At the “Pulse of Money Flow” seminar hosted by FIDT and FiinGroup, Ms. Truong Minh Trang, Executive Director of FiinGroup’s Financial Information Services Division, shared her insights on market valuation. She noted that the market’s P/E ratio stands at 14.3 times, neither exceptionally cheap nor expensive.

However, excluding the real estate sector, the non-financial sector’s valuation is at 22.8 times, similar to the peak valuation levels of 2021 when the market was in a strong uptrend.

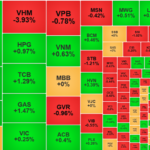

Ms. Trang further analyzed sector valuations, noting that many industries have above-average P/B and P/E ratios compared to the past three years. She pointed out that this valuation barrier has hindered the entry of large investment flows, causing money to circulate within sectors that have already experienced significant growth, resulting in low liquidity.

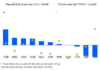

Discussing profit growth, the expert acknowledged that macroeconomic growth and corporate profits are progressing slower than expected. Overall growth relies more on external factors than internal strengths, as evidenced by the moderate levels of private investment and budget capital. However, the bright spots lie in exports and FDI inflows.

Given the current valuation levels and the pace of profit growth, the expectation of high profit growth in the second quarter, compared to low base effects from the previous year, may not be as appealing to investors.

In a context of moderate prices and moderate demand, with money flows consistently weakening, investment strategies and stock-picking techniques become crucial.

Mr. Doan Minh Tuan, Head of FIDT Analysis, suggested four main approaches for investors to navigate this complex environment:

First, consider macroeconomic characteristics: reduced risk of USD interest rate reduction, stable macroeconomic fundamentals, liquidity, interest rates, and exchange rates, robust economic recovery, and stable market valuation.

Second, look for companies with breakthrough revenue growth potential in the next 6-12 months, nearing peak profitability, offering compelling long-term narratives, and leveraging IPOs or M&As.

Third, focus on sectors benefiting from favorable commodity price trends, increased domestic and export demand, supportive policy changes, and economic recovery following the accumulation phase in the latter half of 2022 and 2023.

Fourth, regarding company valuation, target businesses with forward P/E and P/B ratios for 2025 that are below the median of the 2020-2025 cycle. Also, ensure that the technical trends of the stocks leave room for growth in the next 3-6 months.

Regarding investment opportunities in the second half of 2024, Mr. Tuan highlighted the sectors driving economic growth, including production, exports, imports, FDI, international visitors, and retail services. He also pointed out the sectors benefiting from economic recovery: retail consumption, real estate and hospitality, investment, and private economic enterprises.

Analysis of Investment Strategies of Funds in 2023

With a dynamic strategy, major investment funds in the past year have achieved outstanding profitability compared to the VN-Index. Analyzing the investment strategies and portfolio allocation of these funds provides us with additional insights to make investment decisions in 2024.