With over 408.7 million shares outstanding, the execution ratio is 100:15, meaning that shareholders owning 100 shares will receive 15 new shares. It is estimated that the company will need to issue more than 61.3 million shares to complete the 2023 dividend payment.

If the above issuance is completed, REE’s charter capital is expected to increase from over VND 4,097 billion to over VND 4,710 billion.

Previously, on April 26, 2024, REE also paid cash dividends for 2023 at a rate of 10%, totaling nearly VND 409 billion.

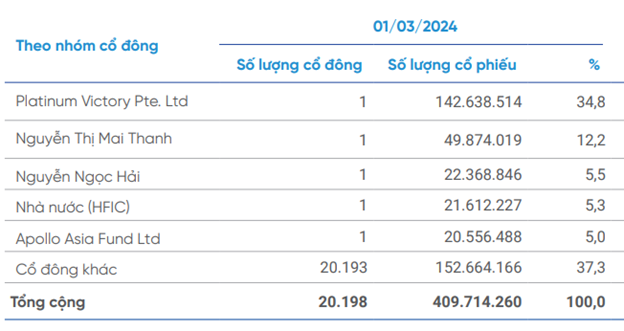

As of March 1, 2024, Platinum Victory Pte. Ltd. is the largest shareholder of REE, owning more than 142.6 million shares, or 34.8%. Following is Nguyen Thi Mai Thanh, Chairwoman of the Board of Directors, holding over 49.8 million shares, or 12.2%. With these holdings, the two major shareholders received nearly 21.4 million shares and over 7.4 million shares, respectively, in this dividend payment.

Source: REE

|

Net profit in Q1 decreased by 36%

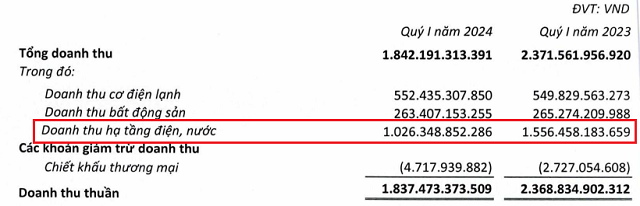

In the first quarter of 2024, REE recorded net revenue of nearly VND 1,838 billion, down 22% compared to the same period last year. The decrease in revenue was due to a 34% drop in the infrastructure electricity and water segment, which contributes the majority of REE’s revenue, to over VND 1,026 billion.

Source: REE

|

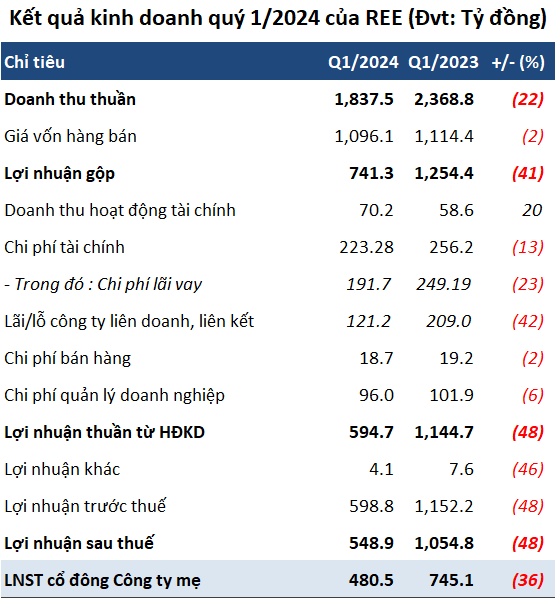

After deductions, the company’s gross profit decreased by 41% to over VND 741 billion. The gross profit margin also narrowed from 53% to 40% in this quarter.

Meanwhile, financial revenue increased by nearly 20% to VND 70 billion. Total expenses for the period were VND 338 billion, down 10% year-on-year, mainly due to a 23% decrease in interest expenses to nearly VND 192 billion. As a result, REE reported a net profit of nearly VND 481 billion, down 36%.

In its explanation, REE attributed the decrease in electricity revenue to the significant decline in profits of member companies and associated companies in the hydropower group, including Vinh Son Song Hinh Hydropower Joint Stock Company, Thac Ba Hydropower Joint Stock Company, and Thac Mo Hydropower Joint Stock Company, among others, which led to a decrease in the company’s profit.

For the full year 2024, REE set a plan to achieve revenue of VND 10,588 billion and after-tax profit of VND 2,409 billion, up 24% and 10%, respectively, compared to the previous year. Thus, the company has achieved 17% of its revenue plan and 23% of its profit plan for the year after the first quarter.

Source: VietstockFinance

|

As of March 31, 2024, REE’s total assets reached nearly VND 35,141 billion, a slight increase of 1% from the beginning of the year. Of this, cash and cash equivalents were nearly VND 3,320 billion, up 10%, and inventories were valued at nearly VND 1,409 billion, up 4%.

On the other side of the balance sheet, REE had over VND 14,286 billion in payables, a slight increase of 1% from the previous period. Of this, short-term and long-term financial borrowings totaled VND 10,697 billion, unchanged from the beginning of the year and accounting for 75% of the company’s total debt.