The Ho Chi Minh City Stock Exchange (HoSE) has announced that it will place restrictions on the trading of ITA shares of Tan Tao Investment and Industry Corporation. The reason for this action is that, as of now, the company has failed to disclose audited financial statements for the year 2023, which falls under the regulations for restricted securities trading as per point a, clause 1, Article 39 of the Listing and Trading Regulations for Listed Securities issued under Decision No. 17/QD-HDTV dated March 31, 2022, of the Vietnam Stock Exchange.

Prior to this, on April 23, 2024, HoSE had sent a reminder to ITA regarding the late submission of its 2023 audited financial statements and annual report. The State Securities Commission of Vietnam (SSC) had also responded to the company regarding the temporary postponement of the disclosure of this information.

“The company responded with Official Letter No. 222/CV-ITACO-24 dated June 24, 2024, to the SSC and HoSE, but failed to provide documents or evidence to support the temporary postponement of the 2023 audited financial statements and 2023 annual report due to force majeure,” HoSE stated in its announcement.

At the 2024 Annual General Meeting of Shareholders held in late June, in response to a shareholder’s question about the company’s delay in publishing its 2023 audited consolidated financial statements and the actual business results for 2023, Mr. Nguyen Thanh Phong, CEO of ITA, explained that since 2022, ITA has faced challenges as HoSE and the SSC had suspended the practice of auditors who had conducted audits for ITA, causing auditing firms to leave.

The CEO added that finding new auditing firms has been difficult, and despite their best efforts to persuade them, no company dares to take on the audit for ITA due to fears that their auditors may also be suspended from practice without a clear reason, as happened with previous auditors. ITA has sent multiple requests to HoSE and the SSC for support in finding a new auditing firm. Due to these unforeseen circumstances, the company has requested a temporary postponement of the disclosure of the 2023 audited financial statements and annual report as per regulations.

“Despite the lack of audited financial statements for 2023, the management team commits to transparency and truthfulness in our financial information. We assure you that we were profitable in 2023, and our financial results accurately reflect our business performance. In 2021, we incurred losses due to provisions for doubtful accounts set by the auditing firm. In 2022, we terminated the land lease contract for the Kien Luong Thermal Power Project due to force majeure. Apart from these reasons, we were profitable in 2021, 2022, and 2023, and our profit margin has consistently been higher compared to our peers in the same industry,” said Mr. Phong.

Also, at the 2024 Annual General Meeting, a shareholder who had purchased ITA shares at VND 17,000 per share two years ago expressed concern about the current market price of VND 5,000-6,000, which would result in a significant loss if sold. The shareholder asked the management team about their plans to improve the share price.

In response, Ms. Dang Thi Hoang Yen (Maya Dangelas), Chairwoman of the Board of Directors of ITA, acknowledged that while the share price has declined, ITA shares have always maintained high liquidity and provided profitable opportunities for short-term traders. She emphasized that the share price does not affect the ownership ratio or voting rights of shareholders.

According to Ms. Yen, since May 2022, ITA has been facing negative influences from certain malicious forces aiming to acquire the company. “ITA has been vigorously fighting back, seeking justice and compensation for our shareholders and investors, both domestic and foreign, by filing a lawsuit in the International Court of Justice. We are awaiting the outcome of this legal process and will report back to our shareholders as soon as possible,” she stated.

In 2024, ITA received an extension of its investment certificate and continued the implementation of the Ecity Tan Duc urban area project. Ms. Yen believes that this is a positive sign and gives hope for achieving success after years of difficulties. “ITA is making every effort to drive the share price back to its ceiling price,” she emphasized.

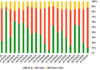

However, the company’s efforts have not yet yielded results, as the ITA share price in the market has continued to decline, currently standing at VND 5,240 per share, a decrease of nearly 19% since the beginning of the year. Compared to its all-time high at the beginning of 2022, the share price has fallen by over 70%.

Foreign investors sell nearly 300 billion VND in the final trading session of the week, while strongly accumulating a real estate stock in the opposite direction.

In a fierce market session, foreign trading is a negative factor with net selling across all three exchanges.