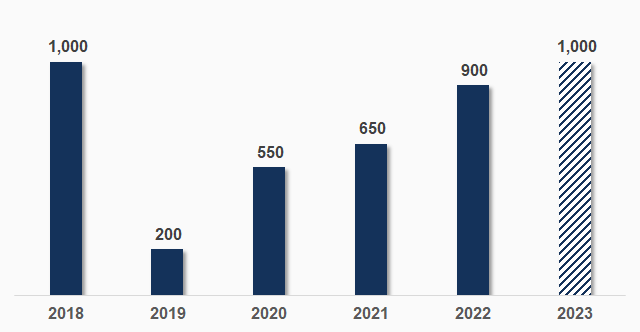

Highest dividend payout in 5 years

According to a notification from VAF, the 2023 dividend will be paid at a rate of 10%, equivalent to VND 1,000 per share. The ex-dividend date is May 30, and payment is expected on June 14.

With nearly 37.7 million shares currently in circulation, VAF is estimated to pay out nearly VND 37.7 billion in dividends. This is also the highest dividend that VAF has paid out since 2019.

|

Cash dividends paid out by VAF in recent years

Unit: VND/share

Source: VietstockFinance

|

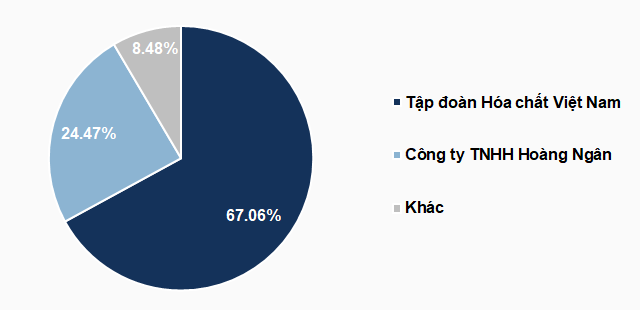

As of March 31, 2024, the largest shareholder and parent company of VAF is Vietnam Chemicals Group (Vinachem), with a direct ownership stake of over 67%. Vinachem is expected to receive more than VND 25 billion in dividends. Another major shareholder, Hoang Ngan Company Limited, which owns 24.5%, will also receive more than VND 9 billion.

|

VAF‘s shareholder structure as of March 31, 2024

Source: VietstockFinance

|

Stock remains under supervision

Prior to this, the Ho Chi Minh City Stock Exchange (HOSE) had decided to place VAF on its warning list from March 21 due to a qualified opinion on its 2023 audited financial statements, which falls under the category of securities subject to warning according to legal regulations.

According to the 2023 audited financial statements of VAF, the auditing firm An Viet Accounting and Auditing Services Co., Ltd. expressed a qualified opinion and provided reasons for the qualification, stating that VAF had not recorded any expected credit losses that may arise related to the request for a review of the judgment and lawsuit against Joint Stock Company for Investment and Construction HUD4 (HUD4).

At the time of the qualified opinion, VAF and HUD4 had not renegotiated the land lease contract for the Bim Son Industrial Park related to VAF‘s project of building a fused magnesium phosphate and NPK fertilizer plant in Thanh Hoa province.

Source: 2023 Audited Financial Statements of VAF

|

VAF has initiated the procedures for a review of the judgment regarding the first-instance judgment dated September 5, 2022, of the People’s Court of Bim Son Town. The People’s Court of Hanoi has accepted VAF‘s request for a review.

According to the resolution of the Board of Directors dated January 3, 2024, VAF continues to implement legal procedures to sue HUD4 in a court of competent jurisdiction to claim compensation for investment costs incurred by VAF due to the land lease contract signed on May 31, 2013, being declared invalid by the People’s Court of Bim Son Town; and the decision to terminate the operation and revoke the Investment Registration Certificate of the project “Investment project for construction of fused magnesium phosphate and NPK fertilizer factory of Van Dien in Bim Son, Thanh Hoa” by the Management Board of Nghi Son Economic Zone and Industrial Zones in Thanh Hoa province since May 18, 2023.

In addition, on March 12, 2024, VAF was also added to the list of securities that do not meet the conditions for margin trading by HOSE, as its 2023 audited financial statements received a qualified opinion, which is not a full acceptance.

In terms of business results, in the first quarter of 2024, VAF achieved more than VND 482 billion in net revenue, up 20% over the same period last year, but net profit decreased by 23%, to over VND 15 billion.

| VAF‘s business performance in the past year |

For 2024, VAF targets total revenue of VND 1,054 billion, up 5%, and pre-tax profit of nearly VND 52.2 billion, down 32%. In terms of dividend plans, VAF expects to pay a cash dividend of 7% (VND 700 per share).

In the market, after many unfavorable developments, VAF stock has maintained an upward trend since December 2022. At the end of today’s trading session on May 22, VAF shares reached VND 14,300 per share, up 3.6% compared to the beginning of 2024, with relatively low liquidity, averaging about 3,600 shares per day.

| VAF stock price since its listing on June 23, 2015 |

|

Fused Magnesium Phosphate Van Dien Joint Stock Company specializes in the production and trading of fertilizers, with its key products being fused magnesium phosphate and NPK fertilizers, mainly serving the domestic market. |