Listed on UPCoM in 2010, Dong Nai Transportation Construction JSC (UPCoM: DGT) did not leave a significant mark on the market due to its modest scale of capital and assets, meager revenue and profit, and the dominance of its parent company, Sonadezi Bien Hoa Industrial Zone Development JSC (Sonadezi), which held a controlling stake of 63.72%.

| Chartered capital and total assets of DGT from 2009 to 2019 |

| Revenue and net profit from 2009 to 2019 |

The turning point for Dong Nai Transportation Construction JSC (UPCoM: DGT) came in 2019-2020, following the first capital increase since the company’s privatization in 2005.

Consecutive private placements and the emergence of new leadership

At the 2019 Annual General Meeting of Shareholders (AGM), the Board of Directors (BOD) proposed a plan to issue 4 million shares at VND 12,000 per share. Shareholders questioned the board about the market price at that time, which fluctuated around VND 28,000-33,000 per share, and suggested an issue price of VND 20,000 per share, arguing that VND 12,000 was selling the company too cheaply to outside investors.

The chairman of the meeting, Mr. Phan Cao Minh, explained that the criteria for identifying strategic investors had been approved by the 2018 AGM, and the 2019 meeting was merely a procedural formality. As a result, 4 million shares were distributed to 5 individual investors at VND 12,000 per share, with each investor receiving 600,000 shares, equivalent to a 9.26% stake. Chartered capital increased to VND 64.8 billion, of which VND 48 billion was used to repay bank loans and social insurance debts, and the remaining was used to supplement working capital. In the same year, DGT also issued VND 190 billion worth of bonds with an interest rate of 11.5%/year and a 2-year term. The bonds were secured by DGT shares owned by individuals and organizations with a minimum value of 65% of the chartered capital, as well as assets owned by DGT or third parties.

In 2020, the BOD continued to propose a plan to issue 20 million shares privately to restructure finances and enhance capital capacity for bidding on construction projects. Several positions in the upper management changed that year. The position of Chairman was transferred from Mr. Phan Cao Minh to Mr. Nguyen Lam Tung, who has a background in finance and was elected to the BOD at an extraordinary general meeting in 2019.

Mr. Tung, born in 1982, has held various positions such as consulting team leader, deputy head, and head of the financial consulting division at the Ho Chi Minh City branch of Saigon-Hanoi Securities JSC, Ocean Securities JSC, and National Securities JSC, respectively. In addition to DGT, Mr. Tung is also an Independent Member of the BOD of DRH Holdings JSC (HOSE: DRH), and a Member of the BOD of Phu Tho Tourism Service JSC (UPCoM: DSP). According to DRH, Mr. Tung has been responsible for numerous large transactions and projects related to privatization consulting, securities and corporate bond issuance consulting, listing consulting, and enterprise restructuring for many years. |

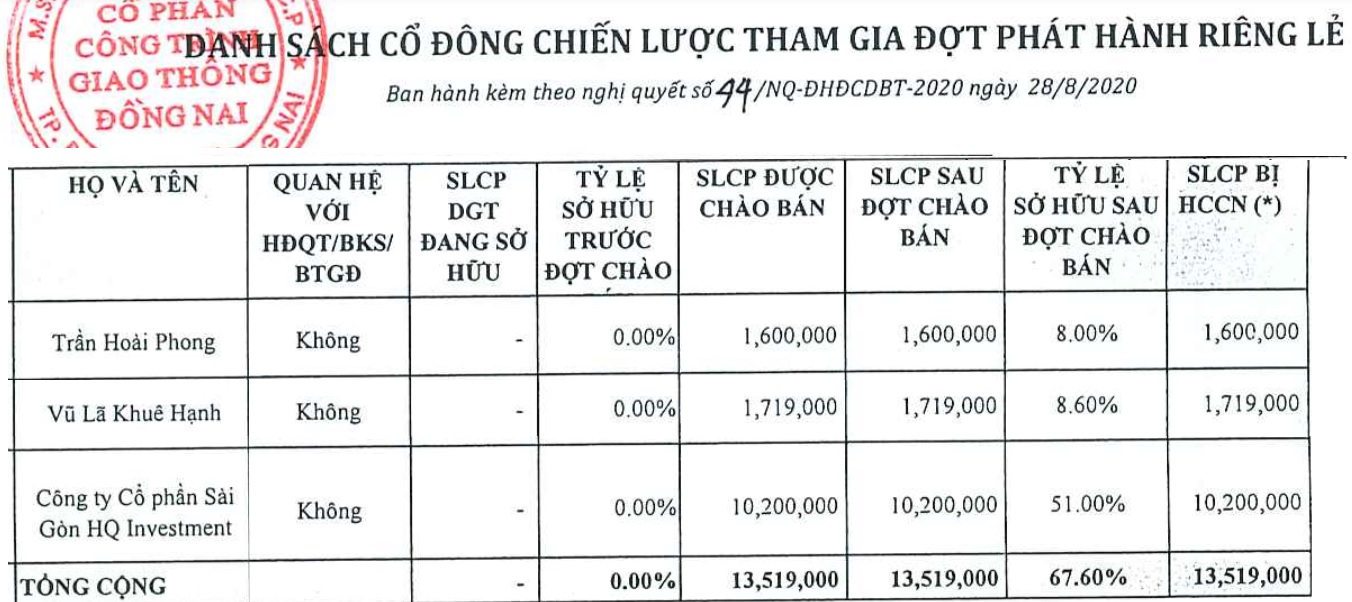

Under Mr. Tung’s leadership, DGT witnessed a turning point in 2020, with its chartered capital increasing from VND 64.8 billion to VND 200 billion through the private issuance of 13.5 million shares at VND 12,000 per share to 2 individuals and 1 organization in August 2020.

