Aqua City LLC has just announced the bondholders’ resolutions for the TPACH2024003, TPACH2025004, TPACH2125001, and TPACH2124002 bond packages, totaling VND 2,400 billion in issuance value, with MB holding 100% of the bonds. The resolutions agree to use certain assets as collateral for a VND 1,100 billion credit limit sponsored by MB, intended for the construction of the Aqua 112ha project.

These bond packages were issued by Aqua City LLC in 2020 and 2021, with one package already extended by bondholders for an additional 24 months on June 14, 2024.

According to Novaland, this agreement with the bondholders will enable Aqua City LLC to meet the conditions for the credit limit. This amount also serves as a foundation for the company to strive to fulfill the remaining disbursement conditions set by MB and proceed with the development of the Aqua 112ha project to honor its commitments to customers.

Furthermore, Aqua City LLC will ensure that the mortgage of secured assets belonging to the project, as agreed between the investor and the bank, will not affect customers’ rights as stipulated in the sales contracts.

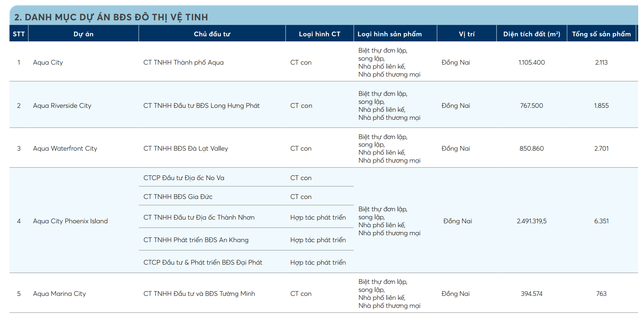

Aqua City LLC is a subsidiary of the Novaland Group, in which Novaland holds nearly 70% of the capital. The company is currently the investor in the Aqua City project, which is one of Novaland’s critical projects.

Previously, Novaland and its member companies’ bond packages worth thousands of billions of VND have also been agreed to be extended by bondholders, with extension periods ranging from 12 to 24 months.

With the government’s support in legal completion, the collaboration of financial partners, and Novaland’s proactive efforts in coordinating with state agencies to resolve legal obstacles, Novaland and the project investors will continue to implement construction activities and hand over real estate properties to customers in phases. They will also continue to restructure their finances to protect the interests of customers, lenders, bondholders, suppliers, shareholders, and other stakeholders.

Declining USD Prices: Banks and Free Market Suffer Declines

Approaching Tet holidays, the USD price in banks and the free market dropped significantly, despite the international USD index maintaining a high level.

Mr. Ngo Dang Khoa (HSBC): Exchange rate under pressure in Q1, expected to stabilize around 24,400 dong/USD by end of 2024

Prior to the rising trend of the USD, Mr. Ngo Dang Khoa – Director of Foreign Exchange, Capital Markets and Securities Services, HSBC Vietnam, has shared some insights and forecasts regarding the upward momentum of the USD and exchange rates.