Market liquidity increased from the previous trading session, with the VN-Index matching volume reaching over 636 million shares, equivalent to a value of more than 14.7 trillion VND; HNX-Index reached over 77 million shares, equivalent to a value of nearly 1.5 trillion VND.

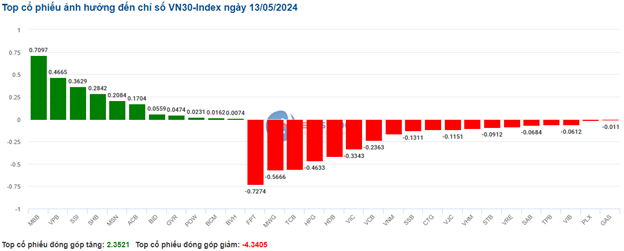

VN-Index opened the afternoon session with a tug-of-war and gradually became more negative as strong selling pressure caused the index to plunge despite buying pressure returning at the end of the session, but the index still closed in the red and ended below the reference level. In terms of impact, VCB, CTG, BID, and FPT were the most negative stocks, taking away more than 3 points from the index. On the other hand, VPB, GVR, and VJC were the most positive influences on the VN-Index, with more than 1.2 points gained.

| Top 10 stocks impacting the VN-Index on May 13, 2024 |

HNX-Index, on the other hand, showed a contrasting performance as the index was positively impacted by stocks such as DTK (7.14%), DHT (8.33%), HUT (1.16%), MBS (1.4%), etc.

| Enter Title |

|

Source: VietstockFinance

|

The seafood processing industry recorded the sharpest decline in the market at -1.78%, mainly due to VHC (-2.99%), ANV (-0.82%), and ASM (-0.86%). This was followed by the accommodation, food and beverage services, and consulting and support services industries, which decreased by -1.24% and -1.05%, respectively. On the contrary, the agriculture, forestry, and fisheries industry witnessed the strongest recovery, with a gain of 2.35%, mainly driven by HAG (+3.79%) and HNG (+0.72%).

In terms of foreign trading activities, they continued to net sell nearly 865 billion VND on the HOSE exchange, focusing on stocks such as VHM (114.36 billion), CTG (102.45 billion), VPB (72.34 billion), and STB (55.82 billion). On the HNX exchange, foreign investors net sold 80 billion VND, focusing on PVS (59.7 billion), BVS (21.14 billion), and VGS (3.95 billion).

| Foreigners’ Net Buying/Selling Activities |

Morning Session: Weak Buying Pressure, VN-Index Turns Negative

At the end of the morning session, the green color failed to sustain, causing the VN-Index to reverse course and decline. The VN-Index lost 4.33 points, settling at 1,240.37 points.

After a brief tug-of-war at the beginning of the morning session, the VN-Index started to plunge. Buying pressure at lower prices was not strong enough, so at the end of the morning session, the main index of the HOSE exchange fell by more than 4 points, closing above the 1,240-point threshold.

Among the banking group, VPB, MBB, and ACB recorded gains. The remaining stocks, such as VCB, BID, CTG, TCB, HDB, VIB, STB, LPB, TPB, etc., were all in the red during the morning session. The mining group also weakened in the morning session, with 12 stocks declining and 9 stocks advancing.

Retail was the group with the sharpest decline in the market, with MWG falling by 1.36%, FRT by 2.74%, PNJ and CTF by less than 1%. Conversely, SVC maintained its upward momentum with a gain of 2.77%.

On the other hand, the most vibrant industry in the morning session was the electrical equipment industry, with a gain of 1.95%. Notable contributors included GEX, which rose by 2.07%, CAV by 1.4%, PHN by 3.36%, and DQC by 2.36%. The SAM stock touched its upper limit with a gain of 6.95%.

Overall, the market performance in the morning session was quite negative. The matching value on the HOSE exchange was just over 6 trillion VND in the morning session. Additionally, foreign investors maintained their net selling activities for the fourth consecutive session.

