Soaring Profits for Six Consecutive Quarters

According to the released results, Kafi Securities has achieved impressive business performance in the first half of 2024. The company’s pre-tax profit surged by over 135% year-on-year to VND 95 billion. Notably, this marks the sixth consecutive quarter of profit growth since the implementation of the new business strategy.

Kafi’s total revenue also increased significantly, reaching VND 137 billion, almost a 100% jump from the previous year. The main business segments, including securities brokerage, margin lending, and investor stock trading, all recorded robust growth of more than five times compared to the same period last year.

Despite a 47% increase in operating expenses, amounting to VND 42 billion due to investments in technology and expansion, Kafi demonstrated effective cost management. The cost-to-income ratio (CIR) improved from 42% to 31%, reflecting enhanced operational efficiency.

“These results validate our development strategy,” said Mr. Trinh Thanh Can, CEO of Kafi. “With our current growth trajectory, we are confident that Kafi will soon achieve its goal of becoming a leading retail securities company in Vietnam.”

Breakthrough in Margin Lending, Innovative Product Suite

In the first six months of 2024, Kafi Securities witnessed extraordinary growth in loan balances, surging from VND 1,100 billion at the beginning of the year to nearly VND 4,000 billion as of June 30, 2024.

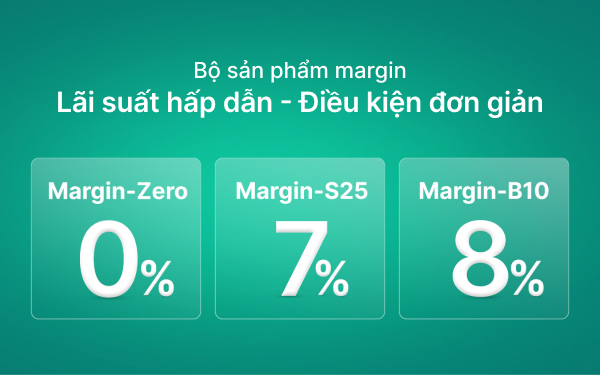

This success is largely attributed to the introduction of three new loan products catering to diverse customer needs with competitive interest rates and convenient terms:

Margin-Zero: Offering a 0% interest rate, this product is designed for customers with a maximum debt balance of VND 100 million. It provides an ideal financial solution for individual investors to access initial investment capital without incurring borrowing costs.

Margin-S25: Featuring a 7% interest rate for clients with an S25 portfolio ratio above 75%. Margin-S25 enables professional investors to optimize profits from highly-rated investment portfolios.

Margin-B10: With an 8% interest rate, Margin-B10 targets customers with debt balances above VND 10 billion, offering financial flexibility and substantial investment opportunities for financially strong investors.

All three of Kafi’s new loan products feature attractive market interest rates and simple requirements, catering to a diverse range of customers. This approach not only boosts loan balance growth but also underscores the company’s innovation and ability to meet the varying needs of investors.

Continuing the Capital Increase Journey, Aiming for VND 7,500 Billion

In the second quarter of 2024, Kafi successfully raised its charter capital to VND 2,500 billion. The company doesn’t plan to stop there, as it targets increasing capital to VND 5,000 billion this year and strives to reach VND 7,500 billion by 2025. This is a crucial part of Kafi’s detailed strategy to foster solid development and expand its business scale.

Mr. Trinh Thanh Can, CEO of Kafi, commented, “The decision to increase capital demonstrates the trust and commitment of our shareholders to the company’s strategy. We will utilize these resources to invest in technology, product development, and network expansion to enhance our competitiveness and achieve our strategic goals.”

With these positive moves, Kafi is confident in continuing to achieve new milestones while delivering increased value to customers and investors in the Vietnamese market.

At the beginning of 2024, Kafi, as the representative of Vietnam, won two prestigious international awards: “Best Fixed Income” by Global Brand Magazine and “Most Innovative Platform for Securities Trading – Viet Nam 2023” by Global Business Outlook Magazine (UK).

In June 2024, at the Vietnam Wealth Advisor Summit 2024, Kafi proudly received two more awards: “Outstanding Financial Brokerage Service” and “Outstanding Technology and Digital Transformation Product.”

HDBank Investor Conference: Sustaining High and Stable Growth

On the morning of February 1, 2024, HDBank (HoSE: HDB), a leading commercial bank in Ho Chi Minh City, organized an Investor Conference to provide updates on its business performance in 2023 and share insights on future directions and prospects for 2024.