Despite significant price hikes, experts believe that the real estate market is still in an exploratory phase and predict a true boom by 2025. The outlook for real estate stocks is being reassessed after a long period of stagnation.

PRICES RISE DESPITE MARKET CONDITIONS, REAL ESTATE REMAINS AN ATTRACTIVE INVESTMENT OPTION

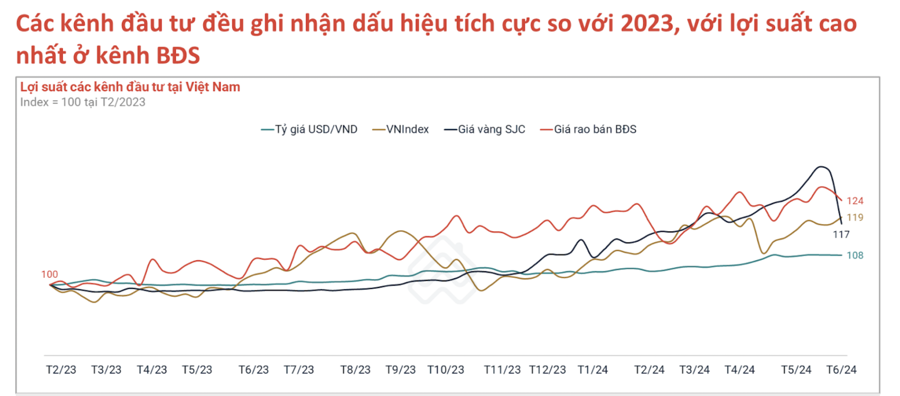

According to Batdongsan.com’s data for the first half of 2024, most investment channels showed positive signs compared to 2023. Real estate continues to offer the highest investment yields. Historical price data up to June 2024 shows that the average asking price of real estate has increased by 24% compared to the beginning of 2023, while the VN-Index has risen by 19%, SJC gold prices by 17%, and USD exchange rates by 8%.

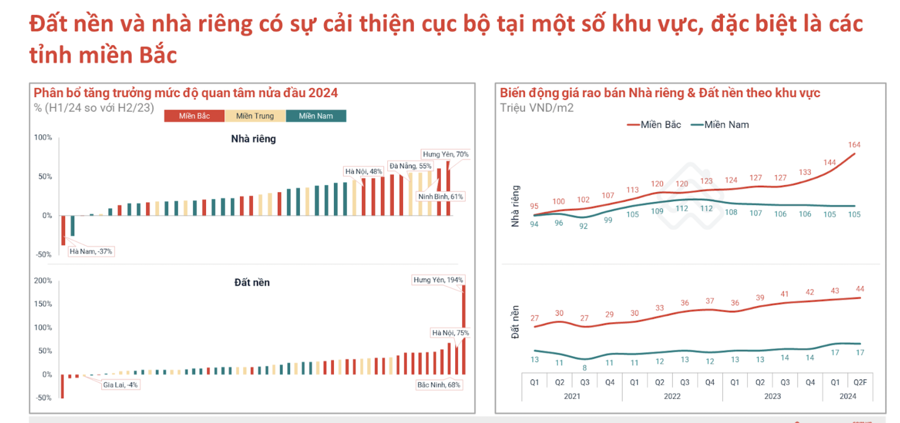

Hanoi recorded a 32% increase in asking prices for detached houses compared to the beginning of 2023, with a 31% increase for apartments and a 10-19% rise for land and villas. In contrast, Ho Chi Minh City’s real estate asking prices have remained stagnant for the past year and a half, except for a slight 6% increase in apartment prices, while other property types have maintained their price levels.

Some northern provinces, such as Hung Yen, experienced a 194% increase in interest in land, while detached houses saw a 70% rise. Hanoi also witnessed a 75% increase in land inquiries and a 48% rise in detached house inquiries. The interest and price increases were particularly notable in Hanoi’s outlying areas due to planning and auction activities. Specifically, in the first half of 2024, land in Dong Anh, Gia Lam, Hoai Duc, Thach That, and Quoc Oai districts saw a 48-104% increase in buyer inquiries, leading to a 4-24% rise in asking prices compared to the second half of 2023.

NO BUBBLE IN THE APARTMENT MARKET

The most vibrant segment of the real estate market in the past six months has been Hanoi’s apartment sector. The demand for apartments in Hanoi peaked in March 2024, with a nearly 60% increase compared to the end of 2023. Although the interest in apartments has cooled down since then, prices have remained steady.

In May 2024, Hanoi’s apartment asking prices reached Ho Chi Minh City’s level, at VND 50 million/m2. Apartments also boast the best liquidity in the market, with 48% of surveyed brokers believing that apartments are in a strong growth phase.

Mr. Dinh Minh Tuan, Southern Regional Director of Batdongsan.com.vn, stated that there are currently no signs of a bubble in the apartment market.

