On May 13, Vietnam Foreign Trade Transportation Corporation (Vinatrans) received the resignation letter of Ms. Le Hoang Nhu Uyen, a member of the Board of Directors and General Director of the company. In her resignation letter, Ms. Uyen requested to resign from her position as of June 17, 2024, citing an overly unstable work environment that is no longer suitable for her to work and contribute to the company.

In her letter, Ms. Uyen also expressed her satisfaction and honor of working at Vinatrans for over 28 years, especially in the past 3 years, where she was promoted to a senior management position.

Ms. Le Hoang Nhu Uyen, born in 1973, holds a Bachelor of Economics in Foreign Economics and a Bachelor of Science in English Language. She has been working at Vinatrans since 1996 and was appointed as the General Director of Vinatrans on February 26, 2021. About a month later, she was elected as a member of the Board of Directors.

Ms. Uyen currently holds 6,000 VIN shares, worth VND 126 million as of May 17. Her income at Vinatrans for the past year was VND 513 million/year, equivalent to VND 42.75 million/month.

At present, Ms. Uyen is a member of the Board of Directors at Vietnam Foreign Trade Transportation Joint Stock Company (VNT), Vinafreight Joint Stock Company (VNF), and Central Foreign Trade Transportation Joint Stock Company (VMT).

Ms. Le Hoang Nhu Uyen

According to our sources, Vietnam Foreign Trade Transportation Corporation (Vinatrans) was established on July 14, 1975, with business activities including freight forwarding and transportation of import-export goods, ship agency services, and agency and general agency services for airlines in freight and passenger transportation… The company was equitized in 2010 and listed on the UPCoM in 2014.

As of now, the company’s charter capital is VND 255 billion, of which Vietnam Steel Corporation (VNSteel) holds more than 95% of the capital. Mr. Nguyen Minh Huy is currently the Chairman of the Board of Directors.

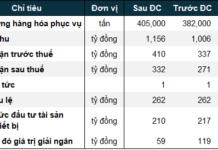

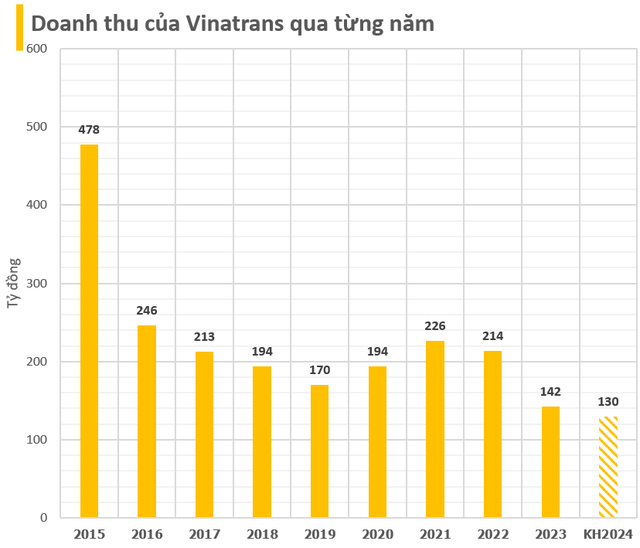

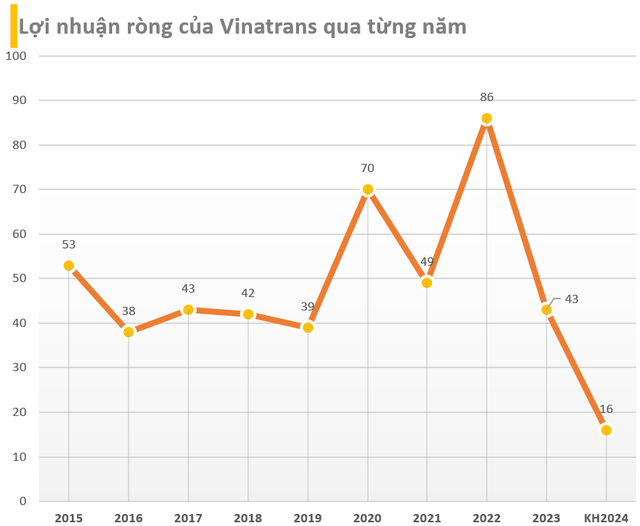

In terms of business results, Vinatrans has been bringing in hundreds of billions of VND in revenue and tens of billions of VND in profit annually. However, in 2023, the company witnessed a significant decline in its business results, the lowest in the past 4 years. Specifically, last year, Vinatrans recorded VND 142 billion in revenue and over VND 43 billion in net profit, down 33.5% and 50%, respectively, compared to the previous year.

In fact, Vinatrans’ gross profit is much smaller than its net profit. The company often has another source of income in the form of dividends from its subsidiaries and associated companies, amounting to several billion VND each year.

For 2024, the company set a modest target of VND 130 billion in revenue and VND 16 billion in after-tax profit, a significant decrease compared to 2023. However, the company has a tradition of setting low targets.

In the first quarter, Vinatrans recorded a 14% and 15% decrease in revenue and after-tax profit, respectively, compared to the same period last year.

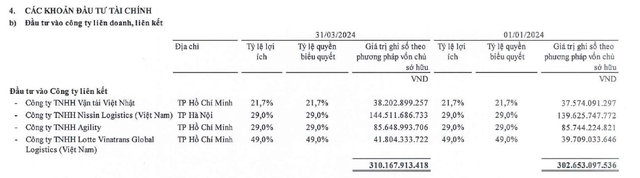

As of March 31, 2023, the company’s total assets were VND 589 billion, a decrease of VND 3 billion compared to the beginning of the year. Of this, the company’s cash and cash equivalents stood at VND 155 billion. The largest proportion of Vinatrans’ asset structure (62%) is long-term financial investments, amounting to VND 366 billion. This is the amount the company invests in its associated companies.

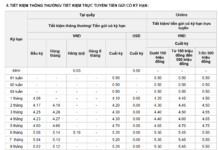

Every year, the company pays a high cash dividend, ranging from 5% to 19%. 2022 was the year the company paid the highest dividend of 19%. On the stock market, VIN shares of the company are currently priced at VND 21,000/share but have had no liquidity for a long time.