The market witnessed a gloomy session on the weekend of May 10, with the VN-Index trading below the reference level for most of the day. At the close, the main index fell 3.94 points to 1,244.70. Foreign exchange transactions were a downside, with a net sell-off of VND 490 billion across the market.

In this context, securities companies’ proprietary trading recorded a slight net buy of VND 11 billion on the three exchanges.

On the HoSE, securities companies’ proprietary trading net bought VND 35 billion, including a net buy of VND 14 billion on the matching channel but net sold VND 50 billion on the negotiated channel.

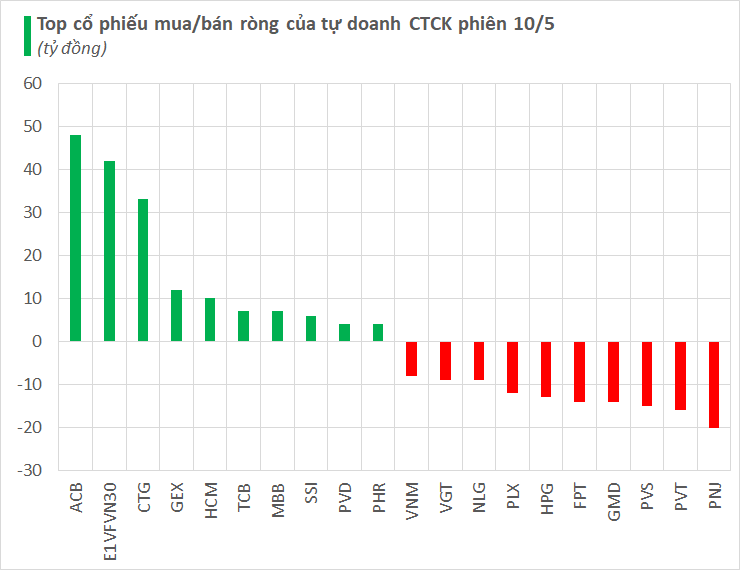

Specifically, the securities companies’ strongest net buying was in ACB with VND 48 billion. The two codes E1VFVN30 and CTG were net bought at VND 42 billion and VND 33 billion, respectively. GEX shares were also net bought at VND 12 billion. In addition, codes such as HCM, TCB, MBB, SSI… were also net bought in the May 10 session.

On the other hand, securities companies’ strongest net selling was in PNJ with nearly VND 20 billion. PVT and GMD codes were net sold at VND 16 billion and VND 14 billion, respectively. This was followed by FPT and HPG, which were also net sold at around VND 13-14 billion each. The stocks that were net sold in today’s session also included a series of codes such as PLX, NLG, VNM, STB…

On the HNX, securities companies’ proprietary trading net sold VND 15 billion, including a net sell-off of VND 15 billion in PVS and nearly VND 1 billion in SHS.

On UPCoM, securities companies’ proprietary trading net sold nearly VND 9 billion, with VGT being net sold at more than VND 9 billion, while QTP was net bought at VND 1 billion.