Oil prices rose on Wednesday after a larger-than-expected drop in U.S. crude inventories, but gains were capped by concerns over rising global stocks.

Oil Rises as US Crude Stocks Fall Sharply

Oil prices climbed about 1% on Wednesday, buoyed by a steeper-than-anticipated drawdown in U.S. crude reserves. However, the gains were tempered by concerns over rising global inventories. Brent crude, the international benchmark, rose by $1.10, or 1.3%, to reach $87.34 a barrel. West Texas Middle (WTI) crude, the US benchmark, increased by $1.07, or 1.3%, to $83.88.

According to the US Energy Information Administration (EIA), the country’s crude oil inventories declined by 12.2 million barrels last week, surpassing the Reuters poll of analysts’ expectations for a decrease of 680,000 barrels.

The threat of supply disruptions due to Hurricane Beryl also boosted prices, although concerns eased after the US National Hurricane Center predicted the storm would weaken as it entered the Gulf of Mexico this week.

Gold Reaches Two-Week High

Gold prices surged more than 1% to their highest level in nearly two weeks on Wednesday, as investors increased bets on a Federal Reserve interest rate cut in September following recent weak US data indicating a softening labor market.

Spot gold finished the session up 1.2% at $2,357.06 per ounce, while gold futures for August 2024 delivery on the COMEX rose 1.5% to $2,369.40.

Initial jobless claims in the US rose last week, while the number of unemployed continued to climb to a two-and-a-half-year high at the end of June, signaling a cooling labor market.

A measure of activity in the US service sector also fell to a four-year low in June amid declining orders, suggesting the economy could lose momentum in the second quarter.

Investors are now eagerly awaiting the release of the non-farm payrolls report on Friday for further clues on the trajectory of US interest rates.

Iron Ore Climbs to Four-Week High on Stable Short-Term Demand and Hopes for Chinese Stimulus

Iron ore futures rose for the fourth consecutive session on Wednesday, reaching their highest level in four weeks. This upward trend was supported by robust short-term demand in China and persistent expectations for additional stimulus measures in the coming weeks.

The September iron ore contract on the Dalian Commodity Exchange (DCE) in China closed nearly 2.6% higher at 864 yuan ($118.79) per ton, a level not seen since June 3.

Singapore-traded iron ore futures for August delivery climbed 3.1% to $113.35 per ton, the highest since June 7.

Beijing has unveiled a series of stimulus measures aimed at reviving the struggling real estate sector, which is a major steel consumer.

Shares of Chinese property developers listed in Hong Kong surged on Tuesday, following private data that showed a continued narrowing of the year-on-year decline in sales for China’s top developers in June.

Copper Extends Gains

Copper prices rose for the fourth straight session on Wednesday, buoyed by signs of stronger demand from China, fund buying, and weak US data that weighed on the dollar and boosted hopes for interest rate cuts.

Three-month copper on the London Metal Exchange (LME) climbed 2.1% to $9,876 a ton, recovering from last Thursday’s two-month low.

US jobless claims, services activity, and factory orders data, which all came in weaker than expected, pushed the dollar index to a two-week low. The weaker dollar makes commodities priced in the US currency more affordable for buyers using other currencies.

Soybeans Recover from Four-Year Low

Soybean futures traded by the Chicago Board of Trade (CBOT) rebounded after hitting a four-year low earlier this week due to concerns about ample supplies and weak demand for US exports, according to analysts.

The market established a one-week high as traders adjusted their positions ahead of the CBOT’s closure on Thursday for the US Independence Day holiday.

Corn futures ended the session lower, trading near four-year lows, while wheat futures also declined.

November soybeans, representing the crop that will be harvested this fall, closed up 8.5 cents at $11.21-1/2 a bushel.

December corn on the CBOT fell 1-3/4 cents to $4.19-1/2 a bushel, while September wheat dropped 7 cents to $5.74 a bushel.

Rubber Falls on Weak Demand

Rubber futures in Japan fell on Wednesday as weak demand weighed on the market. The December rubber contract on the Osaka Exchange (OSE) closed down 2.6 yen, or 0.78%, at 331.4 yen ($2.05) per kg.

On the Shanghai Futures Exchange (SHFE), the September rubber contract rose 60 yuan to 15,105 yuan ($2,076.75) per ton.

Dismal production data from China, the world’s top rubber consumer, contributed to the decline in rubber prices.

Coffee Falls

September arabica coffee futures fell 3.1 cents, or 1.4%, to $2.242 per lb, a day after rising 1.1%. Coffee is finding support from dry weather in top grower Brazil.

September robusta coffee fell 0.8% to $4,058 per ton.

Cocoa Falls

Cocoa futures for September delivery on the London exchange fell £24, or 0.4%, to £6,452 per ton, after rising 5% in the previous session.

Industry sources cited predictions from chocolate makers of a sharp drop in demand due to near-record prices.

Dealers noted that open interest or the number of outstanding cocoa futures contracts fell to their lowest since early in the year.

Cocoa has been trading within an extremely wide range due to reduced liquidity but has stabilized below this year’s record peaks as weather improved in top producer West Africa.

New York cocoa for September delivery fell 1.1% to $7,706 per ton, after surging 6.8% in the previous session.

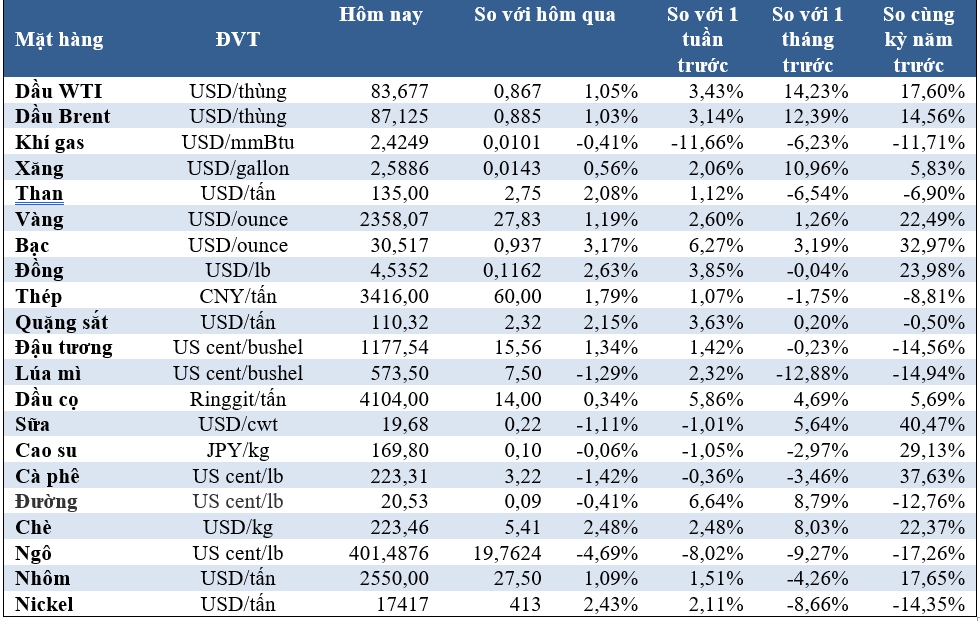

Prices of Key Commodities on July 4 Morning:

Market Update on February 2nd: Oil, Copper, Iron & Steel, Rubber, and Sugar Prices Decline, Gold Surges to Almost 1-Month High.

At the end of the trading session on February 1st, the prices of oil, copper, iron and steel, rubber, and sugar all dropped, while natural gas hit a nine-month low and gold reached its highest point in nearly a month.