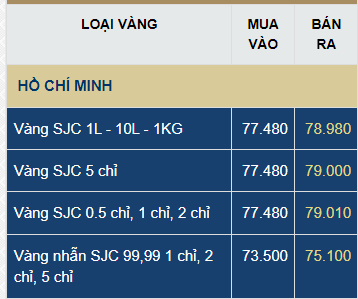

Update as of 11:00 AM: Major gold trading enterprises have adjusted their SJC gold prices. The selling price has been unified at VND 78.98 million per tael, a decrease of VND 1 million. Meanwhile, the buying price witnessed a milder fluctuation, dropping by VND 500,000 to around VND 77.5 million per tael.

————————-

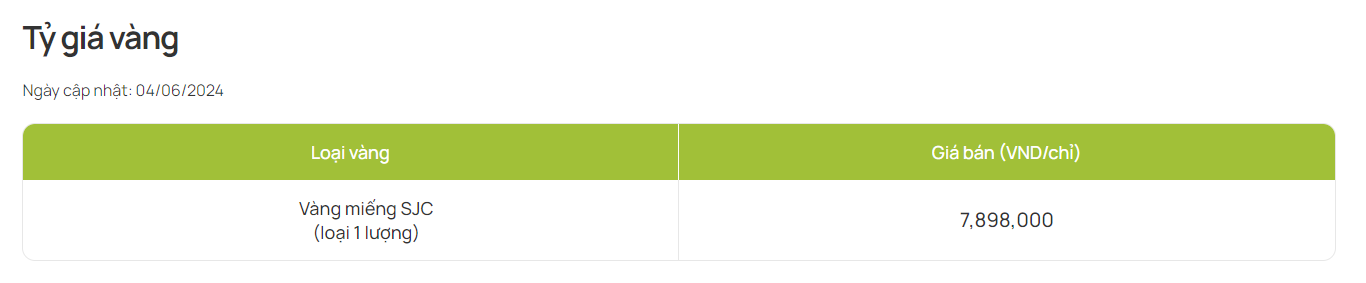

Update as of 10:00 AM: Banks officially announced the selling price of SJC gold to the public today at VND 78.98 million per tael, a decrease of VND 1 million compared to yesterday. The selling price of SJC gold bars set by the State Bank of Vietnam for four banks and SJC Company is VND 77.98 million per tael.

—————————-

At 9:00 AM: The SJC gold price at gold trading enterprises remains unchanged from yesterday, still at VND 79.98 million per tael for selling. Only the buying price varies: SJC and DOJI listed it at VND 77.98 million per tael, while Bao Tin Minh Chau listed it at VND 78.05 million per tael.

Banks have not yet updated the selling price of SJC gold for today, although trading was scheduled to commence at 9:00 AM. Meanwhile, Vietcombank stated that gold sales will only take place in the afternoon (from 1:30 PM), and customers can make a deposit from 9:00 AM. Gold buyers are required to place a deposit with Vietcombank equivalent to 10% of the purchase value, calculated based on Vietcombank’s gold bar selling price on June 3, 2024 (VND 79.98 million per tael) for the reserved amount of gold bars.

The price of 24K gold rings rebounded by VND 200,000-400,000 per tael compared to yesterday. Specifically, Saigon Jewelry Company increased it by VND 200,000 per tael to VND 73.6-75.3 million per tael. DOJI raised it by VND 400,000 per tael to VND 74.05-75.30 million per tael. Bao Tin Minh Chau listed it at VND 73.98-75.38 million per tael.

In the international market, the gold price stands at $2,345 per ounce, recovering about $15 per ounce from yesterday. When converted according to the current VND/USD exchange rate, the international gold price is equivalent to VND 72 million per tael, excluding taxes and fees. Overall, the international gold price is in a sideways trend due to a lack of new economic data for investors to make more definite decisions, especially regarding the prospect of interest rate cuts by the US Federal Reserve (Fed).