Steel on a conveyor belt in a steel mill

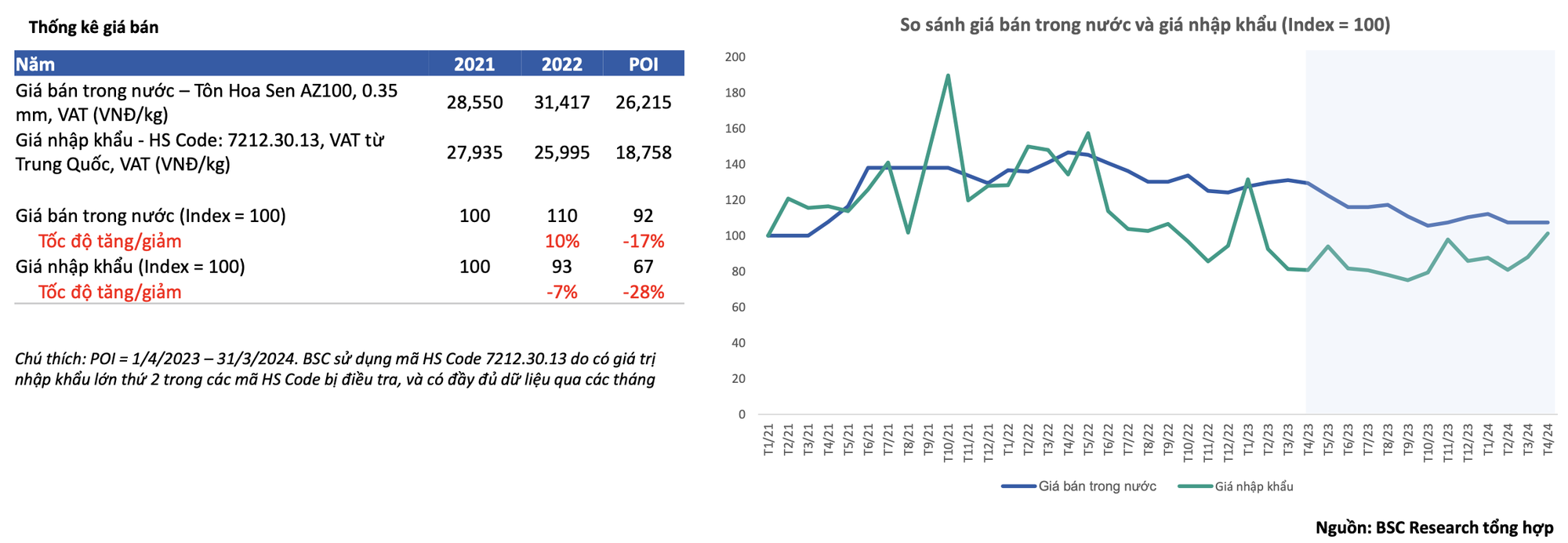

On June 14, 2024, the Ministry of Industry and Trade initiated an investigation and imposed anti-dumping duties on coated steel products from China and South Korea. According to the procedure, the Ministry of Industry and Trade will send the Review Questionnaire to relevant units 15 days from the date of initiation. This will be the basis for drawing preliminary investigation conclusions. The period for determining dumping acts (POI) is from April 1, 2023, to March 31, 2024.

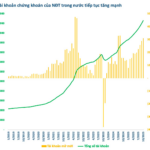

In a recent report, BIDV Securities (BSC) stated that there is a phenomenon of dumping coated steel products as the rate of decrease in import prices from China tends to be faster than domestic selling prices during the POI and POI-1 periods.

Specifically, domestic prices fell only 17%, while import prices from China fell 28% over the same period. This indicates a price suppression effect of more than 2% for coated steel imports from China during the 2022-2024 period.

Graph showing import and domestic prices of coated steel

The growth rate of output of the investigated products is much higher than the growth rate of domestic output. According to BSC’s summary, the output of the investigated products from China increased by 519%, while domestic output increased by only 33% during the POI period.

