With a dividend payout ratio of 25% (1 share receives VND 2,500) and nearly 6 million shares in circulation, NDC is estimated to distribute nearly VND 15 billion in dividends to shareholders. The expected payment date is June 27, 2024.

|

Source: 2023 Audited Financial Statements |

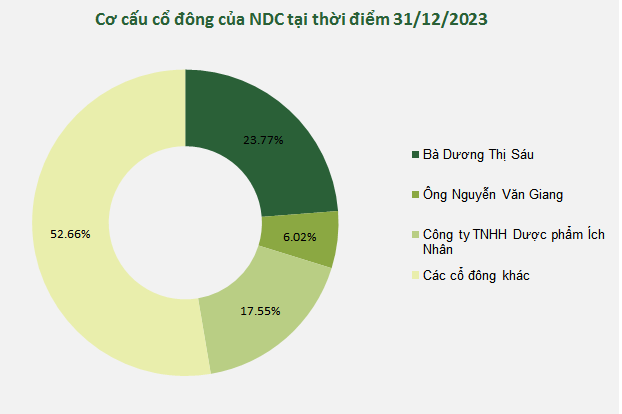

According to the latest update (as of December 31, 2023), NDC’s three major shareholders are Mrs. Duong Thi Sau, wife of Mr. Hoang Minh Chau – NDC’s CEO (holding 23.77% of capital); Ich Nhan Pharmaceutical Joint Stock Company, where Mrs. Duong Thi Sau is the CEO (owning 17.55%); and Mr. Nguyen Van Giang, NDC’s Vice Chairman (holding 6.02%).

With the above ownership ratio, Mrs. Duong Thi Sau will receive more than VND 3.5 billion in dividends, Ich Nhan Company will receive more than VND 2.6 billion, and Mr. Nguyen Van Giang will receive nearly VND 898 million. Thus, the insiders, who are also the major shareholders of NDC, will receive more than 47% of the total dividend, equivalent to more than VND 7 billion.

| Price movement of NDC shares from the beginning of 2023 to May 22, 2024 |

Following the dividend announcement, NDC’s share price surged 12.5% in the morning session of May 22, reaching VND 180,000/share. Despite the high market price, the liquidity of the shares was modest, with only 335 shares traded daily, due to the concentrated shareholder structure.

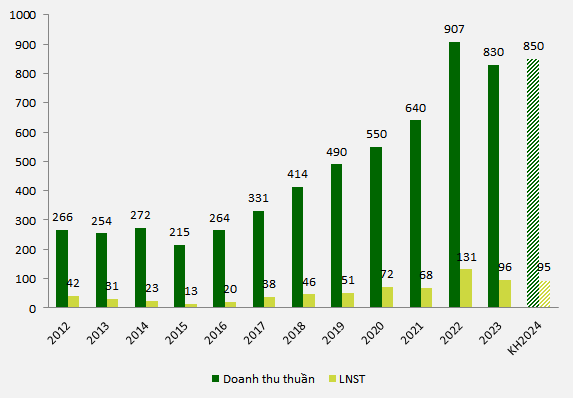

In 2023, the company’s net revenue decreased by nearly 9% compared to the previous year, reaching over VND 830 billion. Specifically, revenue from proprietary trading decreased by about 5% compared to 2022, while revenue from manufacturing activities decreased by more than 20%. The decline in proprietary trading revenue was mainly due to decreased market demand for over-the-counter (OTC) drugs and consumers’ tendency to tighten spending due to inflation and economic downturn.

The decrease in net revenue led to a net profit of over VND 96 billion, a drop of more than 26% compared to the previous year.

|

NDC’s 2024 Business Plan. Unit: Billion VND

Source: VietstockFinance

|

For 2024, NDC expects to achieve VND 850 billion in net revenue, a slight increase of 2% compared to 2023, and a profit after tax of approximately VND 95 billion, similar to the previous year.

Explaining the cautious business plan, NDC stated that purchasing power through the OTC channel has been somewhat affected by weak consumer demand. As a result, growth is expected to be maintained in the first quarter, tend to decrease from the second quarter, and the upward momentum in the second half of the year will also face challenges. In addition, after the prolonged pandemic, taking advantage of the market’s confusion during the period of high demand for, and stockpiling of healthcare products and respiratory products, healthcare products boomed while quality control remained challenging. The emergence of counterfeit and imitation products has caused confusion for consumers and negatively impacted the healthy development of the pharmaceutical market.

According to NDC, while it is necessary to closely monitor the pace of economic transformation and the risk of increasing input costs due to global conflicts, most businesses remain optimistic about their own prospects, the industry, and the economy in 2024. In particular, according to a survey of businesses, the pharmaceutical industry is likely to recover before the economy rebounds, and the situation is expected to improve significantly in the fourth quarter of 2024.

|

Nam Duoc Joint Stock Company (NDC) was established in 2004. The company specializes in the production of pharmaceutical drugs, oriental medicines, and functional foods. NDC’s prominent products in the market include Sui Thanh Nhiet Livecool, Siro ho cam Ich Nhi, and Thuoc thao duoc Thong xoang tan Nam Duoc, among others. The company owns a 10,000m2 pharmaceutical factory in Hoa Xa Industrial Park, Nam Dinh city. |

Khang Di