Illustrative image

The Vietnam Export Import Joint Stock Commercial Bank (Eximbank) has just announced the

application of a new deposit interest rate from today (July 4) with an increase in some

saving terms.

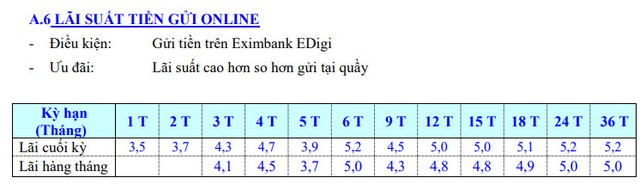

Specifically, for online deposits – the product with the highest interest rate, Eximbank

increased the interest rate by 0.5% per year for 3-month and 4-month terms, to 4.3% and 4.7%

per year, respectively. With this adjustment, Eximbank is currently the bank offering the

highest interest rate for 3-month and 4-month deposits. The interest rate of 4.7% per

year for the 4-month term is even approaching the ceiling rate of 4.75% per year set by the

State Bank for deposits under 6 months.

In addition, the bank also increased the interest rate for 6-month term deposits by 0.7% per

year, bringing it to 5.2% per year.

Eximbank kept the interest rates for the remaining terms unchanged. Accordingly, the interest

rate for 5-month term deposits is 3.9% per year, 9-month term is 4.5% per year, 12-15 month

term is 5% per year, 18-month term is 5.1% per year, and 24-36 month term deposits earn an

interest rate of 5.2% per year.

Eximbank’s 4-month deposit interest rate is approaching the 4.75% ceiling as per the State Bank’s regulations (Source: Eximbank)

Previously, Eximbank had increased deposit interest rates three times in June. However, the

bank only made adjustments to certain terms in each of these changes.

Eximbank is the second bank to increase deposit interest rates in July. Earlier, NCB also

increased its interest rates by 0.1% per year for terms ranging from 1 to 13 months,

effective from July 3.

The trend of increasing deposit interest rates has emerged since the end of March and became

widespread in April, May, and continued into June. However, the increase has mainly been

driven by private joint-stock banks.

In June, 23 commercial banks in the market raised their deposit interest rates, including:

TPBank, VIB, GPBank, BaoViet Bank, LPBank, Nam A Bank, OceanBank, ABBank, Bac A Bank, MSB,

MB, Eximbank, OCB, BVBank, NCB, VietBank, VietA Bank, VPBank, PGBank, Techcombank, ACB,

SHB, and VietinBank. Notably, many of these banks raised their interest rates two to three

times during the month.

According to analysts, the low growth in deposits from individuals and enterprises in the

first months of the year, coupled with the recovery of credit growth, has prompted many banks

to increase deposit interest rates to ensure a balance in capital sources. Deposit interest

rates are expected to face upward pressure in the second half of the year, but the increase

will not be significant as credit demand during this period is not expected to surge.

Latest Interest Rates at Agribank in February 2023: Highest Rate for 24-month Term

Interest rates for deposits at Agribank have further decreased in early February 2024 compared to January. Specifically, individual customers’ deposits are subjected to interest rates ranging from 1.7% to 4.9% per annum, while business customers’ deposits are subjected to interest rates ranging from 1.7% to 4.2% per annum.

A Eximbank Board Member Resigns

The resignation of Ms. Le Thi Mai Loan will be approved by the Shareholders’ General Assembly of Eximbank in accordance with the provisions of the law.