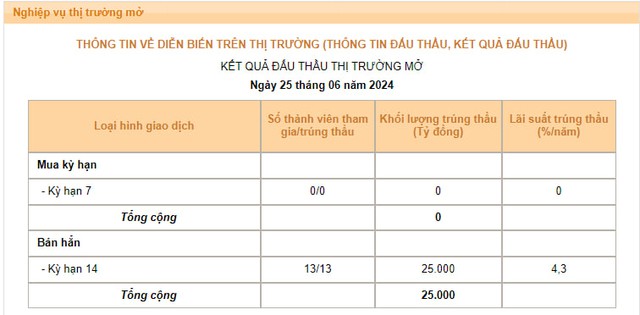

Vietnam’s money market witnessed an interesting development during yesterday’s trading session (June 25) as the volume of treasury bills auctioned soared to 25,000 billion VND—the highest since early March 2023. Concurrently, the auction yield was raised to 4.3%/year from 4.25% in the previous session.

On the other hand, 3,700 billion VND in treasury bills matured, and no market participants were successful in the collateralized securities lending (OMO) channel.

As a result, the State Bank of Vietnam (SBV) net withdrew 21,300 billion VND from the market yesterday, increasing the volume of treasury bills in circulation to 127,960 billion VND. There is now no longer any volume in circulation in the collateralized lending channel.

Source: SBV

Prior to this, starting from the June 21 session, the SBV made adjustments to its treasury bill issuance by reducing the tenor to 14 days, following an extended period of offering 28-day bills.

The SBV’s move to lower the tenor and increase the auction yield of treasury bills is believed to be aimed at raising the VND interbank interest rate amid persistent exchange rate pressures, especially considering the significant decline in interbank interest rates for tenors below one month in the previous week. Additionally, reducing the tenor of treasury bills will provide banks with greater flexibility in managing their liquidity as the peak period at the end of the quarter approaches.

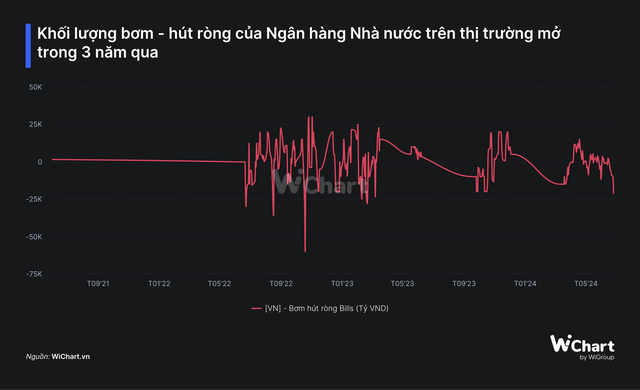

As previously reported, the SBV resumed its treasury bill auctions on March 11, after a hiatus of more than four months.

The issuance of treasury bills has been almost continuously maintained by the monetary authority over the past three months due to persistent exchange rate pressures, as the Fed has remained cautious about reducing interest rates. Moreover, the SBV has repeatedly adjusted the auction yield of treasury bills upwards to enhance the attractiveness of this dong liquidity absorption tool. For banks in need of support, the SBV is ready to provide lending through the OMO channel, but these banks must accept a relatively high interest rate, which has increased to 4.5%/year.

Analysts believe that the SBV’s move to increase the OMO and treasury bill interest rates is intended to establish a higher interbank interest rate, thereby reducing pressure on the exchange rate and foreign exchange reserves.

In fact, over the past two months, despite the SBV’s intervention in the foreign exchange market, USD exchange rates at banks have continued to climb, even reaching the permitted ceiling and exceeding the intervention selling price. This has exerted significant pressure on foreign exchange reserves, which are barely at the safe threshold (three months of imports) recommended by international organizations.

According to market sources, the amount of foreign currency sold by the SBV to commercial banks so far has reached nearly USD 6 billion, almost equal to the accumulated purchases in 2023.

Declining USD Prices: Banks and Free Market Suffer Declines

Approaching Tet holidays, the USD price in banks and the free market dropped significantly, despite the international USD index maintaining a high level.