, with maturities ranging from two to three years and interest rates from 3.7% to 7.2% per annum. Notably, the bank borrowed 25 trillion VND in 2023.

Last year, TCB made timely interest payments of 537 billion VND and repurchased more than 7 trillion VND worth of principal before maturity. In 2022, the bank repaid 376 billion VND in interest and 6.2 trillion VND in principal.

Similarly, Vietnam Maritime Commercial Joint Stock Bank (HOSE: MSB) borrowed 2.8 trillion VND from bondholders through two lots of three-year bonds with a coupon rate of 3.9% per annum. MSB currently has nine bond lots worth 9.7 trillion VND in circulation, mostly maturing in 2026. Half of these were issued last year, with interest rates ranging from 4.3% to 7.5% per annum. In 2023, MSB repaid bondholders 343 billion VND in interest and 5 trillion VND in principal.

Military Commercial Joint Stock Bank (HOSE: MBB), after issuing 1 trillion VND worth of bonds last month, continued to raise a total of 2 trillion VND through six lots of bonds with maturities ranging from seven to ten years and interest rates from 6.18% to 6.47% per annum. A common feature of MBB‘s recent bond issuances is that they all have maturities of at least seven years. However, interest rates in April showed a downward trend for the same tenor.

Bond debt doubles charter capital

Lach Hong Trade and Tourism continued its bond issuance for the third consecutive month. In April, the company offered two new lots worth 590 billion VND, with an interest rate of 9% per annum, unchanged from previous offerings.

To date, the company has borrowed 1.2 trillion VND, double its charter capital (670 billion VND). A common feature of these four lots is that they are all non-convertible, non-warrant-attached bonds, guaranteed by assets, and maturing in 2027, with Techcom Securities Joint Stock Company (TCBS) as the custodian.

VINGROUP Joint Stock Company (HOSE: VIC) had its first issuance of the year with two lots of bonds, each lot comprising 20,000 units with a face value of 100 million VND/unit, raising 4 trillion VND. The bonds will mature in April 2026 and carry an interest rate of 12.5% per annum. Currently, VIC has seven bond lots in circulation, totaling 7.6 trillion VND.

Last year, the enterprise of billionaire Pham Nhat Vuong fully paid interest of 382 billion VND to bondholders of lots VICB2124003 and VICGIFB1626002. Lot VICB2124003 will mature in June this year, while the other lot will mature in 2026.

Earlier in April, VIC‘s Board of Directors approved a plan to privately place 8 trillion VND worth of bonds to restructure its debts. These bonds are non-convertible, non-warrant-attached, and unsecured. The company plans to divide the issuance into four tranches from April 2024 to June 2024, with a maximum term of 24 months.

Vinhomes Joint Stock Company (HOSE: VHM) continued to raise 2 trillion VND through the bond lot VHMB2426003, with a term of 24 months and an interest rate of 12% per annum. This real estate giant had also raised 4 trillion VND in March.

In March 2024, VHM‘s Board of Directors approved a plan to issue a maximum of 10 trillion VND worth of non-convertible, non-warrant-attached, unsecured bonds in multiple tranches. The maximum term is 24 to 36 months, and the issuance will be completed no later than the third quarter of 2024.

|

List of bond lots issued in April 2024

Source: Author’s compilation

|

Corporate Bonds in March 2024: Real Estate Accounts for 80% of Issuance Value