In the morning session, the APEC group of stocks (API, APS, IDJ) hit their upper limits simultaneously. This development followed the appearance of Mr. Nguyen Do Lang – former Chairman of Apec Group and former Member of the Board of Directors of API – at the recent Annual General Meeting of API.

10:40 AM: Divergence Continues

Investors remained skeptical about the short-term prospects of the market, leading to a tug-of-war around the reference level for the main indices. As of 10:30 AM, the VN-Index fell slightly by 0.82 points, hovering around 1,244 points. The HNX-Index dropped by 0.69 points, trading around 236 points.

The breadth among the VN30-Index constituents was slightly negative. Specifically, FPT, MWG, TCB, and HPG subtracted 0.73 points, 0.57 points, 0.56 points, and 0.46 points from the overall index, respectively. Conversely, MBB, VPB, SSI, and SHB maintained buying interest but did not exhibit strong gains.

Source: VietstockFinance

|

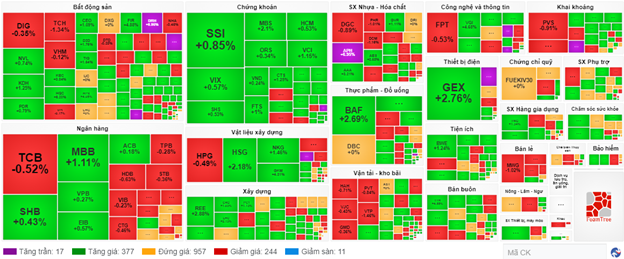

On the positive side, the securities industry witnessed impressive gains in the market. Notably, SSI rose by 0.85%, VCI by 0.94%, MBS by 1.75%, and BSI by 0.9%… As of 10:30 AM, the total trading value of this industry group exceeded 660 billion VND, with a matched volume of over 25 million units, ranking third among all industry groups in terms of trading value, after real estate and banking.

Following closely was the real estate industry, which also exhibited strong divergence, with 39 gainers and 20 losers.

Among the gainers, notable mentions included BCM, which climbed by 0.7%, KDH by 0.97%, NVL by 0.37%, and PDR by 0.79%… On the losing side, the big three of VIC, VHM, and VRE all appeared in the red and significantly influenced the industry group, falling by 0.25%, 0.11%, and 0.22%, respectively. As of 10:30 AM, the total trading value of this industry group exceeded 720 billion VND, with a matched volume of over 48 million units.

Meanwhile, the banking industry also demonstrated divergence, with the number of decliners slightly outpacing the advancers, resulting in a lackluster performance for the industry group. Currently, BID, VPB, MBB, and ACB are among the few stocks that have managed to stay in positive territory, with modest gains ranging from 0.27% to 1.11%. Conversely, stocks such as VCB, CTG, TCB, and HDB are facing selling pressure, with declines ranging from around 0.23% to 0.52%…

Compared to the beginning of the session, the market continued to witness a tug-of-war, with over 950 stocks trading flat. However, the buying side maintained a slight edge. There were 377 advancing stocks and 244 declining stocks.

Source: VietstockFinance

|

Opening: Tug-of-War Around the Reference Level

As of 9:30 AM, the VN-Index started the session on May 13 with a tug-of-war around the reference level, reaching 1,245.47 points. Meanwhile, the HNX-Index also moved in the same direction, recording a slight gain and settling at 236.51 points.

Large-cap stocks such as BID, GAS, VIC, and MSN led the index higher, contributing more than 1.2 points to the gain. On the other hand, stocks such as CTG, MWG, DGC, and MSB weighed on the market, resulting in a nearly 1-point decline.

The market was dominated by green colors in the morning session, with several stocks in the electrical equipment industry showing strength from the beginning of the session. Notably, SAM surged by 6.95%, CAV advanced by 1.26%, and GEX climbed by 0.69%.

Additionally, the seafood industry continued its stable growth trajectory, with all stocks in the industry group trading in positive territory. Among the gainers, VHC rose by 0.78%, IDI by 0.43%, FMC by 0.76%, and ANV by 0.33%.