During the period from 2021 to POI, the import ratio from other countries continuously decreased from 94% to 60%. Meanwhile, the import ratio from China increased from 6% to 40%. During the POI, imports from other countries increased by only 6% compared to 2021. BSC argued that imports from other countries are not the cause of damage to the domestic production industry.

Based on previous cases, BSC believes that it will take 6-8 months for the Ministry of Industry and Trade to reach a preliminary conclusion. For example, the case of imposing anti-dumping duties on coated steel from China and South Korea in 2016 took 8 months from the date of initiation. BSC expects the temporary anti-dumping duties to be applied as early as December 2024, and the official anti-dumping duties to be imposed in the third quarter of 2025, according to Article 70 of the Foreign Trade Management Law 2017.

Graph showing expected timeline for anti-dumping duties

Both consumption and prices are expected to increase from the second half of 2024 to 2025

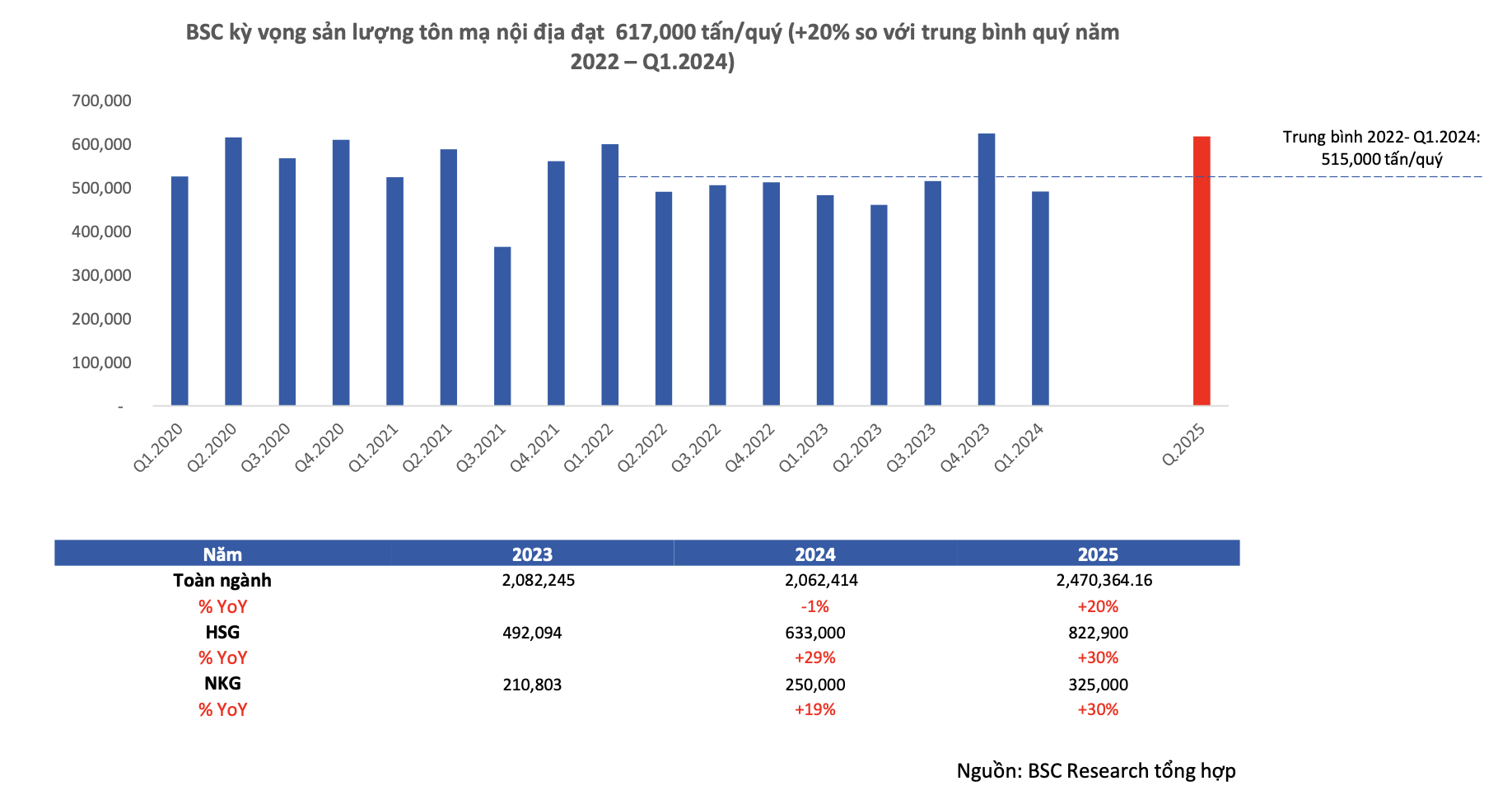

In 2025, BSC expects the domestic coated steel output to increase by 20% thanks to the imposition of temporary anti-dumping duties in the first quarter of 2025 and the official duties in the third quarter of 2025, along with the recovery of the domestic real estate market. BSC’s growth forecast of 20% is based on two factors: First, looking back at the previous period, the domestic coated steel industry grew by 20% in 2017 after the application of anti-dumping duties; Second, the low base in 2024.