Source: DGT

|

|

Sai Gon HQ Investment was established in May 2020, three months before DGT approved the list of strategic shareholders. It had a chartered capital of VND 1 billion and mainly operated in the real estate sector. The founding shareholders included Eco United Holdings LLC with a 34% stake, Uy Nghi Investment LLC with a 40% stake, and Mr. Luong Van Quang with a 26% stake. The company was directed by Mr. Le Quoc Ky Quang, who also acted as its legal representative. In April 2021, the enterprise changed its name to HQ Investment Group JSC. |

The proceeds of approximately VND 162 billion were used by DGT to purchase a 50% stake in Dong Loi Co., Ltd., a company that owns the Quỳ Hợp white stone mine in Nghe An province. In addition, DGT has two subsidiaries: DGT Industrial Park Investment and Development One Member Limited Liability Company and DGT Construction Materials Production and Trading One Member Limited Liability Company.

The 2020 financial results began to show revenue from the stone mines, which was expected to be the main contributor to the company, while in previous years, DGT‘s revenue came primarily from four segments: construction installation (dominant), leasing services, construction material sales, and others, including hot mix asphalt.

The construction installation segment outperformed thanks to the booming real estate market, with revenue in 2020 reaching a record high of VND 665 billion, 71 times higher than in 2019. The company recorded a net profit of VND 88 billion, a significant improvement from the loss of VND 20 billion in the previous year. With this profit alone, DGT eliminated its accumulated losses from previous years.

Along with the impressive profit, the company’s total assets at the end of 2020 “ballooned” nearly sixfold, from VND 250 billion to VND 1,250 billion. Short-term receivables from customers increased from VND 20 billion to VND 664 billion, and inventory rose from less than VND 1 billion to VND 158 billion. Despite the robust business performance and the elimination of accumulated losses, the company’s cash balance remained at a meager few hundred million VND, and the operating cash flow was negative at over VND 244 billion.

In 2021, DGT continued its ambitious plans to double its chartered capital to VND 400 billion and elected Mr. Tran Quang Tuan, Chairman and General Director of Central Construction JSC, to the BOD.

