At the annual 2024 General Meeting of Shareholders on May 21, all of Sonadezi Giang Dien’s proposals were passed.

Sonadezi Giang Dien sets a cautious target for 2024, with a total revenue of over VND 417 billion and an after-tax profit of more than VND 122 billion, respectively 5% and 35% lower than the 2023 performance. The company plans to maintain a 15% dividend payout this year.

SZG plans to lease 9 hectares of industrial land and lease/transfer 3 factories (depending on the actual construction progress) in 2024.

In terms of project development, the company will continue to coordinate with relevant departments to resolve issues related to compensation and land clearance for project implementation, as well as process the necessary paperwork for land use rights certificates for 5 villas in the An Binh Residential Area expansion project.

Additionally, SZG plans to invest nearly VND 136 billion in construction; over VND 73 billion will be allocated to the factory cluster rental project, and approximately VND 59 billion will be used for the Giang Dien Industrial Park project to complete technical infrastructure construction and several auxiliary items.

Furthermore, the SZG General Meeting of Shareholders approved the election of Mr. Hoang Sy Quyet, the General Director, as a member of the Board of Directors, replacing Mr. Truong Dinh Hiep, and Ms. Nguyen Thi Huyen Trang as the Head of the Company’s Control Board for the 2022-2027 term.

Mr. Quyet was nominated by the major shareholder, Tuan Loc Construction Investment Joint Stock Company, which owns 32.79% of SZG’s capital. In addition to his role as General Director of SZG, he also serves as a member of the Board of Directors of Petroleum Investment and Exploitation Port of Phuoc An Joint Stock Company (UPCoM: PAP) and a member of the Board of Directors and General Director of Nhon Trach Investment Joint Stock Company (OTC: NIC). He also holds the position of Deputy General Director at Tin Nghia Total Joint Stock Company (UPCoM: TID).

Repaying Bank Debt

In the first quarter of 2024, SZG achieved a net revenue of over VND 92 billion and a post-tax profit of nearly VND 37 billion, a 9% increase compared to the same period last year. These figures represent 22% and 30% of the company’s annual plan, respectively.

SZG’s Financial Performance from Q1/2022 to Q1/2024

As of March 31, 2023, SZG’s total assets reached nearly VND 3,455 billion, a 6% decrease from the beginning of the year. Inventories accounted for over VND 115 billion, a 2% increase, mainly comprising production and business costs (VND 114 billion), with the An Binh Residential Area project accounting for nearly VND 16 billion, and several other projects.

Additionally, the company had over VND 28 billion in construction work in progress, with the highest amounts allocated to the new factory cluster on Lot 02A&14 (VND 19 billion) and the Giang Dien Residential and Service Area (over VND 6 billion).

Sonadezi Giang Dien had payables of over VND 2,628 billion, of which the majority, over VND 2,437 billion, or 93% of the total debt, was attributed to unearned revenue.

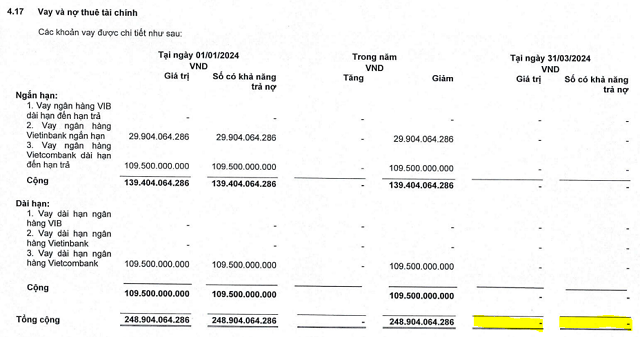

The highlight of this period is the company’s elimination of bank debt. At the beginning of the year, SZG owed nearly VND 250 billion to banks.

Source: SZG

|

Thanh Tú