Graph showing expected output increase in 2025

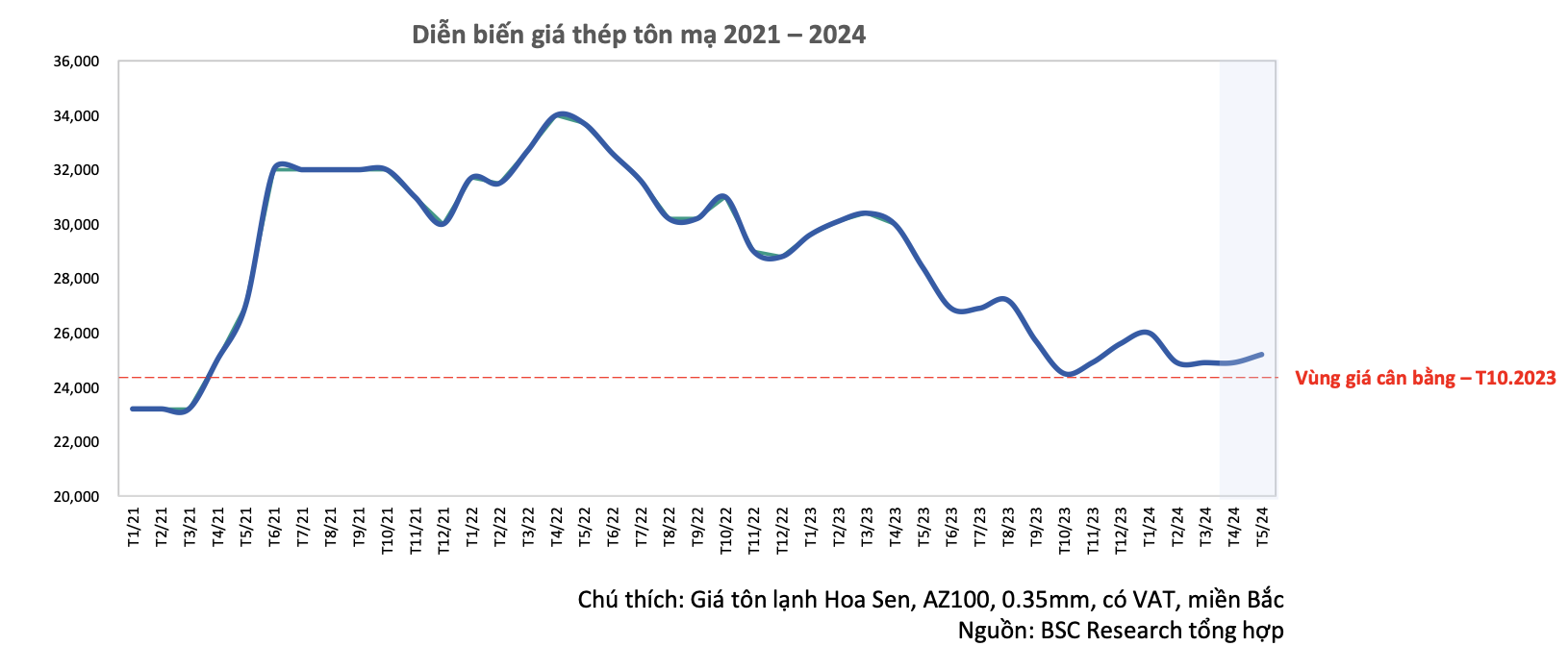

In the second half of 2024 and throughout 2025, BSC expects steel prices to be on an upward trend. In June 2024, BSC believes that domestic steel prices are fluctuating near the balance point of supply and demand, equivalent to the price range in October 2023. According to BSC’s view, domestic steel output will recover as the real estate market returns, and dealers will tend to stockpile more inventory before the anti-dumping duties are imposed. BSC forecasts a 5% increase in steel prices in 2024.

Graph showing expected price increase in 2024

In May 2024, domestic consumption in the industry continued to improve by 7% quarter-on-quarter, up 56% year-on-year. Export output in the industry decreased by 25% quarter-on-quarter but increased by 12% year-on-year.

BSC believes that domestic output will continue to recover in the second half of 2024 and throughout 2025 due to the recovery of the real estate sector and dealers stockpiling inventory before the temporary anti-dumping duties are applied. The export trend may slow down slightly towards the end of the year due to seasonal factors and a slowing EU economy.

BSC also provided an outlook for the top three steel companies:

For Hoa Phat Group (HPG), BSC expects a strong recovery in business performance in 2024 thanks to increased domestic steel output and more positive steel price movements. The Dung Quat 2 project will soon reach 90% capacity by 2026, helping HPG increase its revenue scale by 60% in 2026 and more than double its profit in 2026 compared to 2024, thanks to (1) economies of scale that will reduce HPG’s production costs, and (2) the timing of Dung Quat 2’s operation, which coincides with the new cycle of the real estate and steel industries.