Mr. Tran Quang Tuan – Chairman and General Director of Central Construction JSC

|

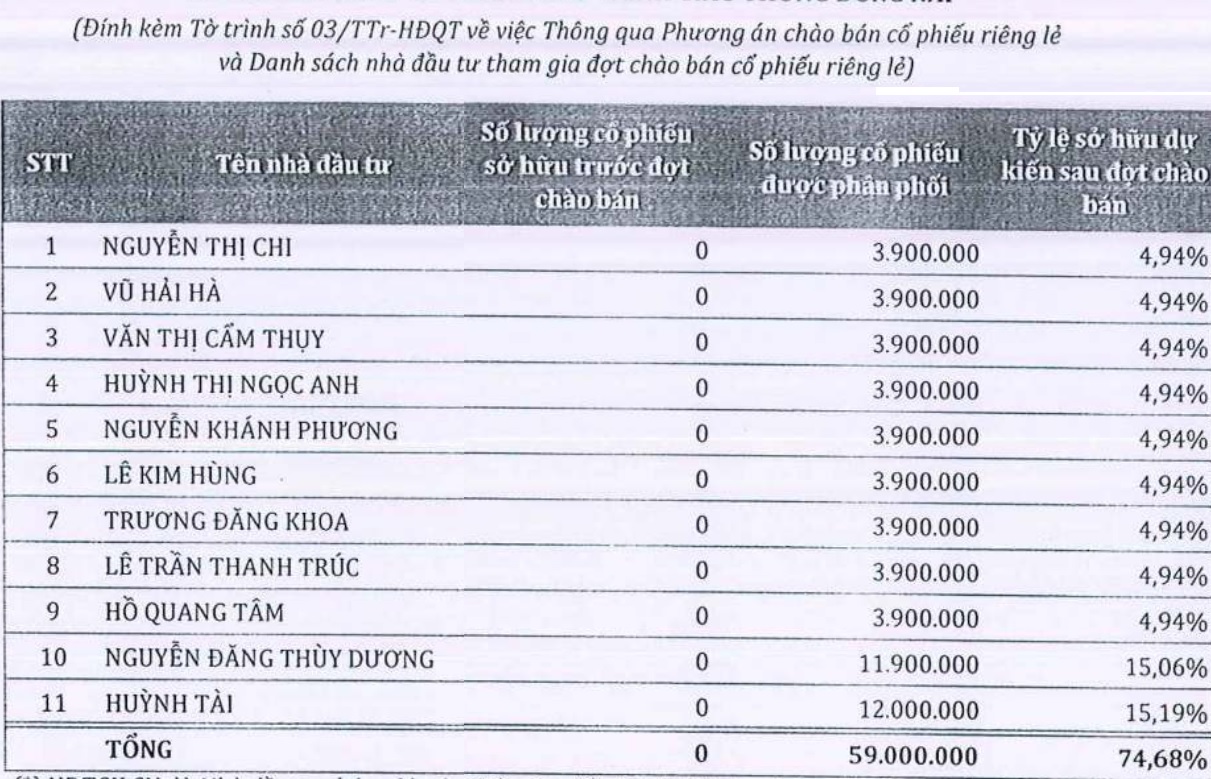

Subsequently, at an extraordinary general meeting in 2021, DGT shareholders approved the private placement of 59 million shares to 11 individuals at VND 12,000 per share to increase capital to VND 790 billion. The proceeds were intended to be used as follows: VND 325 billion to contribute to its subsidiary, DGT Investment One Member Limited Liability Company, VND 15 billion to supplement working capital, and VND 368 billion to pay suppliers.

Source: DGT

|

Despite the substantial capital increase, DGT‘s total assets decreased in 2021 due to a reduction in short-term assets from VND 990 billion to VND 395 billion. This was mainly due to a decrease in receivables from Construction Joint Stock Company No. 1 (CJSC1) from VND 584 billion to VND 11 billion and a decrease in receivables from Ms. Vo Diep Cam Van from VND 150 billion to VND 31 billion in the transaction for the deposit to purchase a 50% stake in Dong Loi Company. Additionally, during the year, the company invested VND 158 billion to purchase 3.6 million shares of Dong Thap Construction and Building Materials JSC (UPCoM: BDT), equivalent to a 9.33% stake.

In 2022, DGT‘s leadership set more ambitious goals, aiming to increase capital to VND 2,000 billion in the 2022-2023 period to expand investments and M&A activities for stone mines in Dong Nai, Binh Duong, and Ha Tinh provinces, as well as to acquire the remaining 50% stake in Dong Loi Company.

With a significant portion of capital allocated to investments and M&A, DGT did not pay dividends to shareholders from 2018 to 2023, despite a dividend payout ratio of 10-15% in previous years.

The company intended to expand its mineral exploitation, construction materials, and construction segments and decided to cancel the use of VND 325 billion raised from the private placement of shares to contribute capital to DGT Investment One Member Limited Liability Company.

|

Chartered capital of DGT from 2018 to 2023

Source: VietstockFinance

|

Where did the ballooning assets come from?

Despite consecutive capital increases, the company’s cash balance remained symbolic at a few hundred million VND. Instead, its assets were concentrated in receivables, such as VND 132 billion from Cuu Long Construction Materials Technology LLC at the end of 2022 and VND 419 billion from a business cooperation contract with Mr. Truong Hien Vu. The company explained that this cooperation lasted for 12 months and involved six contracts to seek investment opportunities in areas such as the Quỳ Hợp white stone mine in Nghe An province (VND 150 billion), the development of inland ports on a 5-hectare area in Dong Thap province (VND 60 billion), the search for two industrial parks in Central Vietnam (nearly VND 90 billion), investments in construction materials and minerals (VND 154 billion), and the search for an industrial park in Central Vietnam (VND 66 billion).

Additionally, on April 28, 2023, DGT signed a promised sale and purchase agreement with Mr. Nguyen Van Dong and Ms. Tran Thi Mai Huong, who held a 50% stake in Dong Loi Co., Ltd., to purchase their entire stake for a price of no less than VND 350 billion, with the transfer deadline set for July 30, 2023. Previously, DGT had paid VND 150 billion to acquire a 50% stake in Dong Loi from Ms. Vo Diep Cam Van.

By the end of 2023, DGT had completed the purchase of Mr. Dong and Ms. Huong’s capital contributions, valued at nearly VND 50 billion, increasing its ownership from 50% to 99.98% in Dong Loi, equivalent to an investment value of nearly VND 200 billion. This brought the total number of subsidiaries to six. Conversely, DGT divested its 3.6 million shares in BDT for a value of nearly VND 95 billion, compared to a capital contribution value of VND 121 billion, resulting in a temporary loss of VND 26 billion.

Moreover, the company’s receivables from Mr. Truong Hien Vu increased by nearly VND 110 billion to VND 530 billion during the year.

DGT also provided short-term loans to Ms. Nguyen Ngoc Ha Phuong (over VND 206 billion) and Ms. Phan Thi Yen (VND 110 billion) at a 0% interest rate and without collateral. The maturity date for these loans was December 31, 2023.

In February 2022, DGT took advantage of the favorable conditions and issued VND 350 billion worth of bonds with a 4-year term and an interest rate of 11%/year. By the end of 2023, the outstanding balance of these bonds was VND 238 billion. The collateral for these bonds included 12 million DGT shares owned by a third party and a land lease contract, along with assets attached to a 1.5-hect