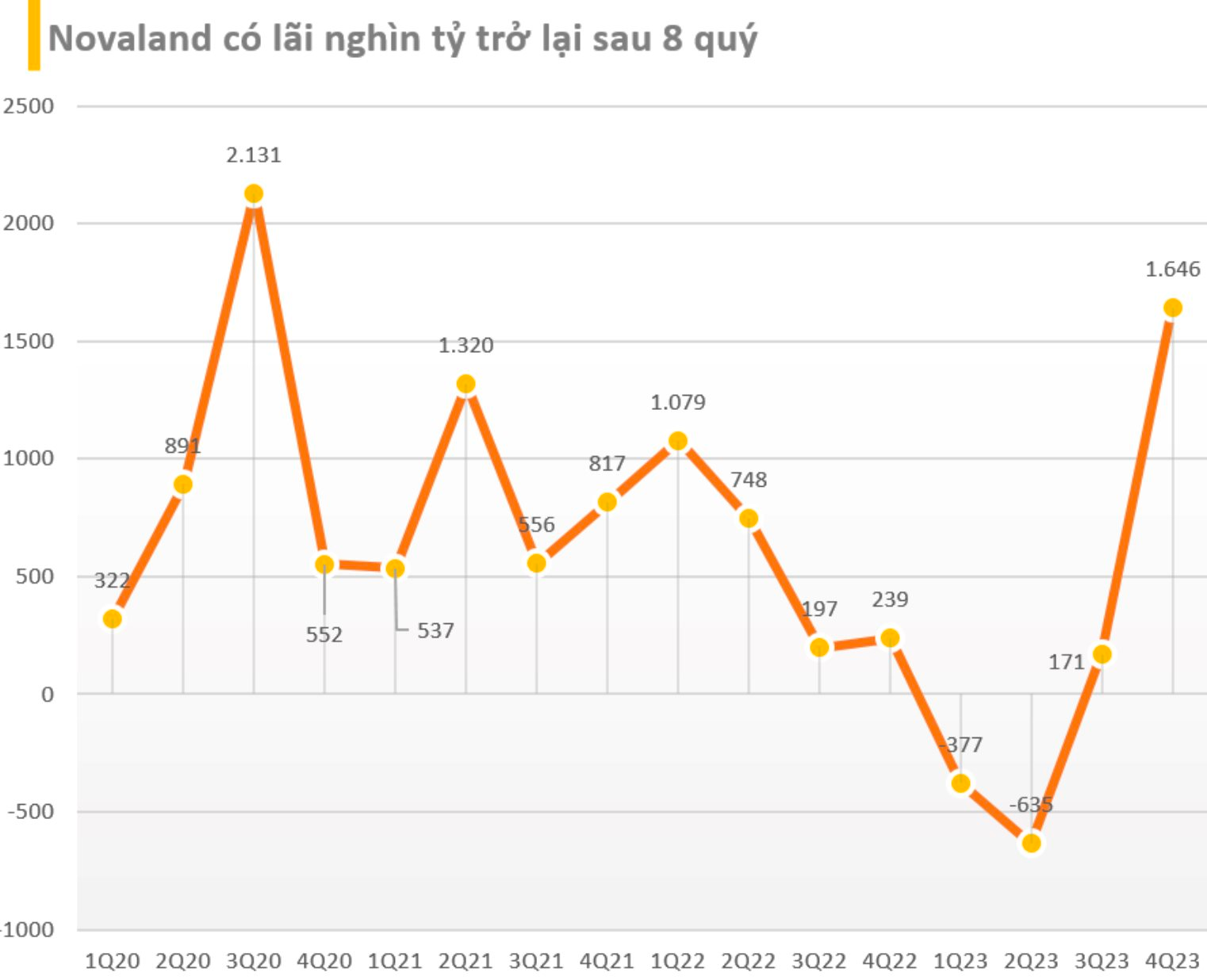

No Va Real Estate Investment Group (Novaland, NVL) has announced its financial statements for the fourth quarter of 2023, with a post-tax profit of 1.642 trillion dong, more than 130 times higher than the same period last year. In the midst of a sluggish market, NVL’s trillion-dong profit does not come from core business activities.

