The Board of Directors of Baruco JSC, a company specializing in natural rubber production and trading, has announced a 7% dividend payout for 2023, equivalent to VND 700 per share. This decision aligns with the resolution passed at the company’s 2024 Annual General Meeting of Shareholders.

According to the announcement, the record date for dividend eligibility is set as May 30, with May 29 being the ex-dividend date. With approximately 112.5 million shares in circulation, the company is expected to distribute nearly VND 79 billion to its shareholders. The payment is scheduled for October 2.

Notably, the Vietnam Rubber Group JSC (HOSE: GVR) holds a dominant stake in Baruco, owning 97.47% of the company’s capital. As a result, GVR is anticipated to receive nearly VND 77 billion in dividends from Baruco’s distribution.

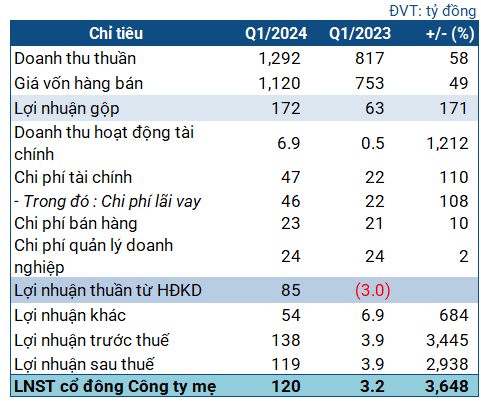

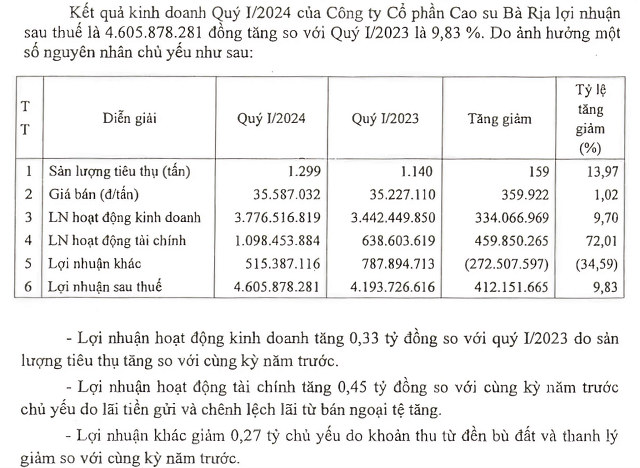

In the first quarter of 2024, Baruco reported impressive financial results, with a 23% year-on-year increase in revenue, totaling over VND 51 billion. The company’s net profit also rose by 10% compared to the same period last year, reaching nearly VND 5 billion. This growth can be attributed to a 14% increase in sales volume and a slight improvement in selling prices. Additionally, Baruco’s financial activities contributed a profit of over VND 1 billion, a significant 72% surge due to gains from deposits and foreign exchange differences.

Baruco’s Explanation for the Growth in Q1 2024 Financial Results Compared to Q1 2023

|

Looking ahead, Baruco’s Annual General Meeting of Shareholders has approved a net profit target of over VND 136 billion for 2024. However, it is important to note that the company’s profit tends to peak in the fourth quarter of each year. The shareholders also agreed on a minimum dividend rate of 5% for this year.

| Baruco’s Revenue and Profit Peak in the Fourth Quarter Annually |

|

Formerly known as Ba Ria Rubber Company, Baruco JSC was established on June 11, 1994, by the Ministry of Agriculture and Rural Development. The company’s initial scope included managing and operating rubber plantations across five farms, with a total area of 13,594 hectares and a workforce of over 5,000 employees. Over the years, the company has evolved and expanded its operations. On December 24, 2009, it transformed into a limited liability company named Ba Ria Rubber One-Member Limited Liability Company. Subsequently, on April 28, 2016, it became a joint-stock company with a charter capital of VND 1,125 billion. Baruco made its debut on the UPCoM exchange on June 16, 2017, under the stock code BRR, with a reference price of VND 12,700 per share. In addition to its core business of natural rubber production and trading, Baruco has diversified its operations by establishing a processing enterprise and engaging in joint ventures and collaborations. The company has also ventured into the hospitality industry, managing hotels and tourism services transferred from the Vietnam Rubber Group. |