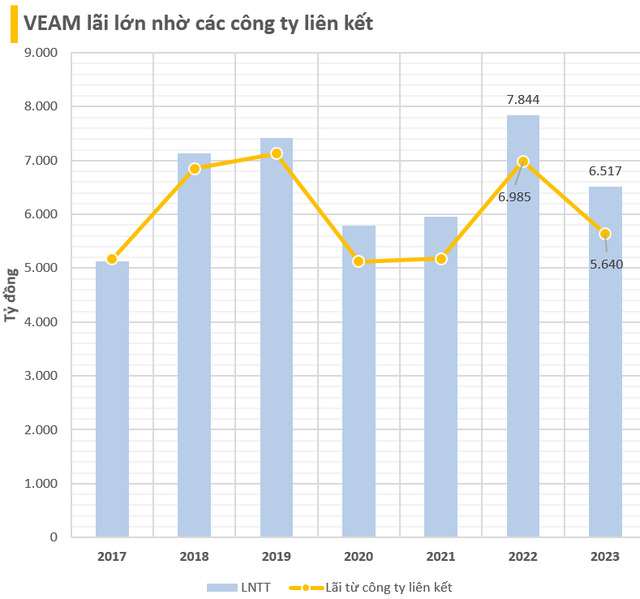

Vietnam Engine and Agricultural Machinery Corporation (VEAM) has established itself as one of the largest automotive enterprises in Vietnam. With holdings in prominent joint ventures, VEAM boasts a substantial presence in the industry. The company currently holds 30% of Honda Vietnam, 20% of Toyota Vietnam, and 25% of Ford Vietnam, solidifying its position in the market.

In 2023, VEAM’s consolidated net revenue surpassed 3,806 billion VND, while their post-tax profit reached an impressive 6,265 billion VND. The primary source of VEAM’s profits stems from their investments in leading automotive joint ventures, namely Toyota Vietnam, Honda Vietnam, and Ford Vietnam.

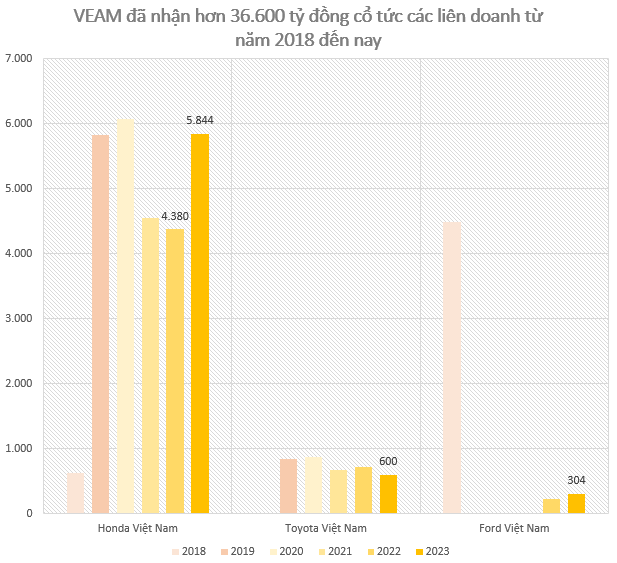

VEAM’s financial reports reveal that they receive significant annual dividend payments from these joint ventures. In certain periods, the dividends received by VEAM even exceed the profits generated by the joint ventures themselves.

For instance, in 2023, VEAM received dividends totaling over 6,800 billion VND from its associated companies. This included 5,844 billion VND from Honda Vietnam, more than 600 billion VND from Toyota Vietnam, and over 304 billion VND from Ford Vietnam.

From 2018 to the present, the dividends VEAM received from its associated companies amounted to more than 36,000 billion VND, with Honda Vietnam contributing over 27,000 billion VND.

VEAM’s profitability in the automotive industry is evident even without considering vehicle sales. While they do engage in the production and assembly of trucks, this segment contributes modestly to their overall performance.

As of the end of 2023, VEAM’s total assets amounted to 27,136 billion VND, including over 13,200 billion VND in cash and bank deposits. This substantial cash reserve generates consistent annual interest income in the hundreds of billions of VND for VEAM.

On the capital front, VEAM’s payable debt stands at a mere 143 billion VND, primarily consisting of short-term debt. As of the fourth quarter of 2023, their retained earnings after tax distribution reached 12,218 billion VND.

Looking ahead, VEAM has outlined a business plan for the parent company, targeting a total revenue of 6,414 billion VND, a 22% decrease from the previous year’s performance. They also anticipate a 19% decline in post-tax profits, estimated at 5,489 billion VND. VEAM notes that this projection does not account for additional provisions or reversals of provisions for inventory obsolescence at the year-end.

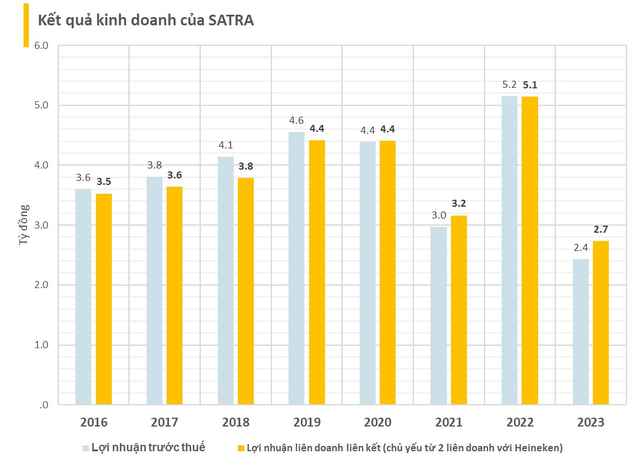

In Vietnam, there are other state-owned enterprises that, like VEAM, reap substantial profits without directly engaging in production or sales. These enterprises benefit from dividend distributions, similar to VEAM. One notable example is the Saigon Trading Group (Satra), which, in 2023, recorded a pre-tax profit of 2,430 billion VND. This profit is largely attributed to their share of profits in joint ventures, amounting to 2,733 billion VND. Satra’s financial performance is significantly influenced by its two joint ventures with the Heineken Group.

Satra currently holds a 40% stake in Heineken Vietnam Brewery LLC and Heineken Vietnam Beverage LLC (Heineken Trading), with the remaining shares held by Heineken’s subsidiaries in Singapore and Australia. According to our calculations, since 2013, Heineken has contributed approximately 39,000 billion VND (equivalent to 1.5 billion USD) to Satra’s parent company. Notably, Satra does not publish financial statement explanations, unlike most other wholly state-owned enterprises.