Volatile commodity prices and exchange rates have impacted overall costs since the beginning of the year. Illustrative image. |

Is Inflation the New Concern?

As gold prices surged, many compared it to the depreciation of the Vietnamese Dong. According to the General Statistics Office, the gold price index in April increased by 17% compared to the end of 2023, while the consumer price index (CPI) averaged a 3.93% increase in the first four months, year-on-year.

Of course, monetary policy calculations must be based on CPI figures, and gold prices, which often fluctuate in the short term, cannot be used. A critical macroeconomic variable for monetary policy is inflation, which has not been much discussed from 2023 to the present, despite the continuous decline in the interest rate base rate.

On the other hand, after the April macroeconomic data and the recent significant fluctuations in the foreign exchange market, inflationary pressures have been mentioned by many experts.

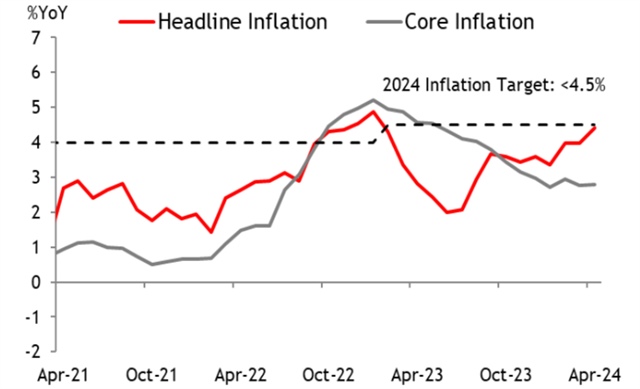

“Inflation seems to have become a pressing issue. This is the first time in over a year and a half that inflation has risen close to the 4.5% ceiling,” said a report by HSBC.

According to statistical data, CPI in April increased by 1.19% compared to December 2023 and by 4.4% year-on-year. Meanwhile, core CPI rose by 2.81%. The CPI figure was almost in line with the market’s forecast, according to HSBC‘s assessment.

The reason for the increase in the early months of this year is explained by the rise in oil and food prices. This further illustrates Vietnam’s vulnerability to fluctuations in global commodity markets.

Headline inflation rose sharply in April while core inflation was unchanged from the previous month. Price increases were concentrated in food, housing, construction materials, healthcare, and transportation. Source: Maybank, CEIC. |

Inflation to Peak in Q3?

Maybank Securities, in its latest report, also raised its headline inflation forecast to 3.7% from 3.5% previously, stating that “it is expected that the SBV will soon take cautious action.”

However, this 3.7% figure still seems much lower than other forecasts, given the government’s target of 4.5% set at the beginning of the year. In April, the Ministry of Finance also updated two other scenarios, at 3.64% and 4.05%, slightly adjusting the previous scenarios.

According to assessments by financial institutions, a 4% forecast is common. According to HSBC, a “good” scenario is that inflation could exceed the 4.5% ceiling in Q2 but only for a very short period before falling back below 4% in Q3 2024.

Experts’ expectations for inflation to peak in Q3 and decline by the end of the year seem to rely heavily on the US dollar interest rate story.

According to UOB Bank’s forecast, published at the beginning of May, the risk remains that the US Federal Reserve (Fed) may delay interest rate cuts but still expects two cuts in September and December.

This implies that the pressure on the Dong will continue until the end of Q3 this year. UOB’s forecast states that the exchange rate will fall below 25,000 VND by the end of the year.

“Apart from short-term external challenges, we expect the Dong to receive support from solid fundamentals and the subsequent recovery of the Chinese Yuan,” the UOB report explained regarding the exchange rate cooling forecast.

In addition to the exchange rate story, according to the analysis team of Mirae Asset Securities, in the coming time, inflationary pressures need attention when credit growth accelerates again, with a target of 15% this year.

Moreover, factors influencing inflation also come from the adjustment of prices of some state-managed services, including electricity, healthcare, education, and the price framework of some transport services.

There are many reasons to be concerned about the return of inflation, although it is still early to tell, as there is still ample room for control. On the other hand, the changes in international and geopolitical macro variables are also unpredictable, as are the related commodity price fluctuations.

However, most experts believe that the government still gives higher priority to economic recovery, meaning accepting inflation at a certain appropriate level. But if inflation is high, monetary policy will likely need to adapt in a more robust manner than it is currently.

Nguyen Dung