Specifically, in the period, NVL’s gross revenue from sales and services (core operations) decreased by 40% to over 2,000 billion dong. Correspondingly, gross profit reached 554 billion dong, a decrease of nearly 45% compared to the same period last year.

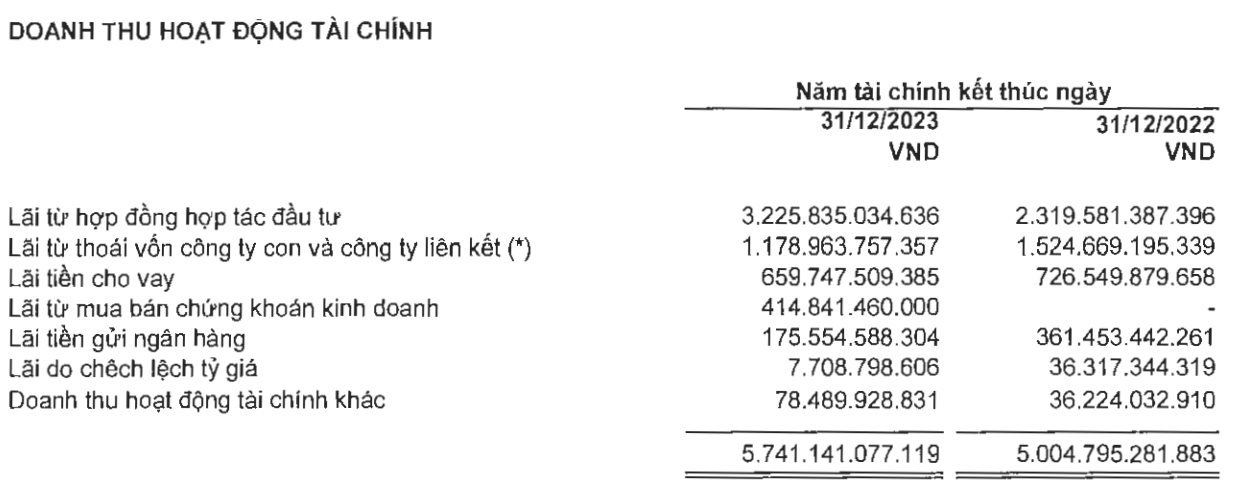

In contrast, financial operating revenue in the period reached 1.825 trillion dong, more than double, helping to increase net profit from business activities to 1.482 trillion dong, doubling the same period last year.

In which, a part of NVL’s financial operating revenue comes from the sale of subsidiary companies. For example, in September 2023, the Company completed the transfer of its subsidiary – Thanh Nhon Real Estate Investment Company – with a transfer value of 3.043 trillion dong. The profit of nearly 1.180 trillion dong represents the difference between the transfer value and the book value of the net assets, which is recorded in the business results report.

