The market opened on a positive note on July 2, with many stock groups continuing their recovery. Increased buying interest helped push the main index higher towards the end of the trading session. At the close, the VN-Index gained 15.23 points, or 1.21%, to finish at 1,269.79. Foreign selling pressure eased significantly, with net selling value of just over VND 30 billion across the market.

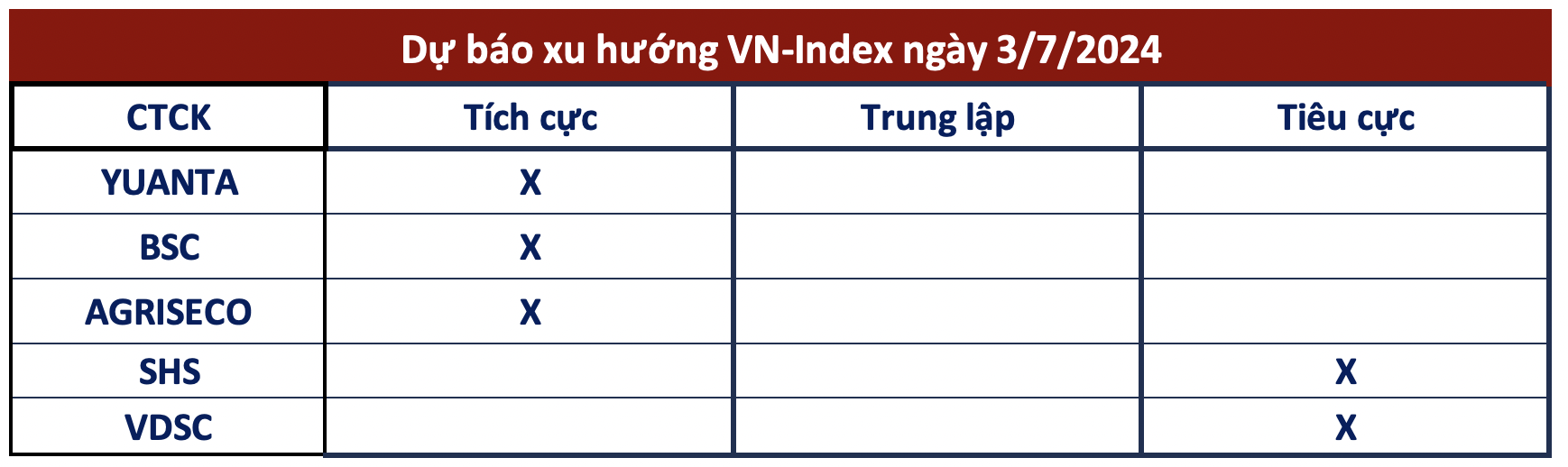

Looking ahead to the next trading session, several securities companies anticipate that the upward momentum could continue before encountering profit-taking resistance at higher levels. However, some remain cautious and warn of a potential correction amid weak liquidity. Investors are advised to trade cautiously.

Yuanta Securities Vietnam believes that the market could continue its recovery trend, with the VN-Index likely to retest the resistance level of 1,277 points. However, the analytics team maintains that the market is still in a technical recovery phase and a short-term trend reversal cannot be confirmed at this stage.

On a positive note, the short-term trend of many bank stocks has improved, indicating that the market’s downward momentum is slowing. This suggests that the likelihood of the VN-Index breaking below the 1,230-point level is low. Yuanta recommends that investors stop selling and continue to hold a low proportion of stocks, approximately 40% of their portfolio, and refrain from buying new positions as short-term risks remain elevated.

Similarly, BSC Securities projects that in the coming sessions, the market could continue its upward momentum towards the 1,280 threshold, but the rally may be capped by profit-taking pressure.

Agriseco Research also forecasts that the VN-Index is likely to advance towards the resistance zone of around 1,280 (+-5) points. However, they caution that the trend following this rally may become less sustainable as liquidity has not recovered correspondingly.

Investors are advised to focus on portfolio restructuring, reducing the proportion of stocks that have already seen significant price increases and speculative stocks as the index approaches the aforementioned resistance zone. Sectors with expected positive profit growth in the second quarter, such as retail, steel, and exports, could be prioritized.

According to SHS Securities, market liquidity remains weak, with trading value only reaching about 60% of the average. As a result, the VN-Index may face pressure and test the 1,255-point region again when it encounters resistance around 1,280 points, corresponding to the equilibrium zone of the short-term accumulation channel of 1,250 points – 1,300 points. Short-term investors should maintain a reasonable proportion and consider restructuring their portfolios as the market awaits second-quarter business results.

Sharing a similar view, Rong Viet Securities (VDSC) states that the rapid price increase has brought the market close to the first resistance zone of 1,270 – 1,275 points. Therefore, the market is expected to be cautious at this level and retreat to test the support level of 1,263 points. Investors need to slow down to observe supply and demand, but they can also consider the attractive prices of some stocks for short-term trading. Additionally, it is crucial to consider the market’s recovery to take profits or restructure the portfolio to minimize risks.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.