|

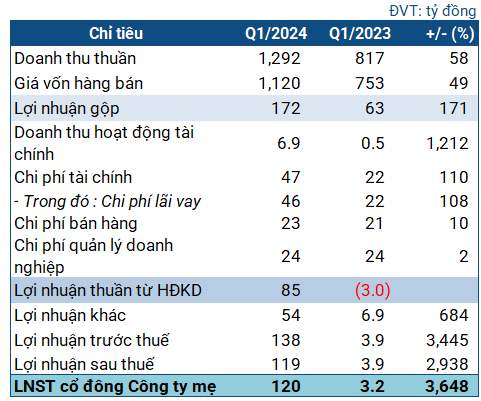

BAF’s Key Business Indicators in Q1 2024

Source: VietstockFinance

|

Specifically, BAF achieved nearly 1.3 billion VND in net revenue in Q1, an increase of 58% compared to the same period last year. After deducting for cost of goods sold, the Company’s gross profit was 172 billion VND, 2.7 times higher than the same period last year. Gross profit margin improved from 5% to 13%, in which the gross profit margin of the livestock segment was 29%.

Financial expenses during the period increased sharply, recorded at 47 billion VND, double that of the same period last year, mostly interest expenses. Selling and administration expenses increased slightly due to the operation of 3 farms: Hai Dang cluster farm, Tan Chau farm and Tam Hung farm. However, a remarkable indicator is the other income of 57 billion VND (only 7 billion VND in the same period last year). This income has increased the final result, helping the Company achieve a net profit of 120 billion VND, nearly 38 times higher than the same period last year, and is also the second highest profit since its listing in 2021.

Compared to the plan approved by the General Meeting of Shareholders, BAF achieved 23% of the revenue target and nearly 38% of the profit after tax target for the year.

BAF reported that pig prices in Q1 recovered strongly from the bottoming out in Q4/2023, currently above 60,000 VND/kg. Pig output in Q1 also grew strongly, reaching 100,000 pigs, with March alone hitting a record of 54,000 pigs. On the other hand, raw material prices for livestock feed decreased by 10-20% compared to before, contributing greatly to livestock results.

Other income increased sharply thanks to the sale of a land lot owned by BAF in Mai Chi Tho street. At the 2024 Annual General Meeting of Shareholders, Chairman of the Board of Directors Truong Sy Ba said that this land lot was initially intended to build an office building for BAF, combining use and leasing. However, after considering financial matters and leasing an office in a more suitable location in 2023, BAF decided that the construction was unnecessary. In addition to the fact that it needed more capital to continue investing, the Company decided to sell the above land lot, bringing in a profit of about 80 billion VND.

At the end of Q1, BAF’s total assets reached nearly 6.8 trillion VND, an increase of 3% compared to the beginning of the year. Current assets increased by 5%, to nearly 3.3 trillion VND. Cash and cash equivalents decreased by 7%, to about 392 billion VND.

Closing inventory increased by 18% to nearly 1.9 trillion VND, including pigs of all kinds expected to be marketed. In-process long-term assets reached 932 billion VND, an increase of 3%, including farms expected to be put into operation in the coming period.

On the other side of the balance sheet, borrowings exceeded 2 trillion VND (more than 853 billion VND is short-term borrowings), including bank loans and convertible bonds issued to the International Finance Corporation (IFC) – interest rate of 5.25% per year for a term of 7 years.

BAF’s financial ratios are relatively stable, with a current ratio of 1.1 times.

Will Q2 be better?

At the 2024 Annual General Meeting of Shareholders, Mr. Truong Sy Ba said that in the nature of the pig farming industry, raw materials account for 70% of the cost. However, there is a delay in recording raw material prices, about 6-8 months. Pig prices in Q1 still recorded raw material prices from Q3 last year – a time when they were still high due to the impact of the supply chain and geopolitical tensions. In other words, the recent “cheap” raw material prices will be recorded from Q2. In the context of current pig prices reaching 63,000 VND/kg, BAF’s Chairman believes that Q2 will have better results than Q1.

In addition, the Company said it aims to have a total herd of 75,000 sows and 800,000 commercial pigs by the end of 2024, double that of the previous year. In addition, it will put into operation 7 new farms in Tay Ninh (Tan Chau, Tam Hung, Hai Dang, Tay An Khanh), Phu Yen (Phu Yen 2), Binh Phuoc (Thien Phu Son), and Gia Lai (Hung Phat Farm 1).