On Friday, June 28th, the US Department of Commerce will release the Personal Consumption Expenditures (PCE) price index report – a key measure of inflation that heavily influences the Federal Reserve’s interest rate decisions. Markets are hopeful that the May PCE data will show a continued easing of inflation in the US, setting the stage for the Fed to initiate monetary policy easing between now and the end of the year.

According to CNBC, the overall PCE index is forecast to show little to no increase from the previous month, marking the first month of increase since November 2023.

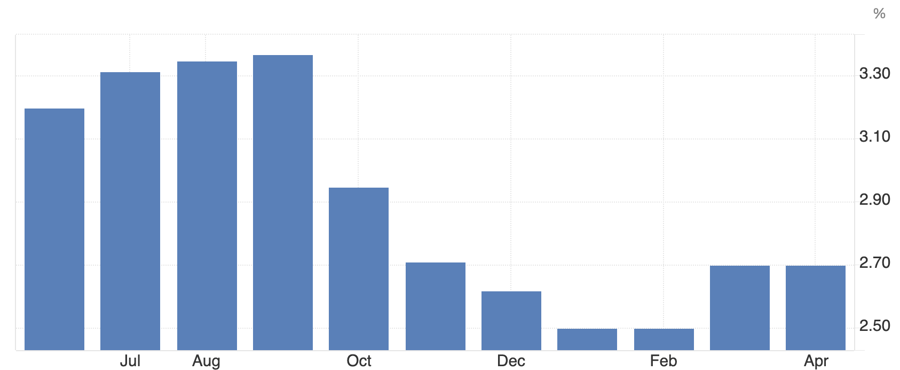

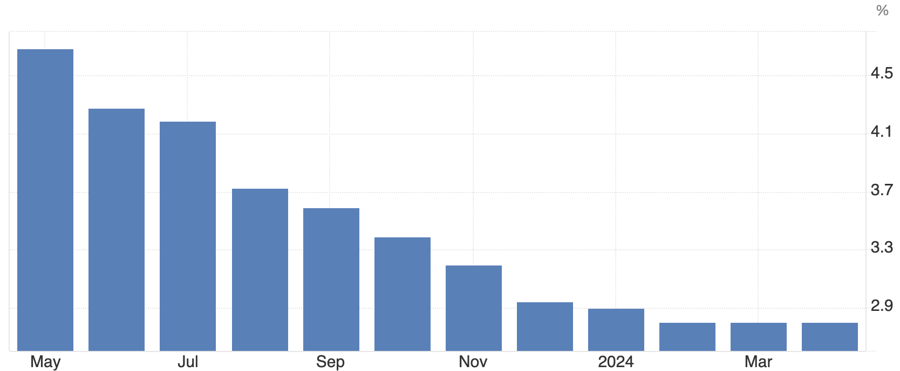

More importantly, the core PCE index, which excludes volatile energy and food prices, is expected to show a slower year-over-year increase than in the previous month. This would be the lowest year-over-year increase since March 2021, when the year-over-year change in the core PCE index first exceeded the Fed’s 2% inflation target for this cycle.

Despite the Fed’s aggressive rate-hike campaign, which pushed the federal funds rate to its highest level in over two decades at 5.25-5.5% and maintained it there for nearly a year, inflation has yet to fall back to the Fed’s target.

A Dow Jones survey predicts that the May core PCE price index will rise 0.1% from the previous month, while the overall PCE price index is expected to remain unchanged. These forecasts represent a deceleration from the respective increases of 0.3% and 0.2% in April.

On a year-over-year basis, both the overall and core PCE price indexes are expected to increase by 2.6%, slightly above the Fed’s 2% inflation target but down from the 2.7% increase recorded in March and April.

If these core PCE forecasts hold true, it could be considered a milestone in the Fed’s battle against inflation. “We are forecasting that the core PCE will be softer than the previous month,” said Beth Ann Bovino, chief US economist at US Bank. “That’s good news for the Fed and for consumers’ wallets, though I’m not sure they’re feeling the relief yet.”

In reality, while inflation in the US has come down significantly from its mid-2022 peak, prices remain elevated. The core PCE index is currently 14% higher than it was in March 2021.

This level of price increase and its negative impact on the economy are why Fed officials are not yet ready to declare victory in the fight against inflation, despite the clear progress made since the rate-hike campaign began in March 2022.

“Getting inflation down to 2% on a sustainable basis is still a work in progress, not a task that has been completed,” said Fed Governor Lisa Cook recently.

Cook and her colleagues at the Fed have been cautious about the timing and pace of rate cuts, even as they agree that rate reductions could begin this year if economic data align with forecasts.

Futures markets are currently leaning towards the possibility of the Fed starting to cut rates in September, with a 0.25 percentage point cut. Traders also believe that after the September cut, the Fed will reduce rates once more before the end of the year. Meanwhile, the Fed’s June update forecasts only one rate cut for 2024.

“We expect the real economy to weaken, not contract, just slow down. That means inflation will weaken further. That’s the basis for our expectation that the Fed will be able to make that first rate cut in September,” said Bovino.

“For now, we know that it all depends on the economic data, and the Fed is watching the situation closely. Will they wait longer? Will they only cut rates once this year? I don’t rule out that possibility. However, the upcoming PCE data may give the Fed the opportunity to cut rates twice this year.”

Meanwhile, the Managing Director of the International Monetary Fund (IMF), Kristalina Georgieva, suggested that the Fed should wait until at least the end of this year before cutting rates, as the US is the only G20 economy growing faster than its pre-pandemic trend, and this strong growth is adding to inflation risks.

“We do see inflation risks in the US. With these risks, we agree that the Fed should keep the policy rate at the current level at least through the end of 2024,” Georgieva said at a press conference on June 27.

The IMF forecasts that the US core PCE price index will end 2024 with a 2.5% increase for the year and slow to the Fed’s 2% target by mid-2025, earlier than the Fed’s projection of 2026.

According to Georgieva, the US economy’s resilience during the Fed’s rate hike cycle is partly due to increased labor supply and productivity. She believes the Fed should wait for clearer evidence of inflation falling back to 2% before initiating rate cuts. However, the IMF’s more “optimistic” assessment of easing inflation in the US is based on indicators suggesting a weakening labor market and slowing consumer demand.

“In the past few years, we have learned that we are in a period of heightened uncertainty. More uncertainty also lies ahead. But we believe the Fed will navigate through it successfully, as they have shown great wisdom over the past year,” Georgieva concluded.

Which bank offers the highest interest rate for online savings in early February 2024?

Beginning February 1st, 2024, several banks have been adjusting their interest rates downwards for savings accounts ranging from 1 to 24 months. Based on a survey conducted across 16 banks, the highest annual interest rate for online savings deposits at a 6-month term is 5%, while for a 12-month term, it is 5.35%.

Propose adding a bad scenario script to “shock” the economy

In addition to the positive economic growth scenarios for 2024, Vietnam needs to prepare for negative scenarios to enhance its ability to cope with unexpected shocks.