|

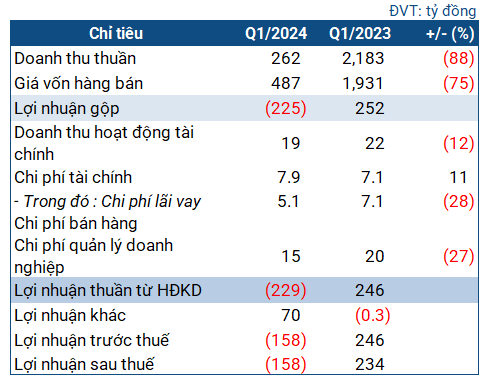

NT2’s Business Indicators in Q1 2024

Source: VietstockFinance

|

In Q1, NT2 witnessed a shocking 88% decrease in net revenue, recording VND 262 billion. Despite a significant drop in the cost of goods sold, the fall resulted in a gross loss of VND 225 billion for the company (compared to a gross profit of VND 252 billion in the same period last year).

Other indicators remained relatively stable, except for a remarkable gain of over VND 70 billion in other income (compared to a loss of over VND 300 million in the same period last year). Consequently, the company ended Q1 with a net loss of VND 158 billion (compared to a profit of VND 234 billion in the same period last year).

NT2’s steep decline is particularly noteworthy considering the increased demand for thermal power in the early months of 2024 due to unfavorable conditions for hydropower (resulting from the impact of El Nino on hydrological conditions). However, NT2’s explanation for this significant loss lacks specific details, merely stating that electricity output fell sharply compared to the same period last year (151 million kWh compared to over 1 billion kWh in Q1 2023).

Regarding the other income, the company stated that after each gas turbine unit at the Nhon Trach 2 Power Plant accumulated 100,000 equivalent operating hours (EOH), the company recognized the value of the spare parts inventory (ISP) at over VND 70 billion, leading to a corresponding increase in other income.

NT2’s balance sheet at the end of Q1 also reveals some issues. The company’s total assets amounted to over VND 8.2 trillion, a 3% decrease compared to the beginning of the year. Of this, current assets decreased by 26% to over VND 3.5 trillion. Cash and cash equivalents held declined the most, by 42% to over VND 1.2 trillion; trade receivables from customers (from EVN’s Electricity Trading Company) decreased by 25% to VND 1.7 trillion. The value of inventories at the end of the period was recorded at VND 335 billion, an increase of 28%.

On the other side of the balance sheet, the company’s total liabilities consist entirely of current liabilities, amounting to over VND 4.2 trillion, a 3% increase compared to the beginning of the year. Both the current and quick ratios are below 1, at 0.83 and 0.75 respectively, indicating risks to the company’s operational viability. However, on a positive note, the company has reduced its outstanding loans to VND 686 billion, approximately 50% of the amount at the beginning of the year. This unsecured short-term loan from Vietcombank is used for the company’s electricity production and trading activities.