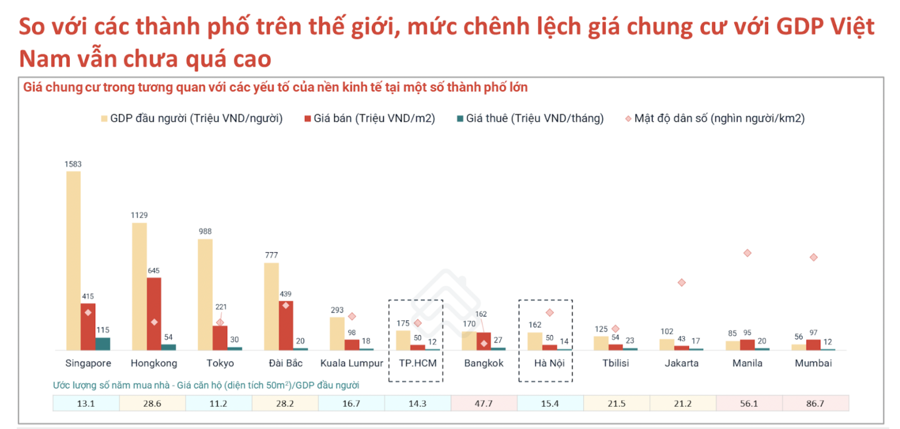

Compared to other cities worldwide, the gap between apartment prices and Vietnam’s GDP is not excessively high. It is estimated that it would take over 47 years of income to buy a 50m2 apartment in Bangkok, Thailand, over 56 years in Manila, the Philippines, and almost 17 years in Kuala Lumpur, Malaysia. In Hanoi and Ho Chi Minh City, it would take around 14-15 years of income to purchase a similar-sized apartment.

“The population growth rate in these two cities indicates a strong real demand for apartments. It is projected that the total housing demand in Hanoi will be 89 million square meters of floor space during the 2021-2030 period, while in Ho Chi Minh City, it will be 107.5 million square meters. With such high demand, apartment prices in Hanoi and Ho Chi Minh City are not excessively high compared to other global cities. Moreover, as the interest rates for home purchases are not expected to decrease soon, and the deposit interest rates have recently been adjusted upwards, there is no ‘bubble’ in the apartment market,” explained Mr. Dinh Minh Tuan.

Predicting the market’s future, Mr. Nguyen Quoc Anh, Deputy General Director of Batdongsan.com.vn, stated that in the next two years, the Vietnamese real estate market could go through several phases: reversal, exploration, consolidation, improvement, and stabilization. In each phase, buyers will prioritize different factors when choosing real estate.

Specifically, from now until the end of 2024, the market will remain in the exploration phase, with buyers prioritizing certainty, such as meeting genuine housing needs, clear legal status, favorable financial support policies, stable rental yields, and optimized costs. In this phase, apartments attract the most attention and have the best liquidity among all property types.

Entering the consolidation phase, expected to begin in Q1/2025, buyers and investors will feel more confident about financial and legal factors but will still prioritize properties that serve genuine housing needs and generate good cash flow. If monetary factors become more favorable, high-cost property types like detached houses and shophouses will gradually improve in transaction volume.

Mr. Nguyen Quoc Anh forecasts that from Q2/2025 to Q4/2025, the market could enter an improvement phase, where people will pay more attention to investment needs and price growth, and will not overly focus on selling prices and legal factors as they did during the market’s stagnant period. This will be the time when land and villas gradually regain their advantage and experience better liquidity.

Starting in 2026, the Vietnamese real estate market is expected to enter a stable cycle, with investors seeking investment opportunities in property types with high price appreciation, limited supply, and high levels of interest.

WHAT’S THE OUTLOOK FOR STOCKS?

In the stock market, residential real estate stocks have been trading at low prices after a period of recovery. KBSV Securities assesses that many real estate stocks are currently trading at 2024fw P/B levels lower than the 5-year average P/B. Thus, KBSV believes that investors can consider these stocks when their prices adjust downward and focus on companies with positive prospects, large clean land banks, solid legal status, ongoing projects, and safe financial structures. Notable investment opportunities include VHM, KDH, NLG, and DXG.

MBS Securities analysts also gave a positive outlook for KDH. Privia, a project with 1,000 apartments, achieved an absorption rate of over 85% in its late-2023 launch, and it is expected to drive a 3% growth in net profit in 2024, with the entire project expected to be handed over in Q4/2024.

Similarly, for DXG, the recently passed Land Law 2024 will help clarify issues related to land use fees. MBS expects these changes to expedite the legal process for the strategic Gem Riverside project, which comprises 3,000 luxury apartments.

Net profit for 2024 is projected to increase by 36.2% due to the continued handover of the Gem Sky World and the remaining Opal Skyline projects. When Long Thanh Airport is completed, a large number of passengers will be directed through the area, benefiting surrounding projects like the low-rise Gem Sky World, which is just a 30-minute drive from the airport. The stock price has a high potential for growth, with an estimated upside of up to 46.8%.