For Hoa Sen Group (HSG), BSC forecasts consumption volume to reach 1.97 million tons (+17% YoY) in 2025 due to (1) the recovery of the domestic market and (2) the imposition of anti-dumping duties on coated steel from China, which will encourage HSG to boost sales in the domestic channel. The expected profit margin is 16%, an increase of 3.9 percentage points compared to 2024, thanks to (1) HSG’s focus on the domestic channel, which has a higher profit margin of 20%, and (2) more favorable global HRC steel price movements as steel demand from China recovers.

For Nam Kim Group (NKG), BSC expects consumption volume to reach 934,292 tons (+7% YoY) in 2025, mainly due to (1) the recovery of the domestic market and (2) the imposition of anti-dumping duties on coated steel from China, which will encourage NKG to boost sales in the domestic channel. Domestic consumption volume is expected to reach 491,711 tons (+23% YoY), while exports are forecast to be 442,581 tons (-7% YoY). The expected profit margin is 11.3%, an increase of 0.6 percentage points compared to 2024, thanks to (1) NKG’s focus on the domestic channel, which has a higher profit margin of 20%, and (2) more favorable global HRC steel price movements as steel demand from China recovers.

Earn money fast like Dang Le Nguyen Vu: Trung Nguyen Legend in Shanghai opens in less than a year and already profitable?

Being open for just 9 months, Mr. Dang Le Nguyen Vu revealed in an interview that Trung Nguyen Legend in Shanghai “is profitable already, despite the heavy investment!”

Steel sales volume in January 2024 increases nearly 60% YoY for Hoa Phat

The sales volume of hot-rolled coil steel, construction steel, and high-quality steel decreased by 16% compared to the last month of 2023, mainly due to the market preparing for the Lunar New Year holiday and having low demand.