The VN-Index fluctuated within a narrow range during the morning session, but started to gain momentum after 2 pm as some stocks attracted positive cash flow. Leading the VN30 group was PLX, surging 5.4% with the support of positive Q1 financial results and a 15% cash dividend payout for 2023. Net profit increased by 70% to 1,133 billion VND. The record date for shareholders to receive dividends is May 15, and payments will commence from May 28 onwards.

Additionally, the aviation group continued to boost the VN-Index, with VJC climbing 4.6% to 118,600 VND per share and HVN rising 3.5% to 20,450 VND per share. Robust revenue and profit growth in Q1 heated up aviation stocks.

VN-Index supported by the upward momentum of steel, oil and gas, and aviation sectors.

With a 4.6% increase, Vietjet’s stock (VJC) reached a new peak in the past year. According to the financial report for Q1/2024, Vietjet’s air transport revenue reached 17,765 billion VND, and net profit reached 520 billion VND, marking a respective rise of 38% and 209% compared to the same period in 2023. Vietjet’s consolidated revenue and net profit stood at 17,792 billion VND and 539 billion VND, reflecting a respective surge of 38% and 212% year-on-year. With this level of profit, Vietjet has regained its pre-COVID-19 performance.

Similarly, HVN, the stock of Vietnam Airlines, is hovering near its one-year peak. ACV, the stock of Airports Corporation of Vietnam, is in a similar situation. ACV recorded a Q1 revenue of 5,644 billion VND, a 19% increase from the previous year, thanks to the recovery of the international aviation market. Net profit surged by 79% to 2,917 billion. ACV’s market capitalization surpassed 8 billion USD, ranking third after Vietcombank and BIDV.

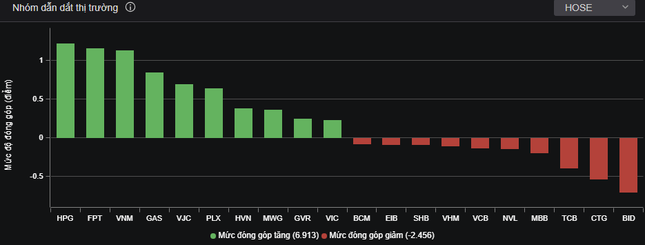

Heading the market’s driving force was the “national stock” HPG, which also boasted the highest liquidity on the exchange, nearing 900 billion VND. HPG, along with the steel sector, was immersed in green, despite the increase being limited to around 1-2%. HPG closed the session with a 2.9% gain, ending at 30,150 VND per share.

Apart from the aforementioned stocks and sectors, the rest of the market was relatively subdued. While the VN-Index concluded the session with a gain of over 7 points, nearly 180 stocks on the HoSE witnessed price declines. Among the VN30 group, 10 stocks recorded losses. The state of differentiation became more pronounced.

At the close, the VN-Index rose 4.33 points (0.35%) to 1,245.91. The HNX-Index decreased by 0.3 points (0.13%) to 231.99, while the UPCoM-Index climbed 0.03 points (0.03%) to 90.68. Liquidity contracted, with the matching value on the HoSE exceeding 15,000 billion VND.