The domestic stock market entered the trading session with a rather cautious sentiment. The market moved slowly, and liquidity did not improve. In the context of investment capital not showing supportive signals, the pressure of price differentiation, the VN-Index fluctuated on its journey towards the 1,280-point mark.

Despite briefly conquering this threshold, the index could not maintain its gains by the end of the session. The current issue facing the market is a lack of driving force, with large-cap stocks, including banks, declining in influence. The VN30 basket had up to 15 losing stocks, however, the VN30-Index still increased by more than 5 points thanks to the efforts of some pillar codes to hold prices.

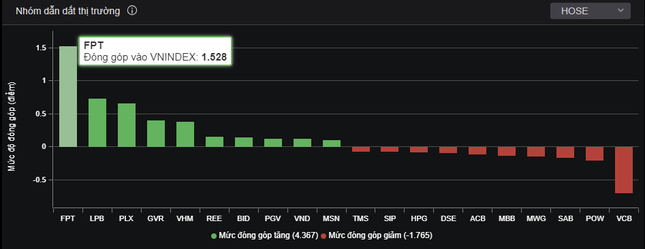

FPT became the most positive driver.

FPT contributed 1.5 points, the most positive in today’s session, and was the only stock to trade in the trillions. FPT’s liquidity far outpaced those that followed, such as VPB (which ranked second with just over VND 500 billion in trading value).

LPB, PLX, GVR, and VHM followed suit. LPB continued to hit a new peak of VND 31,350 per share. In just one week, this stock has increased by nearly 10%, becoming one of the bright spots in the banking group. The bank’s capitalization rose to over VND 80,181 billion.

Today, the Ho Chi Minh City Stock Exchange (HoSE) announced a resolution approving the plan to issue private bonds in 2024 of LPBank. The total maximum issuance value is VND 6,000 billion, expected to be issued a maximum of 12 times in the third and fourth quarters.

At the end of the trading session, the VN-Index increased by 3.04 points (0.24%) to 1,279.89 points. The HNX-Index increased by 0.45 points (0.19%) to 241.88 points. The UPCoM-Index increased by 0.36 points (0.37%) to 98.26 points. Liquidity slightly decreased, with the HoSE matching value at nearly VND 13,000 billion. Foreign investors continued to net sell more than VND 535 billion, focusing on stocks such as VHM, VRE, VCB, HPG, and MWG…

Bank stocks sold off heavily

Today (2/2), the VN-Index continues to rise, but in a cautious trading atmosphere. It is noteworthy that most banking stocks in the VN30 basket are facing strong selling pressure.