Vietnam’s Insurance Supervisory Authority (under the Ministry of Finance) has released an overview of the insurance market for the first four months of 2024. The total market premium income for this period is estimated at VND 71,047 billion, a 4.16% decrease compared to the same period in 2023.

For life insurance, new business premium income in the first four months of 2024 decreased by over 31.6% year-on-year, reaching VND 7,290 billion.

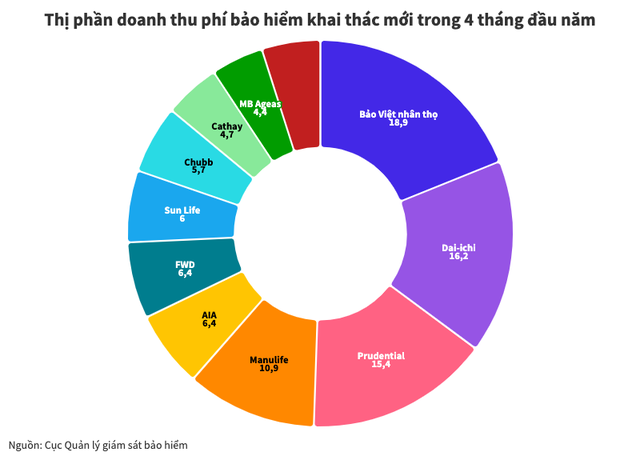

Baoviet Life Insurance led the market in new business premium income during this period with a nearly 18% market share. Dai-ichi and Prudential followed closely with 15% each, while Manulife accounted for 10%. AIA, FWD, and Generali each held a 6% share, and Chubb had a 5.4% share.

Thus, the top three insurers, Baoviet Life Insurance, Dai-ichi, and Prudential, accounted for nearly 50% of the new business market share in the first four months of this year.

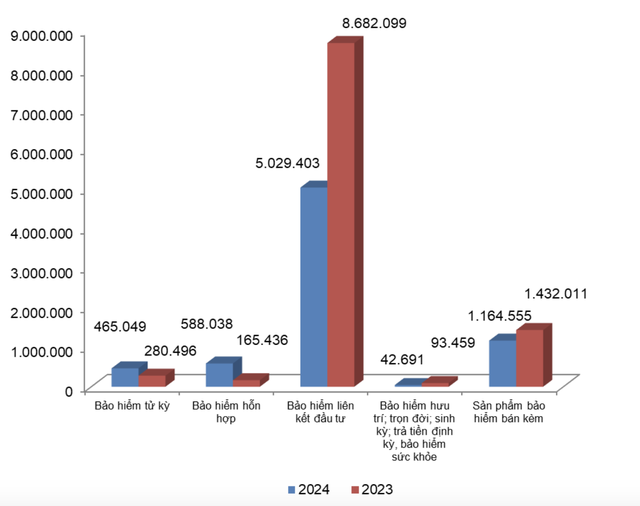

A contrasting performance was observed in specific product categories. Compared to the same period last year, new business premium income from investment-linked insurance decreased by 42.1%, while hybrid insurance and term life insurance increased by 255.5% and 65.8%, respectively.

Currently, investment-linked insurance accounts for the largest proportion of new business premium income at 69%. Hybrid insurance makes up 8%, term life insurance accounts for 6.4%, and other types of insurance (whole life, endowment, annuity, and health insurance) contribute 0.6%. Attached insurance products make up the remaining 16%.

In terms of new business contracts, the authority reported a total of 510,977 contracts for the first four months of 2024, with investment-linked insurance leading the way with a 52.5% market share, comprising 268,453 individual and group insurance contracts.

Overall, the number of in-force contracts in the life insurance market (excluding attached insurance products) stood at 12,152,060 as of the end of April 2024, representing a 12.7% decrease compared to the same period last year.

6 Insurance Companies to be Audited in 2024

According to the Ministry of Finance, the insurance market, especially life insurance, has been growing rapidly and has encountered some issues regarding the quality of advisory services, customer care, and claims settlement.