“Is ‘Winter Funding’ Here to Stay Through 2024?”

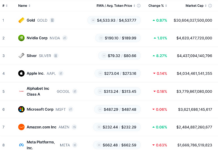

A report by Tracxn Technologies, a market data platform for venture capital, reveals that in Q1 2024 (up to March 15, 2024), technology startups in Southeast Asia successfully raised $816 million.

This figure marks a 40% decrease compared to the total funding of $1.36 billion raised in Q1 2023 and a 13% drop from the $935 million secured in Q4 2023.

The primary reason for this decline is the absence of late-stage funding deals. Investments in startups at late stages of funding in Q1 2024 amounted to only $175 million, an 80% plunge from the $860 million witnessed in Q4 2023.

Specifically, in Q1 2024, no funding round exceeded the $100 million mark. Only three technology startups in Singapore managed to raise $60 million, $75 million, and $90 million, respectively.

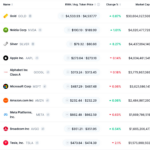

In Vietnam alone, the technology startup ecosystem garnered a total funding of $35.7 million in Q1 2024, reflecting a 39% decline year-over-year. The majority of this capital was invested in Be Group, who secured $31.2 million in a Series B round. Consequently, Be Group’s funding round accounted for over 87% of the total market funding.

Additionally, there were minimal exit activities, with only two M&A deals and no initial public offerings (IPOs) during this period.

According to a report by Do Ventures and NIC, Vietnamese startups attracted a total investment of $529 million in 2023, a 17% decrease from 2022. Furthermore, multiple data sources indicate that the valuation of Vietnamese startups decreased by 10-40% compared to 2022.

“Difficult Exits Make Vietnamese Startups Less Attractive to Investors”

“There are numerous reasons why investment flows into Vietnam have slowed down in recent years.

Firstly, many Vietnamese companies are not accustomed to raising capital, and they prefer slow and steady growth.

Secondly, as mentioned earlier, good companies that can secure funding don’t need it, and those that need it aren’t good enough.

Thirdly, some startups tend to burn through large amounts of capital after successful funding rounds, treating investors’ money with indifference.

Lastly, and most importantly, there hasn’t been a truly successful venture capital exit in the past five years,” said Mr. Nguyen Manh Khoi, Co-founder and CEO of Koru Capital, during a discussion hosted by Genesia Ventures.

Koru Capital, a consulting firm, recently assisted beauty product chain Hasaki and dental clinic chain ParkWay in their latest funding rounds. According to DealStreetAsia, Alibaba, through its subsidiary Alibaba International Digital Commerce Group (AIDC), agreed to acquire a minority stake in Hasaki.

Mr. Khoi emphasized that since the successful exits from Masan, Yeah1, The Gioi Di Dong, and FPT Retail by veteran investment funds like VinaCapital and Mekong Capital, Vietnam has not witnessed any significant exits. This has made investment funds, both domestic and foreign, more cautious about investing in Vietnamese startups, especially in later funding rounds such as Series C or D.

“However, this is a common challenge faced by emerging markets in Southeast Asia. Investors are also facing similar difficulties in Indonesia, not just in Vietnam,” added Mr. Nguyen Manh Khoi.

IPO is considered the traditional exit route for investment funds when investing in startups. However, even prominent startups like VNG, MoMo, and VNLife have not been able to list on Vietnam’s main stock exchanges, HOSE and HNX. VNG has only managed to list on the UpCom market and has plans for an IPO in the US, but the final steps remain uncertain.

Indonesia, which boasts ten ‘unicorns,’ saw its first ‘unicorn’ go public in 2021 with Bukalapak’s listing. GoTo followed suit, listing on both the Indonesian and US stock exchanges. Nevertheless, other prominent Indonesian startups like Traveloka, Ovo, JD.id, J&T Express, and Xendit are yet to find their path to the public markets.

Sharing a similar perspective is Mr. Phan Minh Tam, Angel Investor and Chairman of STI, who can be regarded as a veteran in Vietnam’s investment landscape and has experienced the pain of ‘investing in startups as throwing stones into the pond.’

With a successful track record that includes 24h Technology Communication Corporation, Sieuviet, and 30Shine, STI’s current investment portfolio is diverse, spanning startups at various stages and sectors, such as M Village, JupViec, Rever, Ecomobi, ANTS, Vietnam Australia Vocational College, and Kyna Kids.

“I’ve lost count of the number of startups I’ve invested in and supported, but it’s definitely more than ten. Out of fear of not being able to exit, I used to try every means possible to assist the Founders and CEOs in operating their businesses.

In my opinion, it’s not the company culture or the lack of talent that hinders progress; it’s the weak business operations led by the startup’s leadership that slows down projects and impacts their effectiveness. From my experience, Founders tend to mature and become more capable of handling responsibilities as they approach their forties. So, whether we like it or not, we have to be patient with Founders and their startups,” reflected Mr. Phan Minh Tam.

In the startup community, Mr. Phan Minh Tam is recognized as a compassionate investor who wholeheartedly supports startups that approach him, regardless of whether he invests in them or not.

“Proposed Solutions to Increase Successful Exit Rates in Vietnam”

“I hope that in the future, the government will introduce special policies to enable ‘unicorns’ or mature tech startups to IPO, facilitating successful exits for domestic and foreign investors. Only then can Vietnamese startups attract more investment, grow stronger, and create a positive impact on society,” suggested the Chairman of STI.

In contrast to Mr. Phan Minh Tam, Co-founder Le Hoang Uyen Vy of Do Ventures is a relatively new player in the investment arena. Focusing on early-stage investments, Do Ventures has not yet experienced the pain of “being unable to exit.” However, they share a common trait with STI—their founder, Shark Dzung Nguyen, is equally dedicated to supporting Vietnamese startups.

“When evaluating any startup, Do Ventures considers the business model, market potential, and leadership team before making an investment decision. I empathize with Mr. Khoi’s perspective; indeed, there is a mismatch in Vietnam where startups that need funding are not attractive enough to investors, and vice versa.

To prevent Founders from ‘burning’ through investors’ money, we often advise early-stage startups not to raise too much capital. If you don’t have a lot of money, you can’t spend it recklessly!,” added Ms. Le Hoang Uyen Vy.

Regarding exits, besides IPOs, investment funds can explore alternative solutions such as M&A or selling their stakes to other investors. “Many reputable Japanese investors have entered Vietnam, so if you’re looking to exit a promising startup, you can approach them,” concluded the CEO of Do Ventures.

In 2021, the Sumitomo Mitsui Financial Group (SMFG) acquired a 49% stake in FE Credit, valuing the company at $2.8 billion. Additionally, MoMo secured a $200 million investment led by Mizuho Bank. Furthermore, Sojitz Corporation, through its subsidiaries, acquired New Viet Dairy, Vietnam’s largest food distributor.

Singapore Leads Investments in Vietnamese Startups

In 2023, Vietnamese startups raised nearly $530 million in funding, marking a 17% decrease compared to the previous year. The funding winter has not yet passed, as startups continue to face headwinds from a turbulent global economy.