MSB Head Office Building

MSB plans to increase its charter capital by issuing dividend payout shares from retained earnings as of the audited financial statements on December 31, 2023, after allocating funds according to legal regulations. The issuance ratio is 30% of the total outstanding shares, equivalent to issuing 600 million new shares. After the capital increase, the total number of outstanding shares is expected to be 2.6 billion, bringing the new charter capital to VND 26,000 billion.

Three years after listing on the Ho Chi Minh City Stock Exchange, MSB has achieved a charter capital of over USD 1 billion. The capital increase in 2024 will continue to boost the bank’s competitive position in terms of scale, support its capital buffer, maintain a high CAR, and facilitate credit flow.

June also marked a significant milestone for MSB as it entered the Fortune Southeast Asia 500 ranking of the 500 largest enterprises in Southeast Asia, affirming its strong position and growth potential in the region. This prestigious recognition is based on revenue figures from seven countries: Indonesia, Thailand, Singapore, Malaysia, Vietnam, the Philippines, and Cambodia. With over USD 1 billion in revenue, MSB is one of 70 Vietnamese companies on the list. This achievement not only showcases MSB’s development but also reflects its competitive standing on an international scale and the growing trust of its customers.

In addition to this distinguished award, MSB also released its second Sustainability Report (ESG) in June, underscoring its commitment to economic growth while considering sustainability criteria. Through this report, MSB strives for transparency, enhances governance, and comprehensively considers the environmental and social impacts of its business operations on stakeholders. This approach enables the bank to make well-informed strategic decisions and focus on sustainable development goals while balancing the interests of all stakeholders.

According to MSB’s representative, in the coming years, the bank aims to enhance the comprehensiveness and adherence to international standards of its Sustainability Reports to better reflect its social and environmental impacts and assess the potential effects of climate change on its loan portfolio through scenario analysis and forecasting.

Petrovietnam and PVcomBank collaborate with Hanoi City to organize an artistic light show featuring 2,024 drones

Welcoming the Year of the Rat 2024, Petrovietnam, PVcomBank, together with Hanoi City People’s Committee and Tay Ho District People’s Committee, are organizing a dazzling light show called “Hanoi Art Light Festival – Thang Long Shining” on the eve of Lunar New Year. This will be the largest drone performance ever seen in Southeast Asia up until now, with a total of 2,024 unmanned aerial vehicles (drones) illuminating the night sky.

Vietnam ranks in the top 10 travel markets of Singapore.

Vietnam is among the top 10 tourism markets for Singapore, with a total of 434,000 visitors expected by the end of 2023.

Vietnam Economy 2024: Reaching New Heights

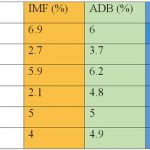

Vietnam has set a target to achieve an economic growth rate of 6-6.5% in 2024 – the Year of the Dragon. Our goal is within reach when compared to the growth forecasts of reputable global economic organizations such as the International Monetary Fund (IMF), the World Bank (WB), and the Asian Development Bank (ADB). Just like a cable car system, Vietnam’s economy has only one direction – moving forward, aiming for even greater heights.