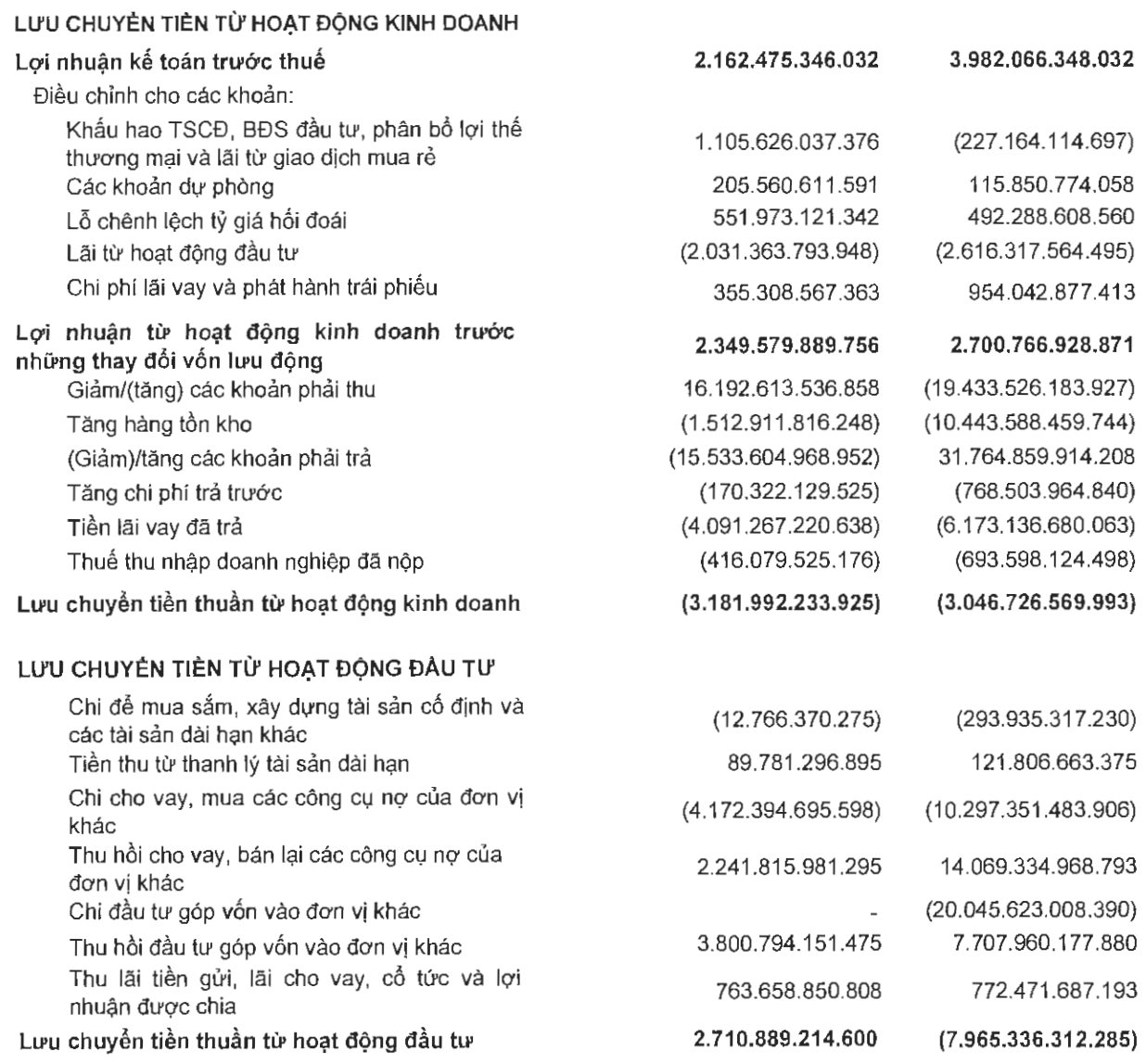

At the same time, selling investment capital also contributes to financial revenue. NVL’s cash flow statement shows that the cash flow from operating activities is still negative over 3,100 billion dong, but the cash flow from investment activities increases to over 2,700 billion (compared to the same period last year is – 8,000 billion).

NVL is trying to find positive profit figures by carrying out various activities such as mergers and acquisitions and transferring shares to subsidiary companies. This move also supports NVL’s stock trading activities. Currently, NVL code is margin-cut, so attracting liquidity will be greatly limited, and the return of positive profit is a condition for the Company’s shares to be margin-funded again.

On the other hand, various financial and sales expenses have reduced significantly due to the restructuring of loans. In mid-December 2023, NVL reached certain agreements related to the structure of the international bond package of 300 million USD…

Accumulated in 2023, NVL recorded nearly 4,760 billion dong of revenue, net profit reached 805 billion dong, a decrease of 57% and 63% respectively compared to the same period last year. It should be noted that the Company incurred losses of over 1,000 billion dong in the first half of the year.

As of December 31, 2023, Novaland’s financial loans reached 241,376 billion dong, a decrease of 16,000 billion dong compared to the beginning of the year. Specifically, the item with the sharpest decline is long-term receivables, from 44,081 billion dong to 33,857 billion dong. The company’s cash and deposits decreased by 5,200 billion dong.

Novaland’s financial loans are at 57,704 billion dong, a decrease of nearly 7,000 billion dong compared to the beginning of the year. In which, bond debt is 38,262 billion dong, a decrease of 5,900 billion dong. Bank loan debt is 9,400 billion dong.

In general, despite reporting trillion-dong profits, Novaland still faces many difficulties and tasks to be resolved, especially the “burden” of 38,262 billion dong bond debt – a consequence of the “drunkenness” in the past.