The Hanoi Stock Exchange (HNX) announced that An Khang Real Estate Development JSC (BĐS An Khang) successfully repurchased two bond lots, ANKHANG2019-02 and ANKHANG2019-03, with a total value of VND 2,480 billion in the final days of 2023, thereby settling its bond debt.

In late 2019, BĐS An Khang issued a total of three bond lots worth nearly VND 3,000 billion, with an interest rate of 11.5%/year. Among these, the ANKHANG2019-01 bond, valued at VND 450 billion with a one-year term, matured in late 2020.

The ANKHANG2019-02 bond, valued at VND 1,000 billion, had a term of 54 months and a maturity date of June 30, 2024. Meanwhile, the ANKHANG2019-03 bond was worth VND 1,480 billion, with a term of 48 months and a maturity date of December 31, 2023.

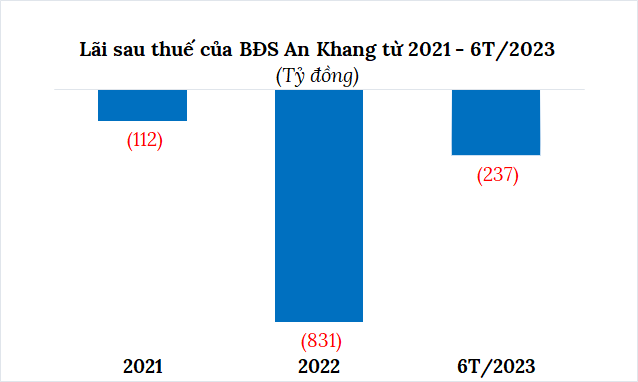

Nearly VND 1,200 Billion Loss

Despite the early bond repurchase, the company’s financial health revealed a net loss of nearly VND 1,200 billion from 2021 to the first half of 2023.

Source: Consolidated by the author

|

As of the end of June 2023, owners’ equity stood at nearly VND 822 billion, a 58% increase compared to the previous year. The debt-to-equity ratio improved from 26.99 to 17.03, corresponding to nearly VND 14,000 billion in debt.

Who is BĐS An Khang?

An Khang Real Estate Development JSC was established on May 18, 2012, under the initial name of City Villa JSC, with its headquarters on Bui Thi Xuan Street, Tan Binh District, Ho Chi Minh City. Its chartered capital was VND 100 billion.

The initial shareholder structure comprised Mr. Bui Phan Phu Loc (holding the position of Chairman of the Board of Directors) with a 99.8% stake, while Mr. Bui Quang Huy and Mrs. Pham Thi Cuc held the remaining shares. At that time, Mr. Loc and Mrs. Cuc were relatives of Mr. Bui Thanh Nhon, Chairman of the Board of Directors of NVL.

In 2015, the company changed its name to Nova Tresor JSC. After this name change, the shareholder structure underwent multiple changes, with the emergence of Mrs. Le Nguyen Diem My, who held a 99.8% stake and served as the Chairman of the Board of Directors.

On November 24, 2016, the enterprise was renamed An Khang Real Estate Development JSC, as it is known today. In November 2023, BĐS An Khang had a chartered capital of VND 4,380 billion, comprising three shareholders: Real Estate Investment JSC Phong Dien, holding 99.966%; Mr. Nguyen Quoc Hien (Chairman of the Members’ Council and legal representative) with a 0.032% stake; and Mrs. Le Thi Hong Xuan with a 0.002% stake.

|

BĐS Phong Điền was once a company related to NVL. In 2020, NVL announced its divestment of 19 million shares in this company. During the year, the company increased its chartered capital from VND 190 billion to VND 903 billion and changed its Chairman of the Board of Directors and legal representative from Mr. Ly Truong An to Mr. Le Thanh Liem. |

Also, in November 2023, the People’s Committee of Dong Nai Province decided to allocate land with an area of more than 31 hectares to BĐS An Khang for continued investment in the construction of transportation infrastructure, greenery, water bodies for sports and recreation, and an administrative area, as part of the Cu Lao Phuoc Hung Urban Area project in Tam Phuoc Ward, Bien Hoa City.

The Cu Lao Phuoc Hung Urban Area (also known as Phoenix Island) spans 286 hectares and is part of the larger Long Hung Urban Area project, covering 1,300 hectares.

Dong Nai allocates nearly 54 hectares of land on Phoenix Island to NVL and related companies

Phoenix Island subdivision at Aqua City.

|