Reporters from Nguoi Lao Dong newspaper observed on the morning of July 1st that many individuals were visiting bank branches in person after encountering issues with their banking apps.

At BIDV’s Ho Chi Minh City branch, bank staff mentioned that numerous customers had arrived to update their biometric data. The primary issues encountered involved older phone models being unable to read the chip-based CCCD information via NFC (wireless connection), and discrepancies between customer information in the bank’s system at the time of account opening and the current information on the chip-equipped CCCD.

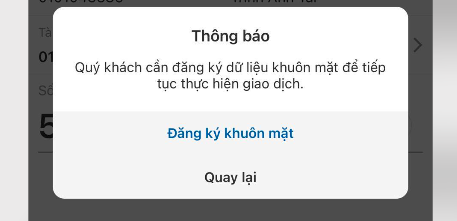

Many individuals continued to experience issues with biometric authentication.

At this BIDV branch, our reporter noticed not only Vietnamese but also foreign customers waiting to update their biometric data. BIDV staff explained that foreign customers needed to visit the branch in person to receive direct assistance.

Similarly, at a Sacombank branch on Nguyen Cong Tru Street (District 1), Ms. Ngoc Thanh, a resident of Thu Duc City, was waiting to update her biometric data for the Sacombank Pay app. According to Ms. Thanh, the issue arose because the information registered for her credit card differed from the information on the chip-equipped CCCD. She had to visit the branch, but the update procedure only took a few minutes.

Customers who have not updated their biometric data will be unable to transfer amounts exceeding VND 10 million starting today, July 1st.

Sacombank staff at this branch mentioned that from the morning until noon, they had assisted over a dozen customers in synchronizing their biometric data. The main issues encountered involved older phone models being incompatible with the update. Only phones running Android 8.0 or higher and iPhones running iOS 13.0 or higher (equivalent to iPhone 6s and later) can update biometric data through the app.

Meanwhile, customers of Vietcombank, VIB, VPBank, and other banks reported inconveniences due to system overload, errors during face scanning, and slow app performance, which affected their payment and overall experience.

Mr. Trinh Nguyen, a VPBank account holder, shared that he had visited a branch to update his biometric data but still encountered system errors. The system repeatedly indicated that his facial data did not match the information stored in the bank’s database.

Some Eximbank customers complained that even after updating their biometric data at a branch, they were unable to transfer amounts over VND 10 million successfully. Eximbank staff explained that the system had not yet been patched, and they advised customers to temporarily make transfers through the bank’s website while they worked on fixing the issue.

Banks advise customers to update their biometric data only through official bank apps or by visiting branches or calling the bank’s hotline. Avoid using any other applications or websites to prevent potential risks of fraud and misrepresentation. Photo: Le Tinh

The banks’ 24/7 hotlines have also been inundated with calls from customers requesting support, not just at the branches. The deputy general director of a joint-stock bank shared that within a few hours on the morning of July 1st, the bank’s hotline had received thousands of calls from customers seeking assistance with biometric data updates.

“The bank has had to increase staff and invest in system upgrades to provide maximum support to customers. While there may be some initial hiccups, biometric authentication for transactions exceeding VND 10 million in transfer amount and VND 20 million in total daily transaction value is necessary to minimize the risks of unauthorized account usage, fraud, and deception,” the deputy general director added.

Avoiding Fraud When Updating Biometric Data

Banks advise customers to update their biometric information only through official bank applications or by visiting branches or calling the bank’s hotline. Avoid using any other applications or websites to prevent potential risks of fraud and misrepresentation.

Ms. Nguyen Thuy Hang, a resident of Ho Chi Minh City, shared that a week earlier, after struggling for nearly two hours to authenticate her biometric data through the bank’s app, she turned to social media for guidance to save time and avoid going out. She posted a “.” in comments on Facebook posts asking for help with the process. Soon after, someone claiming to be a credit officer called and asked for her CCCD and PIN to assist with the biometric update, promising to complete the process within five minutes. Suspecting fraud, Ms. Hang declined the offer. She eventually had to go to a branch to get her biometrics updated. She believes that sharing her phone number publicly on social media may have led to the suspicious call.

Couple Charged after Declaring a Pool Worth Over 49 Billion VND

With hundreds of participants, our organization is known for hosting multiple rope jumping events. However, due to financial difficulties, the owners of the organization have announced their inability to cover the costs totaling over 49 billion VND.

Common Scams to Watch Out for During the 2024 Lunar New Year Online

As the Lunar New Year approaches, cybercriminals are ramping up their activities in cyberspace, causing a significant impact on people’s lives. The rise in cybercrime has become more sophisticated and complex, posing a threat to individuals and their personal information. It is crucial for us to be vigilant and take proactive measures to protect ourselves and our online presence.