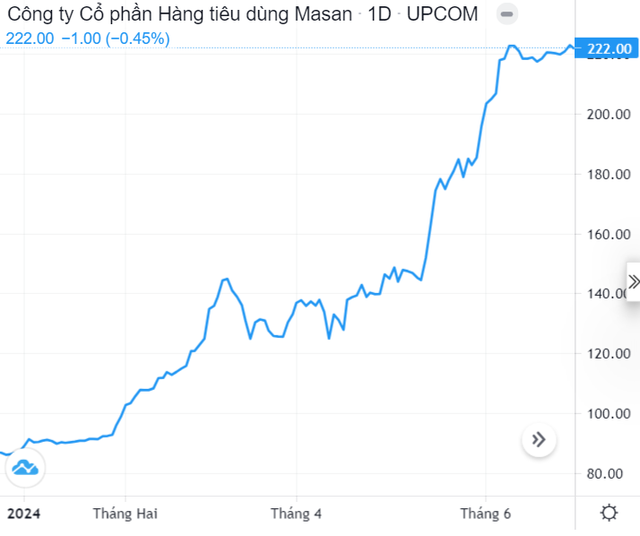

Shares of MCH, owned by Masan Consumer Holdings, have soared since the beginning of the year. Specifically, MCH shares closed at VND 222,000 each on June 28, 2024, marking a staggering 154% increase year-to-date.

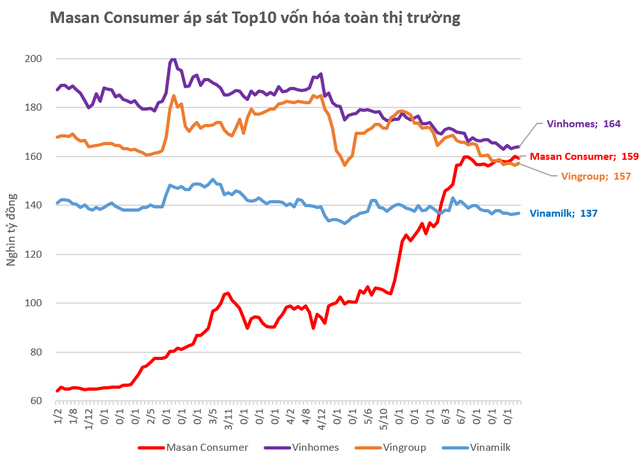

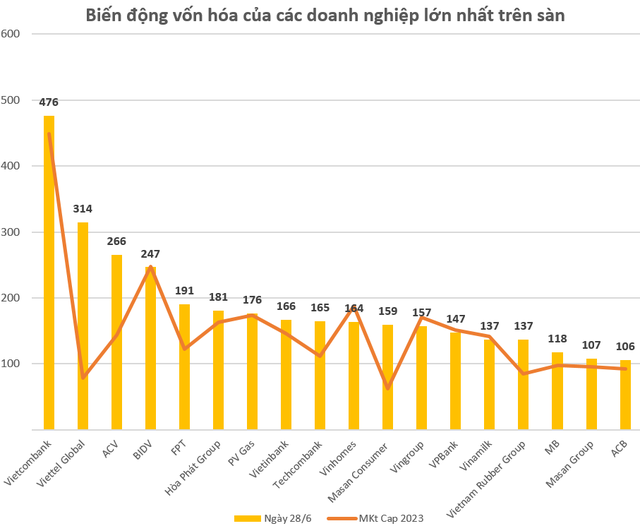

With its current market price, Masan Consumer’s market capitalization stands at approximately VND 159 trillion (around $6.2 billion), reflecting a VND 97 trillion surge since the beginning of the year. Consequently, the company’s market value has surpassed that of several prominent enterprises listed on the stock exchange, including Vingroup, Vinamilk, GVR, ACB, and MB, propelling it closer to the top 10 companies with the largest market capitalization in the market.

Masan Consumer’s market capitalization is also nearly 50% higher than that of its indirect parent company, Masan Group Corporation (MSN).

The growth prospects of companies in the consumer goods sector for 2024 are supported by expectations of economic recovery and consumer demand, along with the government’s approval of a 2% reduction in the value-added tax (VAT) rate, applicable to goods and services currently subject to a 10% rate (now lowered to 8%).

