The Vietnamese stock market extended its winning streak to the fourth consecutive session, buoyed by the positive performance of large-cap stocks. The energy, technology, and telecommunications sectors were among the bright spots, attracting investment and leading the market. The VN-Index closed the trading session on July 4th just shy of the 1,280 mark, registering a gain of 3.04 points. However, liquidity weakened, with trading value on the HOSE surpassing 14 trillion VND.

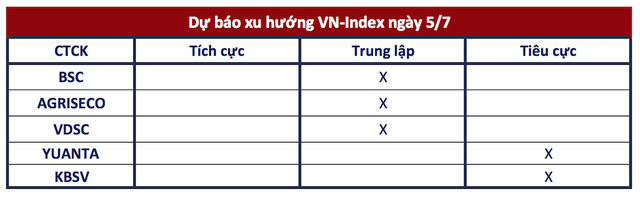

Regarding the market outlook for the upcoming sessions, securities companies offered the following cautious assessments:

Potential for Volatility

BSC Securities: The VN-Index climbed modestly, adding over three points on the day and finishing at 1,279.89. Sector performance was relatively balanced, with 12 out of 18 sectors posting gains. The energy sector led the advance, followed by information technology and telecommunications.

In terms of foreign trading activities, they continued to offload on the HSX while purchasing on the HNX. With the VN-Index approaching the 1,280 threshold, short-term volatility may arise at this level. Investors are advised to exercise caution in their trading decisions.

Sideways Movement Expected

Agriseco Securities: Agriseco Research anticipates a sideways market with a short-term balance around the MA20 line in the upcoming sessions. As the index moves towards the resistance area, some volatility may occur during the upward trajectory, as the recovery lacks accompanying liquidity support.

Investors are recommended to focus on portfolio restructuring, reducing exposure to stocks that have already experienced significant gains or those with speculative tendencies as the index nears the 1,280 resistance zone (±5 points). For new investments, consider buying leading stocks in sectors with expected profit growth in Q2, such as retail, steel, and exports.

Fluctuations within the 1,270-1,280 Range

VDSC Securities: VDSC foresees the market temporarily fluctuating within the 1,270 – 1,280 range in the near term. However, the upward momentum could continue after this exploratory phase, supported by recent positive developments. Investors should proceed with caution, observing supply and demand dynamics, while also considering buying opportunities in select stocks for short-term trading. Additionally, remain mindful of the market’s recovery to realize profits or adjust portfolios to mitigate risks.

Potential for a Corrective Phase

Yuanta Securities: The market may undergo a corrective phase in the next session, and while short-term risks are gradually diminishing, low liquidity indicates that investors remain hesitant to re-enter the market. The psychological indicator continues to edge higher, suggesting that new buying opportunities are emerging, but the market may still experience corrective phases and struggle to swiftly surpass the 1,290 resistance level within the next 1-2 sessions.

The short-term trend of the overall market remains neutral, but large-cap and mid-cap stocks have entered a bullish phase. Therefore, investors are advised to utilize corrective phases to increase their equity exposure to a balanced level.

Buying Interest Yet to Broaden, Risk of Reversal Persists

Investors are advised to partially realize profits on trading positions and reduce exposure back to safer levels as the index approaches resistance thresholds.

Bank stocks sold off heavily

Today (2/2), the VN-Index continues to rise, but in a cautious trading atmosphere. It is noteworthy that most banking stocks in the VN30 basket are facing strong selling pressure.