The TV2 board has outlined specific plans for revenue and profit targets for 2024, with a focus on maintaining stability amidst economic challenges.

For 2024, TV2 aims to achieve a revenue of nearly VND 1.3 trillion, reflecting a 16% increase from the previous year. The company’s profit before tax is targeted to remain steady at VND 66 billion.

Acknowledging the impact of global macroeconomic factors, complex geopolitical conflicts, and intense competition among major countries, TV2 expects 2023 to be a challenging year. Additionally, the company highlights the risks of financial and monetary instability, energy and food insecurity, and the ongoing pandemic’s effect on global economic growth.

Domestically, Vietnam faces inflationary pressures, volatile fuel and raw material prices, and challenges in the energy sector. In anticipation of these difficulties continuing into 2024, TV2 sets a cautious goal of maintaining profits without emphasizing aggressive growth.

Despite these conservative targets, TV2‘s performance in the first quarter of 2024 exceeded expectations, with a remarkable 92% increase in revenue, surpassing VND 238 billion. The company also achieved a 34% rise in net profit, amounting to over VND 11 billion. These impressive results are attributed to the EPC contract for the Hau Giang Biomass Power Plant project, which entered a peak construction phase, and the successful completion and acceptance of the survey and design consulting services for the 500kV power line project.

|

|

| TV2’s Business Performance |

Looking ahead, TV2 aims to not only meet its production and business targets but also accomplish several key tasks in 2024. Notably, the company will facilitate the implementation of the Song Hau 2 Thermal Power Plant project, scheduled for June 2024, while preparing for potential adjustments in personnel, systems, and financial management. Additionally, TV2 will focus on completing and operating the Hau Giang Biomass Power Plant and the Thac Ba 2 Hydropower Plant.

The company will closely follow the Power Development Plan 8 (PDP8) and other relevant plans and local implementation strategies. TV2 will proactively research and advise EVN on potential new energy projects, including fuel transitions to biomass, ammonia, hydrogen, or blended combustion, as well as smart grid technologies and energy storage solutions.

Furthermore, TV2 intends to explore new projects in 2024, such as green hydrogen and ammonia production, pumped hydro storage combined with solar power, and exporting clean energy to foreign markets. The company will also seek opportunities to develop renewable energy projects and biomass projects in Tra Vinh and An Giang provinces.

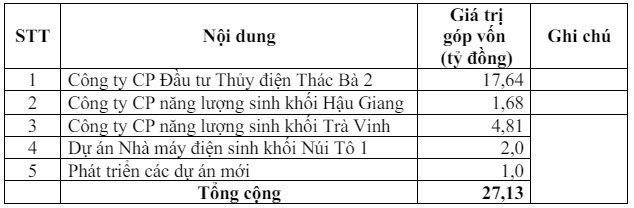

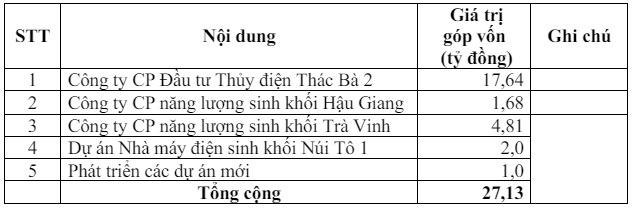

Regarding profit distribution, TV2 proposes a dividend payout of 10% for 2023 and aims to maintain or exceed this level in 2024. The company’s investment and capital contribution plans for 2024 total more than VND 27 billion, with a significant portion allocated to Thac Ba 2 Hydropower JSC (nearly VND 18 billion). Additionally, the company has allocated VND 46.4 billion for its 2024 capital construction plan.

Source: TV2

|

Notably, TV2 intends to establish three wholly-owned limited liability companies, based on a resolution passed at the 2019 Annual General Meeting of Shareholders. This decision is aligned with the company’s strategy to streamline its organizational structure and enhance operational efficiency. The three new companies will be formed by converting existing branches: the Survey and Construction Branch, the Electrical and Mechanical Branch, and the Power Plant Operation and Maintenance Branch.

At the meeting, Chairman

In terms of compensation, the meeting approved a monthly salary of VND 40.5 million for the Chairman of the Board of Directors for 2024. The total salary fund for managers and inspectors for the year is nearly VND 3 billion, while the total bonus fund is nearly VND 418 billion.

Song Hau 2 Project Secures Adequate Funding

One of the key concerns addressed at the meeting was the progress of the Song Hau 2 Thermal Power Plant project, which is considered TV2‘s most important venture. The project has faced challenges due to the Ministry of Industry and Trade’s notification of violations in April 2024 and the potential termination of the BOT contract with Toyo regarding capital mobilization.

TV2’s 2024 Annual General Meeting of Shareholders. Photo: Chau An

|

Providing an update on the project, Chairman Nguyen Chon Hung stated that TV2 has two contracts for this project. The first is an EPC contract with Sunway Construction from Malaysia, signed on February 28, 2023, and the second is an O&M contract for operation and maintenance. During this period, the investor, Toyo Ink Behard – a subsidiary of Toyo Ventures Holding Berhad, is responsible for capital arrangement.

Toyo has recently signed a contract with Eximbank Malaysia for a capital commitment of USD 980 million. Notably, Eximbank Malaysia has also confirmed the commitment of other banks to provide over USD 2.1 billion in funding for the Song Hau 2 project, ensuring sufficient capital for the investor.

“The deadline to secure funding is June 30, and we are confident that the bank’s arrangements have already exceeded the project’s investment value,” said Mr. Hung. He added that the required disbursement for this phase is only USD 120 million, while Toyo has secured a commitment of USD 980 million from Eximbank Malaysia.

Regarding the project’s potential, Mr. Hung acknowledged the challenges ahead but expressed confidence in TV2‘s ability to overcome them. He highlighted the company’s experience in similar projects, such as Vinh Tan 4, as well as its role as a general contractor in wind, solar, and biomass power projects, including the Hau Giang Biomass Power Plant.

Mr. Hung emphasized that while the Song Hau 2 project is significant, TV2 is also pursuing various other projects and partnerships with foreign bidders, not limited to those within the Power Development Plan 8 (PDP8). He added, “We cannot evaluate a company based on a single project. Song Hau 2 will bring additional revenue to TV2, but to grow, we must focus on diversifying our portfolio and creating more job opportunities. We should not settle for a few trillion but instead strive to go further.”

Bamboo Capital (BCG) surpasses 4,000 billion VND in revenue, reduces debt by 5,500 billion VND by 2023

The amount of debt to be paid has been reduced by more than 5,498 billion VND as the Group has actively settled all borrowings in order to lessen the cost of interest and ensure financial stability for the business.

Building Peace earns over one hundred billion in Q4 2023, breaks four consecutive quarters of losses, HBC stock soars in January 30th session.

As of December 31, 2023, Hòa Bình Construction continues to incur a cumulative loss of nearly 2,900 billion Vietnamese dong.