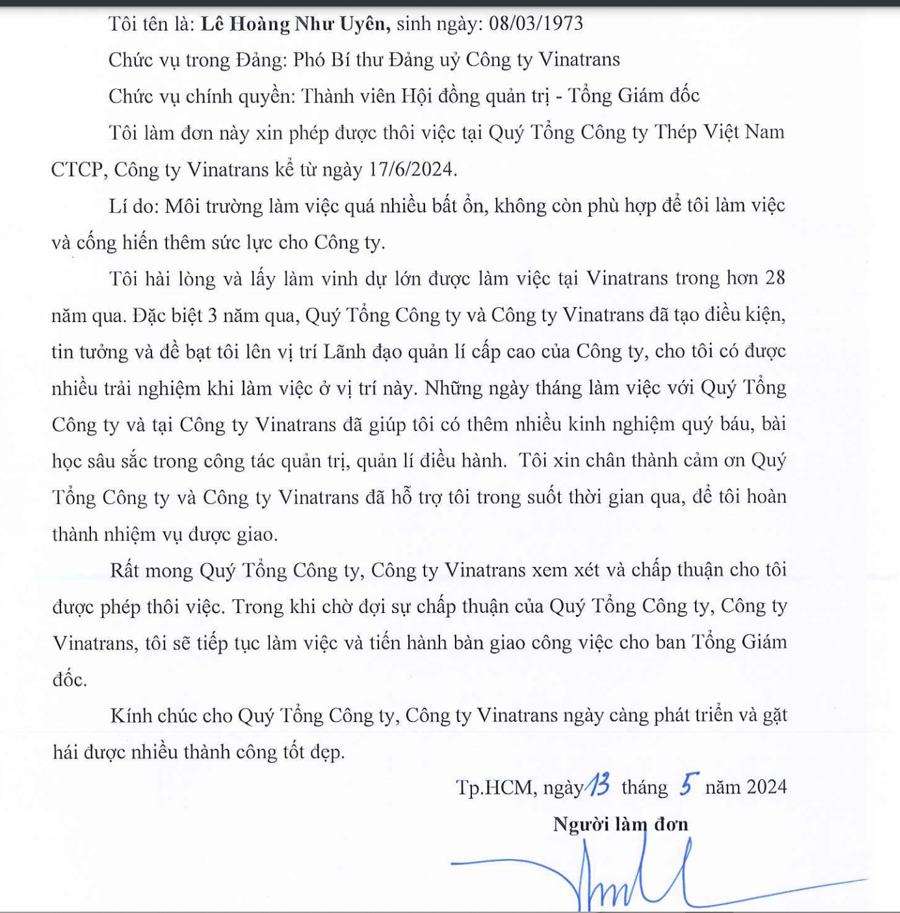

Vietnam Foreign Trade Logistics Joint Stock Company (Vinatrans, UpCOM: VIN) has recently announced an unusual update regarding the resignation of its General Director, Ms. Le Hoang Nhu Uyen.

Ms. Uyen expressed her satisfaction and honor for having worked at Vinatrans for over 28 years. Particularly in the past 3 years, the Vietnam Steel Corporation – Joint Stock Company (VNSTEEL; UPCoM: TVN), the parent company that owns more than 95% of Vinatrans’ shares, promoted her to a senior management position within Vinatrans.

However, she has decided to resign due to an “extremely unstable working environment, which is no longer suitable for me to work and contribute my efforts to the company.”

Ms. Le Hoang Nhu Uyen, born in 1973, is a Ho Chi Minh City native with a Bachelor of Economics degree in Foreign Economic Relations and a Bachelor of Science degree in English Language.

She joined Vinatrans in 1996 and has been with the company for over 28 years. In late February 2021, Ms. Uyen was appointed as the General Director of Vinatrans.

Vinatrans is known as a state-owned enterprise that was equitized in 2007 with a charter capital of VND 255 billion. Its main business is in logistics. In late November 2010, the Ministry of Industry and Trade transferred the state ownership representative rights of Vinatrans from the Ministry of Industry and Trade to the Vietnam Steel Corporation (VNSTEEL) for management.

In terms of business performance, the recently published consolidated financial statements for Q1/2024 show that the company’s net revenue reached nearly VND 28.5 billion, a 14% decrease compared to the same period last year. Meanwhile, after-tax profit reached VND 9.7 billion, a 15% decrease.

Vinatrans’ business performance has been declining. In the past four years, the company’s highest annual revenue was nearly VND 230 billion in 2021, but it dropped to VND 142 billion in 2023. The highest after-tax profit was nearly VND 96 billion in 2022, but it decreased to over VND 43 billion in 2023.

For 2024, the company plans to achieve a revenue of VND 130.6 billion and a pre-tax profit of VND 16.5 billion, a 1% and 18% decrease, respectively, compared to the previous year. The company mentioned that it has signed a contract with BAT, a tobacco company, and has the opportunity to increase revenue by providing services to internal customers this year.

However, Vinatrans did not win the bid to provide services in 2024 for several major customers, such as ABI, Number One Ha Nam, and Number One Chu Lai. Additionally, some customers from 2023, such as Nissin and Toan Phu, have decided to discontinue their use of Vinatrans’ services.

As a result, this year, the company is in the process of completing the first phase of capital withdrawal from Vietway, VNT Logistics, and Vinatrans Da Nang, and is preparing for the second phase of capital withdrawal from Agility Vietnam, Vinafreight, and Vector as part of Vinatrans’ restructuring plan.

Regarding the parent company, in Q1/2024, the Vietnam Steel Corporation (VNSteel, UPCoM: TVN) recorded a revenue of over VND 7,500 billion and a net profit of VND 36 billion, a decrease of 10% and 44%, respectively, compared to the same period last year.