However, the enthusiasm for MCH specifically stems from a series of new initiatives that the company has declared it will aggressively pursue from 2023 onwards: a premiumization strategy, a global expansion (“Go Global”) initiative, and a listing on the Ho Chi Minh Stock Exchange (HOSE).

At this year’s annual general meeting of shareholders, Masan Consumer’s shareholders approved the listing of all outstanding MCH shares on the HOSE. Currently, MCH is traded on the UPCoM exchange. According to a disclosure dated May 30, 2024, by Masan Group, the transfer of MCH’s listing from UPCoM to HOSE is expected to take place in the second quarter of 2025.

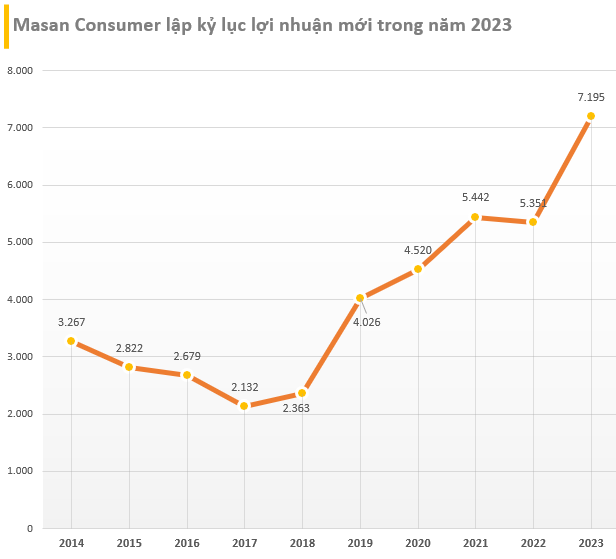

Additionally, the company’s consistently robust financial performance over the past quarters has served as a “boost” to its market capitalization since the beginning of the year. Specifically, in 2023, the company achieved a new record in profit. In the first quarter of 2024, the company recorded revenue of VND 6,727 billion and net profit of VND 1,505 billion, representing increases of 7.4% and 31.5%, respectively, compared to the same period last year. The gross profit margin continued to climb, reaching 46.7%, a figure that was only surpassed in the fourth quarter of 2023 and reflected a 4.5% improvement compared to the previous year.

According to an assessment by SSI Securities Corporation, Masan Consumer has achieved remarkable growth compared to its peers in recent years, with a compound annual growth rate (CAGR) of 10% for revenue and 11% for net profit during the 2019-2023 period.

SSI believes that this growth trajectory will persist in 2024-2025, supported by recovering consumer demand, new product launches for the domestic market, and expanded exports. Masan Consumer’s competitive advantage stems from its integration within the Wincommerce ecosystem, which will drive the company’s growth. The gross profit margin is expected to remain above 45% due to the company’s product premiumization strategy.

Currently, 98% of households in Vietnam use at least one product from Masan Consumer, as the company has successfully built a comprehensive product portfolio that spans from the kitchen to the living room and bathroom. In a market estimated at $8 billion, Masan Consumer has essentially met all essential at-home needs.

However, compared to the entire FMCG market in Vietnam, which is valued at $32 billion, Masan Consumer’s market share is less than 5%. Therefore, Masan Group’s management aims to target a larger and more premium out-of-home market, starting with the OMACHI brand of self-heating hot pot and self-cooking rice products.

With its “Go Global” strategy, Masan Consumer sets its sights on exporting to a global market of 8 billion consumers. Initially, the company has achieved success with its CHIN-SU products on major e-commerce platforms such as Amazon (USA) and Coupang (South Korea), aiming for international revenue to contribute 10-20% of total revenue.

As Masan Consumer ventures into larger markets, it is expected to witness more substantial revenue growth. Accompanying this expansion, the company also anticipates improved profit margins due to a favorable product mix and the downward trend in raw material prices.

“DPM’s Profits Vanish Into Thin Air, Accounting for Over 90% in 2023”

“DPM, the industry leader, achieved a remarkable feat by generating a profit post-tax of over 90% in 2023, marking its lowest net earnings since 2019.”

Foreign investors sell nearly 300 billion VND in the final trading session of the week, while strongly accumulating a real estate stock in the opposite direction.

In a fierce market session, foreign trading is a negative factor with net selling across all three exchanges.